Should You Invest In Commodities

Post on: 20 Июнь, 2015 No Comment

Highlights

- Conventional wisdom says investors should have a small allocation to commodities.

- Over the long term, commodities have given investors a real return of zero.

- Some experts advise investors to buy firms that produce or mine commodities.

Investing » Should You Invest In Commodities?

Investing strategies

Videos

Tools

But not everyone is on board. There is one very good reason not to invest in commodities themselves. Their expected long-run real return is zero, writes Dylan Grice, a London-based strategist for Societe Generale Bank, in a report titled Commodities for the long run? Not on your Nellie — I’d rather eat coal!!

On an inflation-adjusted basis, The Economist’s commodity-price index is essentially unchanged since 1871, he says. Hence the zero return.

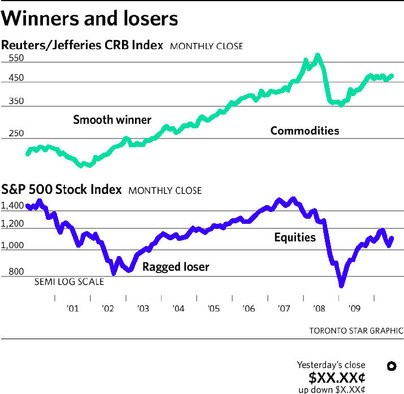

Commodities are raw materials that can be bought and sold and include products such as coffee, wheat and precious metals. Of course, some commodities have experienced periods of strength. Gold and oil prices have been rising over the past decade, for example. But it all ends badly, according to Grice.

Prior commodity bull markets have been much like England football (soccer) managers, he writes. They promised much, burned brightly for a while, but ultimately crashed, breaking the hearts of those who believed in them most.

Technological impact

Much of the long-term downward pressure on commodity prices comes from technology. Just look at whale oil. More than 100 years ago, it represented an important energy source. But the advent of electricity and crude oil eliminated the need for whale oil in the 20th century.

Inflation-adjusted whale oil prices are down quite dramatically from a century ago, Charles Lieberman, chief investment officer at Advisors Capital Management in Hasbrouck Heights, N.J. notes. Whaling is now prohibited.

More On Commodities:

investing

Similarly, advances in agricultural technology have helped keep a lid on crop prices. Fertilizer improvements and development of drought- and insect-resistant seeds have been significant, says Jeffrey Saut, chief investment strategist for Raymond James Financial in St. Petersburg, Fla. There’s been a huge leap on the biotechnology side of agriculture.

Natural gas represents one more example. Just a few years ago, gas prices were soaring, and some analysts feared major shortages in the U.S. But since then, companies have been able to extract previously inaccessible shale gas with hydraulic fracturing, and gas prices have dropped.

Another factor arguing against commodities is they don’t pay dividends. Indeed, you may be paying for the privilege of owning commodities, Lieberman says. That’s because carrying and storage costs are built into the futures and exchange-traded funds, or ETFs, that many people use to invest in commodities.

Even if you just buy gold and stick it in a safety deposit box with no storage fee, you’re paying a cost, Lieberman says. That’s because you’re forgoing the interest you could be earning by owning a bond instead.

Tangled up in contango

If you invest in commodities using futures, you have to deal with rolling over contracts as they expire. There’s a problem that can arise at rollover time — contango.

Technically, contango is when a futures contract is trading above the expected spot price at contract maturity. In English, it means the new futures contract you have to buy is getting more expensive. And contango often occurs when commodity prices are rising. So you’re getting penalized for seeing the market go your way.

Commodity prices are very volatile, as many have probably noticed with the price of gasoline over the past few years, which can cause major losses for investors.

Commodities go on secular trends that you can probably take advantage of, but that’s more the ilk of being a professional trader rather than an investor, says Mick Heyman, an independent investment adviser in San Diego. Professional traders can make a fortune, but most of us don’t fit that. We’re the 99 percent, and most of the 1 percent shouldn’t be doing it.

Commodities are too risky for the clients of Raymond James, Saut says. Say you’ve gone short on orange juice futures, trading on margin, he says, referring to a strategy that bets against an asset with borrowed money. If there’s a freeze overnight in Florida, that could wipe out your whole position, he says, since orange juice prices would rise.

Stocks as a proxy

To be sure, Saut and others advise an exposure to commodities, but through stocks of companies involved in the commodities industry rather than through commodities themselves. That’s been my strategy for the last decade, says Chris Litchfield, a former hedge fund manager who is now a private investor in Greenwich, Conn. He thinks commodities are in a bull market that could last another eight years.

You can invest in anything from an integrated oil company to an ETF made up of companies that mine precious metals. And many of these companies and funds pay an attractive dividend.

But don’t expect your ride will always be steady with these investments. Commodities are a bit less speculative if you get exposure from a company that mines or produces a commodity, Lieberman says. But that segment is still more volatile than the stock market on average. The average investor wouldn’t want to devote too much of their portfolio to that.