Spanish investments in Latin America a way out of economic crisis

Post on: 21 Май, 2015 No Comment

In an economic crisis, Spanish investments are going to Latin America— a region of growth and profits. But Spain may face “anti-Spanish cries of neocolonialism.”

The recent merger of Spanish private equity firm Mercapital SL have announced plans to raise the first fund as a merged entity to invest in healthcare, consumer retail and business services in Latin America with great expectations. (Photo Mercapital )

Latin America has been a fertile soil for Spanish investments for decades. Lately, the table seems to have turned due to still stable and growing economies in the LATAM region while Europe and the U.S. are facing troubled economic times. Spain is strengthening its efforts in the region but who is really capitalizing on these trends?

According to a report from the Council on Hemispheric Affairs. the Iberian country has put its “Spanish eyes” once again on Latin America, hoping to find profitable sources for their foreign direct investments and sustain existing ones in relatively stable growing Latin American economies.

However, the report says, they will have to change their ways in order to avoid “anti-Spanish cries of neocolonialism” as many Latin Americans claimed Spain’s investment companies disregard the welfare of local populations. U.S. companies’ same approach has originated criticism as well.

Spaniards will also have to compete with other actors interested in the same scenario. China, for one, is heavily investing in the region at an accelerated pace. And then, the Latin American multinationals themselves— the so-called multi-Latinos— are thriving to expand into new markets within and outside the region.

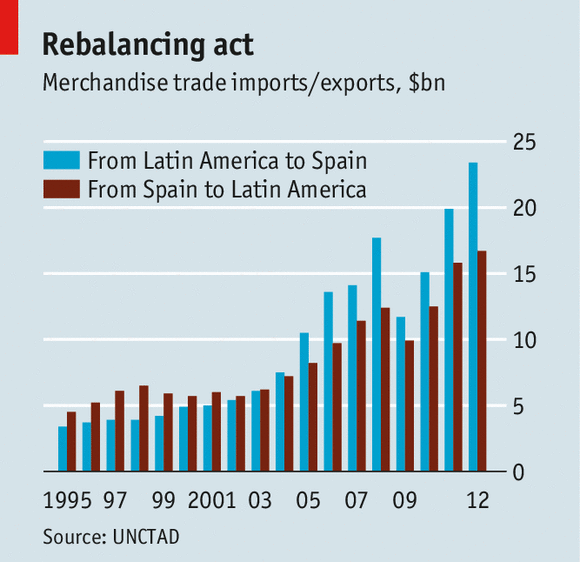

Credit: The Economist

Despite the global economic crisis of 2008, from which Europe and the United States have not been able to recover, Latin American economies are still showing growth . maybe not as favorable as predicted.

Brazil, for instance, grew 2.7 percent in 2011 and although forecasts were optimistic for 2012, it would probably stay at the same level for this year or maybe lower. Mexico is expected to grow between 2.9 and 3.1, although Mexican economists are cautious due to the impact of a global economic slowdown in coming months.

These numbers, although low, are still better than ratings by agency Standard and Poor’s Corp. which predicted that the Spanish economy will contract next year by 1.5 percent.

Since 2007, Spain’s investments in the region increased from €45 billion to €116 billion in 2010, and have contributed €115 billion through its Latin American subsidiaries. Spanish enterprises, the report says, have become more dependent on Latin America, since between 16 and 52 of their profits come from the region.

Investment firms are trying to increase direct action in the region. The recent merger of Spanish private equity firms Mercapital SL and N+1 Private Equity, for instance, have announced plans to raise about €500 million ($615 million) for their first fund as a merged entity to invest in healthcare, consumer retail and business services in Latin America with great expectations.

However, “no es oro todo lo que reluce ” (not everything that glows is gold— an old Spanish saying).

Companies such as Brazilian Natura, a large cosmetic retailer and others have come up with creative ways to gain market share. (Photo Natura)

Latin America is not the same open field it used to be. Local firms have pursued consumers with creative strategies that are paying off, making market penetration for foreign companies even harder.

Companies such as Brazilian Natura, a large cosmetic retailer that worked at the base of its consumer market; America Movil, which offered pre-paid phone cards to millions with no credit history; and others have come up with creative ways to gain market share, and are now tough competitors for the Spanish new wave of FDIs.

In this scenario, six Spanish firms that represent 95 percent of Spanish investments in Latin America— Telefónica, Repsol, Santander, BBVA, Endesa and Iberdrola— have endured great difficulties lately.

Repsol’s stake at YPF, the oil and gas giant. was nationalized by the Argentinean government back in April of this year, creating a wave of controversy around the decision made by President Cristina Fernandez.

Santander and Banco Bilbao Vizcaya (BBVA) have been fiercely competing to buy Latin American banks in Argentina, Brazil, Peru, Chile and Mexico to compensate for huge losses at home.

Spains Endesa, the largest electric utility in Chile, Argentina, Colombia and Peru, is trying to push a controversial planned capital increase of up to $8.02 billion in its Chilean unit Enersis, the biggest ever in the local market but the company will make a noncash assets contribution and is being resisted by Enersis partners.

Iberdrola, an energy company with markets in Brazil, Venezuela, Bolivia and Honduras, has put all its hopes in the Latin American market, as electricity production and distribution domestically fell, while it increased 1.2 percent and 34.3 percent in the region.

Hunted by debt, Telefonica SA (TEF), Spain’s biggest phone operator. is considering selling its shares of its entire Latin America business, according to a recent report on Businessweek.

By now, one man is thinking big in this particularly turnaround. Yes, Carlos Slim, the richest man in the world, is rapidly growing his empire by going on a frantic shopping spree.

Not only has he made his move in Argentina with YPF— buying 8.4 percent of its stake— and America Movil SAB to acquire Telekom Austria, but with his telecommunication companies operating in 18 countries in the Caribbean and Latin America, for sure he is dreaming of Telefonica.