Select Sector SPDRs Select Sector SPDR ETFs

Post on: 16 Март, 2015 No Comment

E xchange-traded funds (ETFs) are growing in popularity. Bucking difficult market conditions, assets invested in ETFs have increased from $569 billion in January 2008 to $693 billion in September 2009. The flexibility provided by Select Sector SPDR ETFs in creating low-cost portfolios with customized asset allocations have enabled them to carve out a niche in the ETF world.

Consumer Discretionary Select Sector SPDR Fund (XLY)

Consumer Staples Select Sector SPDR Fund (XLP)

Energy Select Sector SPDR Fund (XLE)

Financial Select Sector SPDR Fund (XLF)

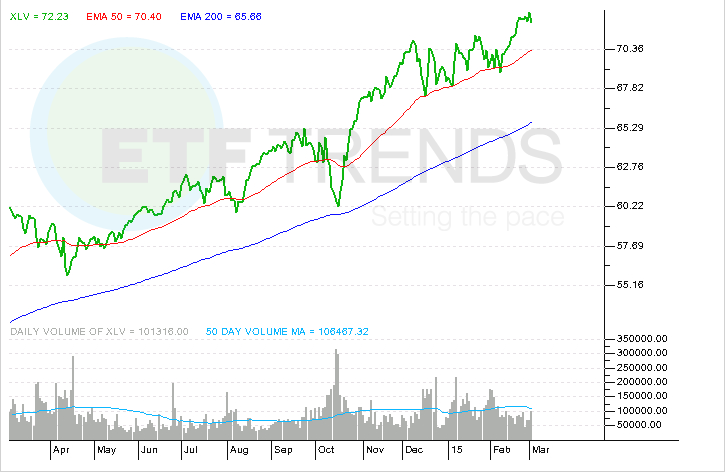

Health Care Select Sector SPDR Fund (XLV)

Utilities Select Sector SPDR Fund (XLU)

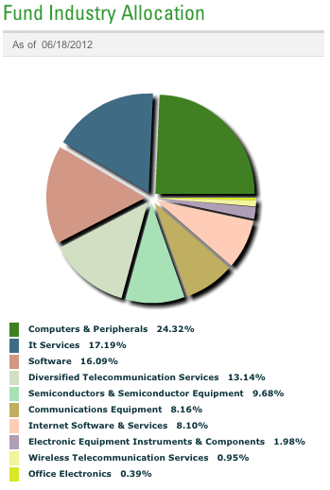

The Select Sector SPDRs are formed by allocating each stock in the S&P 500 to one Select Sector SPDR ETF. Collectively, the nine Select Sector SPDRs make up the S&P 500.

Select Sector SPDR ETF Performance

The performance of an individual Select Sector SPDR ETF is tied to the performance of shares in that sector. Share prices in certain sectors are influenced more by the economy and by factors such as government policies, regulations, or commodity prices.

As such, an individual Select Sector SPDR ETF’s performance can be quite different from other Select Sector SPDRs as well as the S&P 500 index. For example, in 2005 Energy Select Sector SPDR (XLE) gained over 40% while Consumer Discretionary Select Sector SPDR (XLY) declined almost 6% and the S&P 500 gained about 5%.

Winnow Out the Chaff from the Grain.

AlphaProfit’s proven process selects winning sectors and industry groups while leaving out losers. AlphaProfit subscribers have thrashed the S&P 500 by more than 2-to-1 with gains of 117%, 46%, and 45% in wireless, healthcare providers, and energy services investments, respectively. Order your subscription with our sixth anniversary sale and save!

Benefits of Select Sector SPDRs-based Custom Portfolios

Select Sector SPDRs provide low-cost exposure to specific sectors. They provide investors the ability to build customized portfolios that over-weight or under-weight particular sectors. By over-weighting specific sectors or by eliminating exposure to troubled sectors investors can enhance returns, reduce risk, or both.

Enhance Returns

Take the case of an investor who doubles the weighting to both energy and financial sectors in 2005 vis-а-vis the S&P 500 and proportionally reduces allocation to the seven other sectors. This investor earns almost 8% compared to the 5% gain for the S&P 500, a 60% improvement. The higher return is achieved with a 5% increase in daily volatility as standard deviation in daily returns increases from 0.64 to 0.67.

Reduce Risk

Likewise, take the case of an investor eliminating exposure to financial and technology sectors in 2008 and proportionally increasing allocation to the other seven sectors. This investor limits losses to 30% while the S&P 500 loses 37%, a relative improvement of 7%. The superior relative return is achieved with a 13% reduction in price volatility. The standard deviation in daily returns declines from 2.41 to 2.10.

Investors can increase returns, reduce risk, or both by mixing Select Sector SPDRs in different proportions. Investors can take this concept to the next level of higher return and lower risk by targeting specific industries within individual sectors.