Silver ETF What is Silver Exchange Traded Fund

Post on: 24 Май, 2015 No Comment

Categories

DEFINITION of Silver ETF:

An exchange traded fund is that which invest primarily on raw silver asset. As a grantor trusts, where each shares of ETF represent specific rights to a exact amount of a silver which is measured in ounces. One ounce is equal to 28.5 grams. Exchange Traded Funds (ETFs ) is a relatively a new phenomenon and gaining a popularity rapidly. Silver ETF came out after an gold and oil ETFs. ETFs charges you for expenses done by them. ETF takes a money for to run an exchange traded fund, an d that money is recovered from the investors. “Expense Ratio” is called in which a all ETFs charges a fees in an percentage. The cheaper the fund will be lower the expense ratio will be. One should always try to compares a expense ratio from a different ETFs which will indicate how much money is to be spent in fees. Mostly all the mutual funds do this, so in this respects we can say ETFs are like mutual funds.

SILVER ETFs:

Primary aim of a Silver ETFs is to track approximate spot price of silvers in an open market. Silver ETFs is helds in a taxable account subject to higher long term gains in capital rates on any kind of holding of more than a year. Gains are accessed accessed on a silver is as collectible and it is a subject to 28% long term gains on a capital rate. ETF market is coincided with bull markets in the commodities which includes gold and silver. Silver ETFs which tracks a physical commodity and as well as stocks of a silver which have gained a popularity as all the investor wants the cost effective ways so that a silver can be owned. Silver ETF is tends to be more practical for most peoples than buying, storing and insuring a physical silvers especially when one considers the dealers spread. If you expect the financial Armageddon and then you are storing up a silvers then an ETF cannot be your answer, however if you are looking to trades the metal good Silver ETF for a great investment vehicle.

INDIAN SILVER ETF:

India first Silver ETF(Exchange Traded Fund) is entered Benchmark Mutual Fund. Benchmark which is not only a specialists in ETFs, but it also been a pioneer behind the getting Indians to looks at a exchange trade fund which is as a mode of investment. Benchmark Asset Management Company (BAMC) is the part of a Goldman Sachs group. Benchmark Asset Management Company is the first asset management company in India which has a primary focus on an indexing and it use a quantitative technique in an for creating a products which is innovative. Benchmark is running and co-promoted by some professional who is having a long experience in the Indian and International Financial Market. Silver ETFs provides a limited control.

PROS AND CONS OF SILVER ETF:

Silver ETF gives the option to investors to track the prices of silver in their portfolio without having the costs and inconveniences of not holding the actual silver cost. Silver is been a neglected orphan in the precious markets of metals.

LIST OF SILVER ETFs IN INDIA:

After the oil and gold ETFs ,next in the line is a silver ETFs. The list of silver ETFs in which you can invest in:

Silver ETFs which Hold Physical Silver

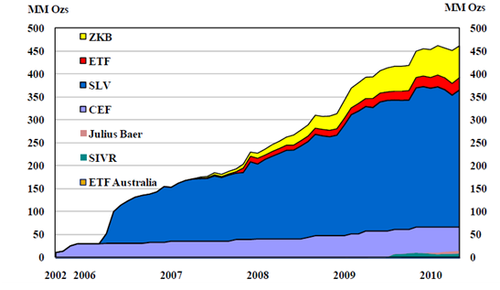

1. iShare Silver Trust ETFs (SLV): iShare Silver ETF that holds a physical silver and also the price of ETF which reflect silver holdings at any specified time.

Silver ETFs which own Future Contracts:

1. Powershares DB silver Found(DBS): It is an ETF which tracks the prices of a silver by investments in a rule based index which is made up of future contracts on the silver.

2. E-Tracs CMCI Silver Total Return(USV): It is an ETN and also tracks a UBS Bloomberg CMCI silver total return index. It tracks the prices of a silver.

Double Silver ETFs

1. Proshares Ultra Silver ETF(AGQ): It returns the daily which are 200% of daily prices of silver. Daily returns mean the volatility increased and it also means that over the long run, funds has a very good chance of not running twice the prices of silver.