Should you invest in silver and gold stocks or ETFs Yahoo Finance Canada

Post on: 20 Июнь, 2015 No Comment

Is now the right time to jump on the silver bandwagon? (Part 3 of 3)

In addition to the potential headwind from higher real rates, it’s also not clear that either metal is that mispriced. Valuing commodities is notoriously difficult, as there are no cash flows.

Still, on a relative basis, it’s instructive to compare the prices of certain commodities to each other. For example, three years ago, silver (SLV) traded at close to $50 an ounce. At the time, this was a ratio of 32-to-1 versus gold; meaning gold was trading at 32x the price of silver, a level that suggested that silver was very expensive, at least relative to gold. Since then, the price of silver has fallen by more than half.

Today gold (IAU) is trading at roughly 63x the cost of silver. While this is slightly above the forty-year average of 58-to-1, it’s well within the margin of error. This suggests that neither metal looks particularly cheap or expensive relative to the other.

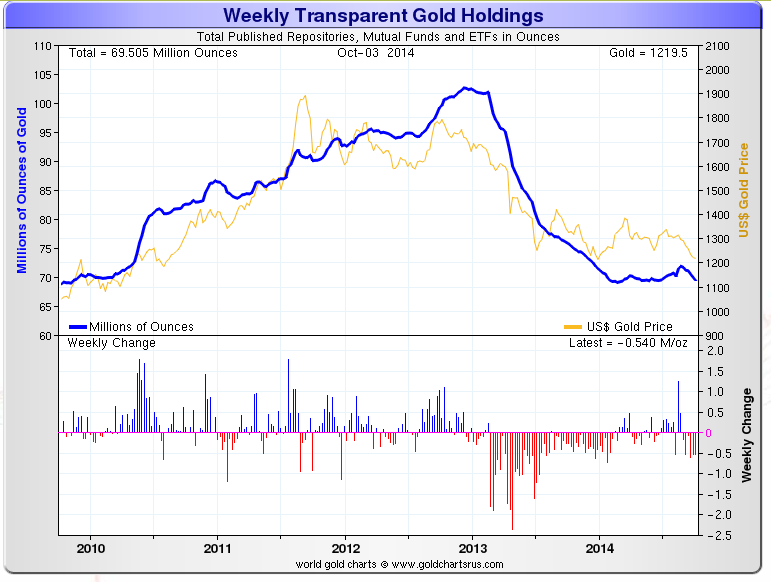

Market Realist – The following graph shows you the five-year gold (IAU) and silver (SLV) ratio. The ratio was as low as 32-to-one versus gold in 2011, and it has been steadily climbing since then. It currently stands around 63-to-one.

For investors looking to take a bet, one factor favoring silver is arguably the economy. Fifty percent of silver demand is tied to industry. If the economy does improve, silver demand should rise faster. That said, both silver and gold are vulnerable to higher real rates, neither looks particularly mispriced. and investors in silver will need to contend with a lot of volatility.

While I believe that most investors should always have a small allocation to precious metals, it’s not clear that this is the time for a dramatic increase in the allocation to either metal. For investors looking to add to positions or for an incremental play on global growth, I’d prefer cyclical stocks or Japanese equities over both silver and gold.

Market Realist – Although the global economy has been gaining speed recently, an oversupplied market and a stronger dollar may keep curb silver prices. Most analysts expect silver to stay in the range of $19–$21 an ounce in 2014.

If you want to learn more about why gold and silver aren’t interchangeable, read Must-know: 3 reasons silver isn’t the same as gold .

Commodities’ prices may be highly volatile. Prices may be affected by various economic, financial, social and political factors, which may be unpredictable and may have a significant impact on the prices of commodities.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Browse this series on Market Realist: