SPDR gold ET lawrieongold

Post on: 9 Август, 2015 No Comment

Gold down in dollars but up in Euros

Julian Phillips commentary for today on movements in the gold and silver markets and their respective price drivers.

Gold

New York closed yesterday at $1,166.90 up $1.20 in a thin market but with more heavy ETF sales, but still dominated by currency issues. Asia took the gold price down to $1,158.00 before London opened. London then Fixed the gold price at $1,161.00 down $13.75 and in the euro, at €1,079.398 up €1.426, while the euro was at $1.0756, down another one and a quarter cents. Ahead of New York’s opening, gold was trading in London at $1,164.00 and in the euro at €1,083.55.

Silver

The silver price closed at $15.79 down 8 cents. Ahead of New York’s opening it was trading at $15.75.

SPDR Gold ETF

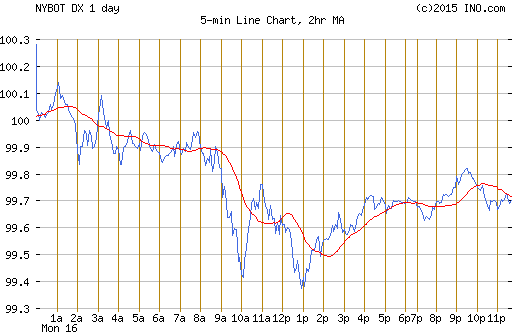

There were sales of 3.284 tonnes of gold from the SPDR gold ETF and of 0.6 of a tonne from the Gold Trust on Monday. The holdings of the SPDR gold ETF are at 753.037 tonnes and at 164.86 tonnes in the Gold Trust. Once again the ETF sales dominated as the euro continued to fall and the dollar to surge up to 98.38, up from 96.80 last week.

The euro continues to tumble as it sits at $1.0742 and headed lower, currently taking gold down with it. As you see gold is now rising in the euro and falling in the dollar.

With financial markets closed to it and the Greek central bank keeping its banks on a tight leash, the Greek treasury could face a cash crunch in one, two or three weeks. Greece won’t get any more cash from its €240 billion ($260 billion) rescue program until its official creditors are satisfied that the Greek Prime Minister is committed to all the economic fixes needed to meet its conditions. After the swagger of the government’s election are we watching Greece put firmly in its place? Or will they go to a referendum to get support for a Greek exit from the Eurozone? Or will they wait until they see funding finally halt and have to return to the Drachma. The issue is not off the table by any means. An exit, we feel will see a stronger euro.

There was little Asian demand for gold, despite bargain prices. Perhaps they are waiting for even better bargains. We see demand rising when a bottom is set in place. What is for sure is that Asian demand has not gone away.

Again we expect the next fortnight to continue to be a volatile one, in both currency and precious metal markets.

We see the silver price continuing to fall with gold but not at the same pace, we feel. Once Asian demand comes in we expect the silver price to recover quickly.

Julian D.W. Phillips for the Gold & Silver Forecasters www.goldforecaster.com and www.silverforecaster.com