Sandridge Still Big in the Mississippi Lime

Post on: 16 Март, 2015 No Comment

US Equity | Energy

Casey Hoerth

Stock quotes in this article:

chk

Of all the latest horizontal drilling plays in North America, the Mississippi Lime could be one of the most disappointing. Back in 2012, some had high hopes for this multi-layered play situated between Oklahoma and Kansas.

One of those people was Tom Ward, the former CEO of Sandridge Energy (SD ). Ward, at one time, predicted a production surge from the Mississippi Lime that would make this shale play rival the Eagle Ford and the Bakken.

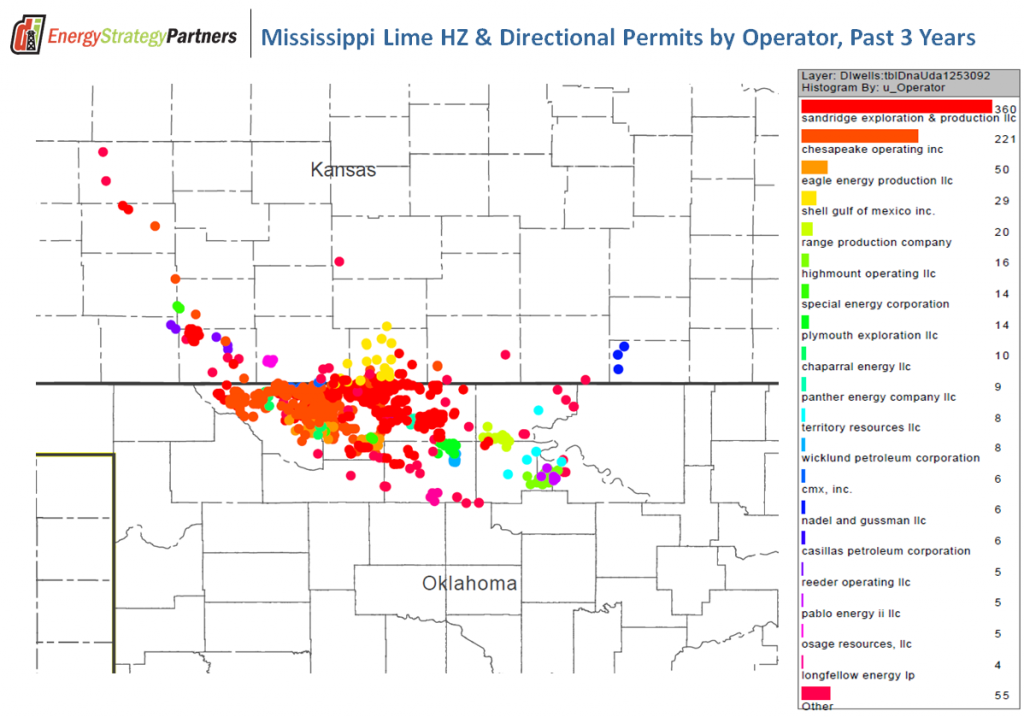

That hasn’t happened. Between 2009 and 2010, companies rushed into the Mississippi Lime, but by early 2013, that trend reversed and these players left just as fast as they came. The casualty list is a prestigious one.

Late in 2013 Shell exited its 600,000 acre position with 45 producing wells. The returns just weren’t there. In early 2013, Chesapeake Energy shed a 50% interest in some 850,000 net acres, to Sinopec. Four months later Chesapeake sold the other 50% at less than a third of that price. Apache acquired 580,000 acres in 2012, but also exited the play to target the Permian Basin.

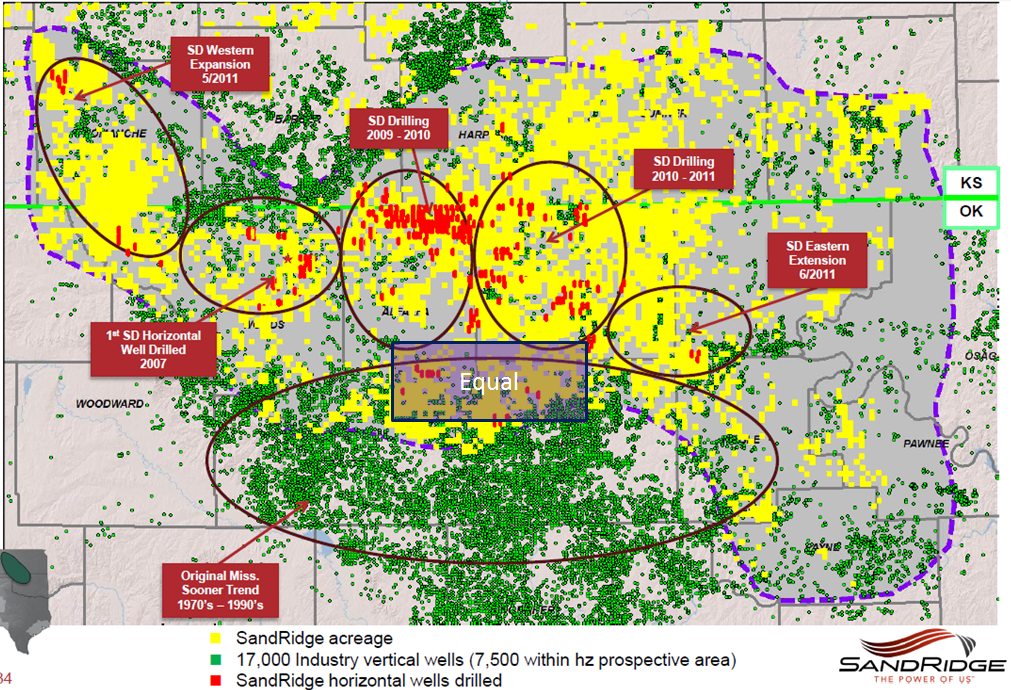

One of the few names left is Sandridge Energy, which had been gradually collecting contiguous acreage parcels as all the other players vacated. Sandridge now has about 2 million acres here; roughly equal to Chevron’s acreage count in the Permian.

Last year, after an intense proxy struggle, Ward was removed from his duty and replaced by a more shareholder-friendly management regime. For his part, Ward was also a co-founder of Chesapeake Energy (CHK ), and his style of management was not dissimilar to that of Aubry McClendon. Ward bet on huge acreage positions and maximized drilling over as much acreage as possible.

The new management team is more value-focused and prefers a measured drilling schedule. It also accepts the reality that others have acknowledged — that the Mississippi Lime has a lot of low-return, ‘dud’ locations. Management now seeks to focus on core areas within this increasingly lonely play.

With more than 1.8 million acres in the Mississippi Lime, Sandridge now has a big economies-of-scale benefit, and not just in the conventional way. In the oil part of this play, saltwater actually outnumbers oil by a ratio of ten to one. For every 100 barrels of oil, an operator in this play must also deal with 1,000 barrels of saltwater. The scale of facilities required for this means that operators here had better have a large acreage position to stay economical. This represents quite a barrier to entry.

Since its regime change, Sandridge has done a lot to turn itself around, including a cleanup of its balance sheet to ensure long-term funding. Also, management expects 25% compound production growth for multiple year.

Most important, however, is the company’s ability to make this play a profitable one. The above type curve shows Sandridge’s current $2.9 million well providing an IRR of 64% given present pricing. 64% is not great, but it is certainly respectable. As you can see, management believes it can improve that IRR to 79% within three years and ultimately push returns up to 128%.

Sandridge is quite a potential turnaround story, and one that I believe investors can get behind. The company has a market cap of $3.18 billion, and trades at a price to book value of just 1.88x — not bad for a company growing production at 25% per year. Most shale players growing at a similar pace currently trade at over 3x book.

As Sandridge gets its act together, this stock will continue to have some great upside.