Stock United States Oil Fund (USO)

Post on: 16 Июнь, 2015 No Comment

economic continue to warm up

Cashing in on Black Gold with USO

Top Contributor: Rob Eberenz | Created when NYSE:USO was $26.30 | Edit | History

The economic strife in U.S. equities over the past nine months was premised by the popping of the crude oil bubble. As the world watched U.S. crude oil futures rocket to a level of $147 / barrel on July 11, 2008, the hype heard at every corner preached we would reach $200 / barrel. Instead it turned out to be the result of massive speculation on the part of many large financial institutions and pension funds, due to a lack of clarity in equities and a new China that was assumed to be self supported by a rising middle class. Every driller, refiner, and seller of petroleum based products cashed in, with Exon Mobile (XOM) cashing in its highest net income on record at 14.3 billion dollars in the third quarter of ’08 alone.

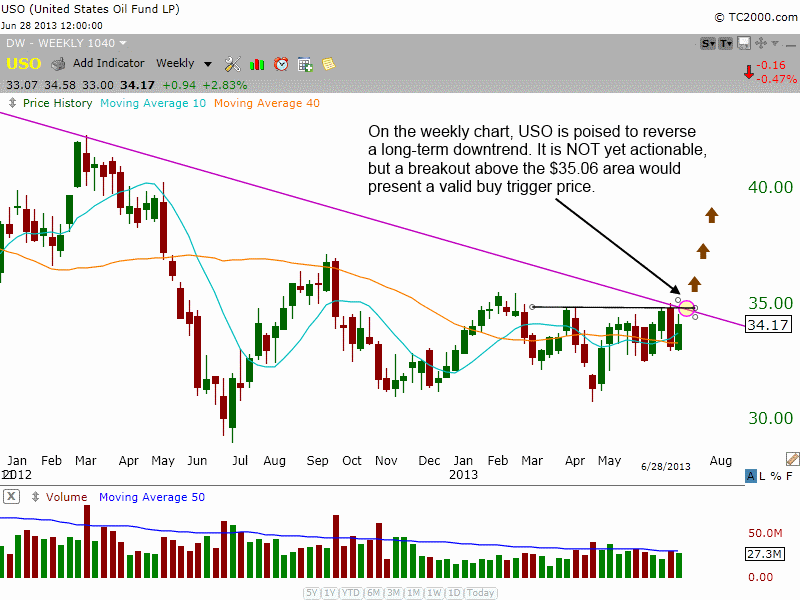

Crude oil, specifically the West Texas Intermediate (WTI) light sweet crude oil futures, have dropped 71% from their high on July 11, 2008 to the 42 dollar range today (Wed. March 11, 2009). The USO ETF specifically tracks the WTI light sweet crude oil futures and is the best way to trade this specific spot price of crude oil futures here in the United States.

The USO hit a bottom on February 18, 2009 at 22.86 and has since appreciated to a peak at 28.65 on Monday, March 9. This represents a 25% increase over a period of one month, and corresponds to news that OPEC has begun cutting output. We learned today that crude Inventories reversed the trend from last week and inventories actually rose .7 million barrels to a high of 351 million barrels. This news is what has pushed the price of WTI crude down over 6% to under $43/barrel today.

The message I am sending is contrary to the bearish signals in the market today for several reasons. Firstly, gasoline demand has shown signs of growth on a year over year basis, hovering between 2.0% and 1.5% growth. Secondly, USO was nearly equal to its 50 day moving average (DMA) when it reached its high of 28.65 on Monday, and it has now decreased to nearly 90% of its 50 DMA. The WTI itself is trading near the psychological resistance level of $40/barrel.

It is important to understand the moves that the U.S. Dollar and the WTI have made in the same direction are very abnormal and NOT sustainable. This is due to the deflation (0% inflation) situation that the U.S. economy has undergone prior to the rest of the world. The U.S. equities have undergone the pain from our financial system duress earlier, and our economy has aggressively deleveraged our economy at the same time as the Fed Funds Rate (FFR) has dropped to 0%. This is going to cause an inflationary trend in domestic commodity prices (especially oil) that will occur as foreign governments begin dropping their rates and the dollar growth subsides.

Finally, natural resources used for energy will be precursors to the broad recovery in the U.S. equity market as speculators gain momentum and the doomsday scenarios become less tangible.

Buy USO in several tranches using dollar cost averaging over the next week to find a solid entry point between 23 and 27. This trade will be an anti-inflation trade to protect your portfolio and also find tailwinds as the entire economy starting with banks and then industrials develop a foundation.

(100 character max) Cancel