Should Investors Fear the Fearless Market

Post on: 27 Май, 2015 No Comment

Adam Jeffery | CNBC

The global economy continues to show signs of slowing, yet stock markets are back near their highs for the year. Analysts are questioning how long this will last, and worry markets are fearless and schizophrenic.

The first month of the second quarter is behind us, and the ‘growth scare’ that we feared has materialized, to some extent at least. The market reaction to the downbeat economic news is in some important respects surprising and instructive, said Michael Gavin, head of emerging markets strategy at Barclays Capital, in a research note on Thursday.

Gavin noted that safe haven bonds did well in April, but underperformed credit, and equities in most advanced markets, while Italian and Spain government bonds posted record low yields.

All of this points to a market that seems more inclined to distinguish between disappointment and fear, and less inclined to flee risk for safe havens when the economy disappoints… But it also suggests that market performance has become highly conditioned by the financial context created by the systemically important central banks, and the expectation of more liquidity to come in the event that the world economy remains weak, he said.

For investors focused on macroeconomic data, there is plenty to worry about, after a slew of weak data in recent weeks. Thursday’s HSBC Chinese manufacturing survey revealed a drop in new export orders for the first time this year and Wednesday’s U.S. manufacturing activity data showed a fall to 50.7 in April, its lowest reading in six months. U.S. first quarter growth numbers also missed expectations on Friday and analysts are concerned second quarter growth could be even worse.

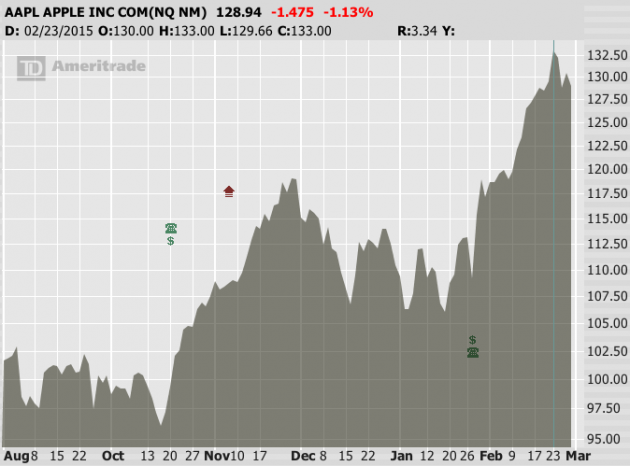

Despite this, the S&P 500 and the Dow Jones have both reached record highs in recent weeks, on the wave of a risk-on rally that gained momentum at the start of the year. In addition, the U.K.’s FTSE 100 has staged an 11-month rally, its longest winning streak since its 1984 inception.

Onwards and upwards, Citi analysts wrote in a research note focused on the U.K.’s FTSE All Share index. which has returned around 11 percent and largely outperformed gold year-to-date. This is an unusual example of where a risk-on asset outperformed a risk-off asset, during a risk-off period, Citi said, calling the index schizophrenic.

However, Philipp Bartschi, chief strategist at Sarasin, warned a correction could loom, and said he booked profits on stocks in April.

The latest macro data suggests the global economic cycle has passed its peak. This increases the risk of stock market setbacks. Investors who currently welcome the liquidity flooding into the markets from the central banks may soon start to worry about the lack of economic growth, Bartschi wrote in a note on Thursday.

The major question, according to Gavin, is what will happen once central banks start to lessen their market-supportive stances.

Should we be worried that good news may eventually be bad news for markets? Gavin said.

For the time being, with inflation still dormant in most advanced economies, and highly stimulative policy stances the norm, we think it will remain a theoretical question.

—By CNBC.com’s Matt Clinch; Follow him on Twitter @mattclinch81