Silver Price Breaks Above 2008 High in Early London Trading

Post on: 26 Июль, 2015 No Comment

SLV ETF adds 2.35 million ounces. China/Japan at daggers drawn over fishing flap. Irish eyes aren’t smiling. Silver breaks above 2008 high. Bank of Japan 2nd currency intervention fails. and much, much more.

Yesterday In Gold & Silver

Ever since the run-up after the FOMC meeting on Tuesday afternoon, the gold price hasn’t done much of anything. hanging around just under the magic $1,300 level. Thursday’s price action was more of the same. Gold’s high price made it up to $1,297.20 spot at 11:30 a.m. Eastern.

Silver’s price action was a little more interesting. The price didn’t do much in Far East trading on Tuesday, but began to sell off shortly after London opened for trading on Thursday morning. This sell-off reached its nadir about 8:10 a.m. in New York. From that point, silver gained a bit, but began to rally more noticeably once the London p.m. gold fix was in moments after 10:00 a.m. Eastern time. The rally [such as it was] ended at 11:30 a.m. and then proceeded to trade sideways for the rest of the day. Silver’s high price tick [$21.26 spot] was at 1:00 p.m. Eastern right on the button.

According to James Turk, the silver price made it up to $21.34 in early 2008 before the roof caved in. It appears that the silver world is waiting [nervously?] for that old high to get broken before really jumping back on the bandwagon. Thursday was the second day in a row that silver closed over $21. and I find that encouraging.

The world’s reserve currency hit its low at precisely 3:00 p.m. Hong Kong time on Thursday afternoon, before recovering about 55 basis by 9:00 a.m. on their Friday morning. and had declined about 30 basis point in four hours as I write this shortly after midnight Eastern time. The U.S. dollar is hanging onto the 80 level by its fingernails.

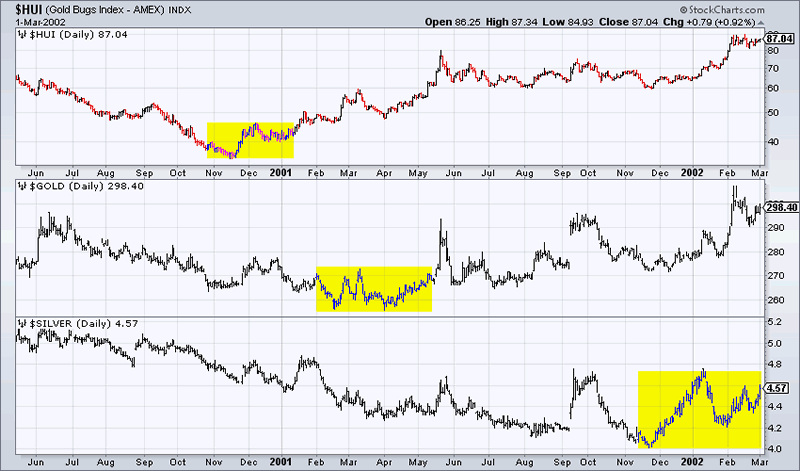

With no direction forthcoming from the precious metals themselves, it appears that the precious metal stocks followed the movements of the Dow on Thursday. with the HUI finishing down 0.97%. and I wouldn’t read a thing into that.

The CME’s Comex delivery report showed that 40 gold and 10 silver contracts were posted for delivery on Monday. With the month winding down, the deliveries from the shorts to the longs that are standing for delivery are coming to an end. The process will begin anew with first day notice for delivery into the October gold contract. That day is Thursday, September 30th. Last day for delivery [and trading] for the September contract is the 29th.

Both the GLD and SLV ETFs had a report yesterday, but GLD reported a withdrawal of 87,942 ounces. There was also a withdrawal form GLD on Tuesday as well. This is very strange considering the price action. But over at SLV yesterday, they reported receiving another big chunk of silver. This time it was 2,348,170 troy ounces. In the last three days, SLV has taken in 6.4 million ounces.

The U.S. Mint had another sales report yesterday as well. They reported a smallish 1,500 ounces of gold sold into their gold eagle program. another 1,500 one-ounce 24-K gold buffaloes. plus a tiny 50,000 silver eagles. Month-to-date, the U.S. Mint has sold 57,500 ounces of gold in the gold-eagle program. 10,000 one-ounce gold buffaloes. and 1,095,000 silver eagles.

There were pretty big movements over at the Comex-approved depositories on Wednesday. It was all confined to Brinks and HSBC. Between the two of them, they shipped out 1,192,965 ounces of silver. The link to that activity is here .