Silver A Rigged Market Coming To An End

Post on: 21 Июнь, 2015 No Comment

Saturday 14 December 2013

No one can question the fact that the demand for silver has grown exponentially in the

past few years, record sales for American Eagle coins being one small example, record

buying in India, another larger example. Demand has never been greater. Supply, on

the other hand, keeps diminishing.

The reason why silver continues to languish is purely a political one. Silver, along with

elites who have controlled the United States since it was forced into bankruptcy in 1933.

The next move was to have President Nixon repudiate gold backing in 1971. The stage

was set to flood the world with Federal Reserve Notes, backed by oil, hence the petro-

dollar as the worlds reserve currency. The US has been exporting its debt-ridden

society on the world ever since. What it did not count on was China, even Russia, to a

lesser extent, emerging as world powers, and world powers that now have the gold.

The Western central bankers have been leasing, hypothecating and re-hypothecating

gold with impunity, no country ever strong enough to challenge Western financial

supremacy. Then, in the 1990s, China wanted its gold back from the United States.

Sorry, Chinks! was the arrogant response from the US. It was gone, leased out

to keep a controlled lid on the worlds price of gold. Central bankers were running a

There was a reason why, in the Wizard of OZ, the theme was to follow the yellow brick

road. The all-controlling Wizard behind the curtain was a fraud. The all-controlling

The way in which the elites are fighting back is why silver is under $20, right now.

If the price of silver were allowed to rally and reflect reality, the exponentially higher

prices would expose what lies behind the central bank fraud. The market is rigged.

The sad truth is all markets are rigged. The Libor interest rate market, the Federal

If you want an idea of what to expect for the future price of silver, one only has to look

central bank tentacles, the probability is that the ratio will move more toward 20:1.

Wherever it goes, anything less than 62:1 makes silver preferred, on that basis.

This remains the best opportunity to be buying and holding physical silver. Only buy

the physical metal, in coin or bar form, as you can afford. Do not buy silver in any form

of paper, for you are unlikely to ever received physical, if promised. Plus, the fine print

will tell you that delivery can be made in some form of paper payment in place of

physical delivery.

If one has learned anything over the past few years, it is that governments cannot be

trusted, and there is zero credibility in banks, all thieves, given the opportunity. Does it

make sense to wait for the best price possible? Not as far as we are concerned. Silver

reasons for buying are about wealth preservation that will eventually lead to increased

wealth, when price finds its eventual true level. It is not worth the risk if you intend to

There could be one more new low in the near future, but that does not mean the physical

will be commensurately lower. It is a personal choice. The time to buy is now, in the

present. When silver eventually reaches over $150 the ounce, will it have made any

material difference if you paid a dollar or two more or less the ounce? We live in an

increasingly Orwellian world. Name, address, and SSN may be required, at some point.

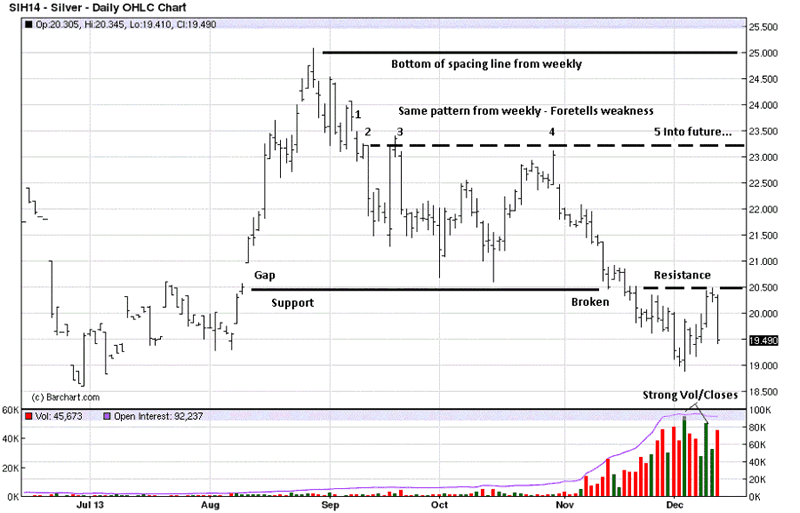

Whenever spacing exists, the probability is high that the last swing low will be exceeded.

With $18 having been a previous area of support, from 2008, and again in 2009-2010,

the ability for sellers to move the market lower will be met with increasing buying support.

For now, that spacing is indicative of silver having its work cut out to change the trend,

and trends can take time to change. The one exception would be a surprise event that

moves the market unexpectedly, creating a V-bottom, with price accelerating off the lows.

The labeling on the weekly supports what was expressed on the monthly. The focus will

be on explaining the numbers. When we say there is a high degree of logic in reading

developing market activity, the more detailed weekly chart serves as a great example.

At 1. you see a wide range vertical decline bar. This is telling us that sellers just took over

there is another failed rally at 4. respecting the horizontal line drawn almost a year

This is the message from the market that tells us about the participants and the degree

of control sellers have over buyers. Sellers remain in charge, despite all of the bullish

news and indicators there are about strong demand for and a shortage of silver. All of

that bullish news has been priced into the market. In other words, it is going to take

something new to move the market to the upside.

Our scenario is not a definitive explanation for silver, but it goes to show the kind of

thinking one needs to better understand why precious metals are going lower and not

higher. One of the strongest moving factors to act as a catalyst for silver will be the

fate of the fiat dollar. That is all central bankers care about.

Chinas and Indias record buying arent even enough to change the trend. Let that be