Safe havens fall and risk assets ralley Forex Trading News March the 31st

Post on: 2 Май, 2015 No Comment

Russians reiterate that they have no interest in invading Ukraine, but also pressed home that the West should also give up designs to push Ukraine into NATO and the EU. This came out on the weekend so markets haven’t had a chance to react to it, however this morning we can already see the risk appetite increase from price action in US$’s and yen. Friday night did give some good economic news which started the ball rolling in that direction anyway, with improved outlooks from Germany, UK and US. So expect to see safe havens fall and risk assets rally early in the week, ie stocks up, whilst in FX the greenbacks/swissy/yen will weaken along with bonds and gold.

Tomorrow we have the RBA coming out with their interest rate stance, do not expect a change. it will be what Glenn says in statement that is released at 230pm Sydney time that could provide some volatility, but unlikely to do that either. Thursday night is the BOE and ECB’s turn at playing with rates. Again, no rumours of change going to occur. All three central banks have recently gone on record as saying that rates will remain low into the foreseeable future. They won’t be raising them anytime soon and leave door open to further cuts if necessary, is how to read that. So the first thing the market will be looking for in these meetings is a change to the “remain low” rhetoric. Aunty Janet let it slip over in the US and we saw the fallout from that 10 days ago. Don’t expect the seasoned bankers of Stevens/Draghi/Carney to make the same mistake. In fact, tonight we have both Yellen and Carney talking publicly. Janet doesn’t have a question time, so nothing their but Carney does and people will be looking for snippets from him to gauge what Thursday may bring.

DATA HIGHLIGHTS TODAY – EU CPI. Canadian GDP. US Fed Chair Yellen. UK BOE Gov Carney.

AUDUSD – Has put in a high test bar that tested the 93 cent resistance level. Stops should definitely be tightened now as a pullback could be imminent and RBA is talking tomorrow.

Resistance: 9300/9390

Support: 9085/8900/8654

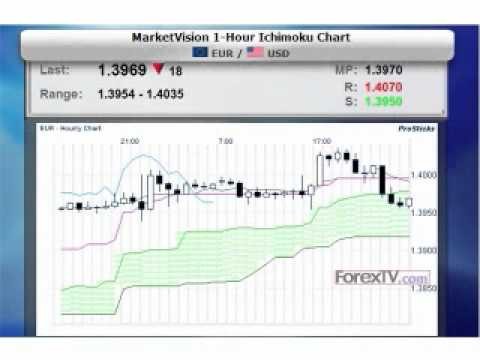

EURUSD – Closed right on the 50ema and almost in middle of the day’s range. Can’t get any more un-committed than that!

Resistance: 14050/14260/14320

Support: 13740/13488

GBPUSD – A slightly HH buyer bar and stop is now breakeven. Keep an eye on momentum but with Carney talking tonight we should get a kick higher I suspect.

Resistance: 16785/1.69/1.70

Support: 16300/15950/15830

NZDUSD – We got the sellers on Friday. Need to see a LL than 8649 in today’s bar for a potential trend reversal trade tomorrow. Momentum is weaker here which adds to the attraction.

Resistance: 8676/8842

Support: 8090/7925/7714

USDCAD – It is still a LHLL but minor signs of strength being a buyer bar. A HHHL in today’s bar gives us a signal to get long, from where we would normally look. However, I think there is signs of a fundamental shift coming from Canada. They have been super bearish for almost 2 years now. I get this sense that tide is turning. Commodity markets too are seem to be bottoming and that can only assist the Leafs.

Resistance: 11170/11233

Support: 10859/10715

USDJPY – Well. There you go. Just when you close your eyes, yeaarhh! She bucks you awake. Had that happen on horseback in the NT a couple of times, not fun to wake up half out of the saddle and the rocky ground looming fast. But I digress. A good strong bar that broke through recent minor resistance at 102.70. Has all the hallmarks for a good entry, apart from 2 things, risk:reward potential & momentum is already heating up. Better idea is to go down time frame (ie 4hr or 1hr) charts and trade the trend on that chart until the daily exhausts itself.

Resistance: 105.57/108.35/110.50

Support: 100.62/100/99.80

GOLD – Weakened slightly again and I reiterate, there is little reason to own gold right now.