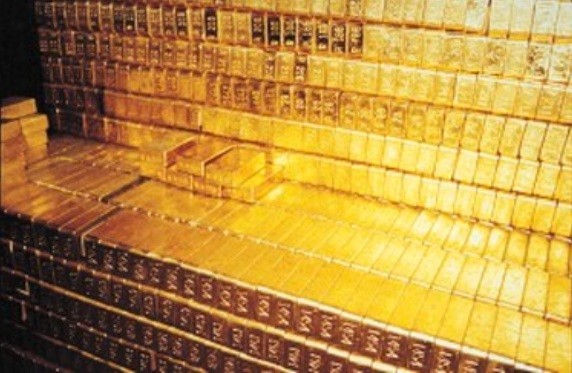

Soverign Gold Coins Your Best Option For An Upturn In Precious Metals

Post on: 2 Июнь, 2015 No Comment

Last week Federal Reserve Chairwoman, Janet Yellen announced interest rates will not rise and tapering will continue into July. For investors this spelled a weak US economy and gold prices smashed the $1,300/oz. barrier.

The realisation that the US economy is not doing as well as some economists projected seemed to carry more significance than the upcoming energy crisis now pending on two fronts: the oil crisis in the Middle-East due to rising tensions in Iraq, and the natural gas crisis in the Ukraine-Russia dispute.

Will gold prices return to previous levels?

Gold reached a two-week high as conflict was raging in Iraq. Though most investors were pleased with the jump, some were skeptical about whether the metal’s good fortune would continue. Some see gold going sideways again as they claim the geopolitical news is not a catalyst out of the $1,250-$1,275/oz. channel (these prices being short term support and resistance respectively)while any macroeconomic improvement could cap a further rally.

Contrary to these predictions, gold has gone way up instead of lower, currently trading at around $1,315/oz. However, as it happened during the Ukraine crisis, geopolitical news is definitely a contributing factor but that alone couldn’t push the yellow metal’s price higher. Gold’s safe-haven appeal intensified Thursday when US President Barack Obama announced plans to deploy up to 300 military advisers to Iraq to help its struggling security forces fend off a wave of Sunni militants who have overrun large parts of the country, according to The New York Times. In simple terms, this spells military intervention.

As far as gold prices are concerned we have every reason to be optimistic, as prices bounced off the $1,310/oz. mark Monday and tested the $ 1,320 point in mid-session.

Commemorating 100 years since the beginning of WWI, and 70 years since D-day that practically ended WWII, the 2014 gold Sovereign maintains its high profile while selling for less than £ 200. Gold Sovereigns are always at the top of the list for investors and collectors, even though they have traditionally carried the same design for almost 200 years.

There have been, however, some exceptions to the rule: 2002 sovereigns have a shield design to celebrate the Queens Golden Jubilee year- the fifty years of her reign. This was only the second time in over a century that a design other than the familiar St. George and Dragon reverse was used on British gold sovereigns. The last occasion was in 1989 to celebrate the 500th anniversary of the very first gold sovereign. These 1989 sovereigns were only issued as proofs, and are now difficult to find.

Although there were bound to be a few who did not like the new design, preferring the usual St George & Dragon design, demand for 2002 sovereigns was higher than normal, yet the Royal Mints issue limits remained the same as for 2001. As a result the Royal Mint soon sold out, and prices went to a higher premium.

Purchased as an investment tool, as a part of your collection or for a very special gift, gold Sovereign coins make an excellent choice, especially at coininvestdirect.com prices.

Subscribe

Subscribe to our e-mail newsletter to receive updates.