Risk On Risk Off 4 ETFBased Strategies Reviewed

Post on: 22 Июнь, 2015 No Comment

Whatever happens in Greece and the rest of Europe over the next few weeks, many traders want to know whether they should go into risk on or risk off mode.

Risk on? Risk off? Could it be so simple? I kind of doubt it, but that was the subject of a CME Group white paper, Pursuing Risk-on, Risk-off Trades , published back in November 2011.

There is much interest in taking risk exposures based on the prospects, or lack of, economic flare-ups. Sometimes, these types of positions are whimsically referred to as risk-on, risk-off transactions with a nod to the Karate Kid film franchise.

I.e. when economic tensions decline, you might accept more risk — or turn your risk-on — by taking an aggressive market position. When economic tensions are expected to flare-up, reduce risk — or turn your risk-off — by taking a defensive market posture.

The CME Group recommended a few different strategies to consider so I thought I’d see how they worked if you’d used ETFs to follow them. Even if you don’t place trades like these, I found that following some of them may help you understand where markets may head in the future.

***

Carry Trade: Australian Dollar / Japanese Yen

The Australian dollar bears interest, while the Japanese yen costs little or nothing to borrow. A currency carry trade would be to sell (or borrow) yen and use the proceeds to buy the Aussie, earn the interest, and pocket the difference. This is what many currency traders do during risk on conditions, reversing that position when the carry trade unwinds when risk off seems wise.

Here’s how to execute the trade the Australian Dollar ETF (NYSEARCA:FXA ) and Japanese Yen ETF (NYSEARCA:FXY )

- Risk on: Long FXA / Short FXY

- Risk off: Short FXA / Long FXY

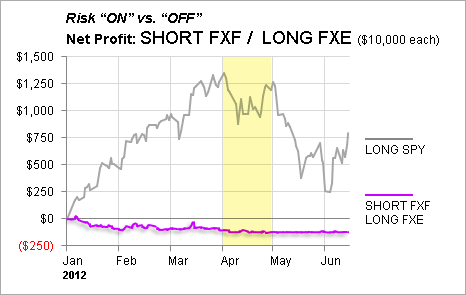

This chart shows the performance of the risk on version of this trade against a long position in the S&P 500 ETF (NYSEARCA:SPY )

The yellow area shows the time period when, retrospectively anyway, turning risk to the off position would have made sense. (Turn risk off in May and go away?). At the very least, this chart shows how reviewing a popular currency carry trade can reveal attitudes toward risk as you can see this trade would have been a profitable one to reverse in April.

* * *

Evaluating Eurostress: Euro and Swiss Franc

The CME Group paper suggests that when risk goes into on mode, traders move assets into currencies other than the US dollar, such as the Euro. So one strategy would be:

- Risk on: Long Euro / Short USD

- Risk off: Short Euro / Long USD

There’s no need for a paired ETF trade here because buying the Euro ETF (NYSEARCA:FXE ) essentially includes the short US dollar component of the position. And when risk is off, a short FXE position represents that trade in terms of being long the US dollar.

This has not appeared to work out very well.

Shorting the euro made sense later in April, but a long position was not particularly rewarding earlier in the year.

Another version of the trade suggested in the CME Group white paper is the same, except pairing the euro with the Swiss franc instead of the US dollar. You could use the euro ETF and the Swiss Franc ETF (NYSEARCA:FXF ) as follows;

- Risk on: Long FXE / Short FXF

- Risk off: Short FXE / Long FXF

You can see little deviation in this trade compared to the US dollar version above.

Why? Well, the Swiss have not cooperated with currency traders who might bet on a stronger Swiss franc. The Swiss, it seems, are not exceptionally keen on the idea of making Swiss goods more expensive on world markets. And I can’t say I blame them.

* * *

Gold: A risk or safety trade?

One mistake I think the CME Group white paper makes is assuming that gold is an asset that investors turn to in times of stress, but avoid when risk is turned back on again.

So their suggested trading strategy pairs a gold and S&P 500 position, which could be executed using the SPY ETF and the SPDR Gold Trust (NYSEARCA:GLD ) as follows:

- Risk on: Short GLD / Long SPY

- Risk off: Long GLD / Short SPY

Year to date, this would have been a rather whipsawed trade and would not have revealed much about the risk on/off stature of the market overall.

Over the past few months (and for the past few years as I see it), gold has not generally sold off substantially just because stocks are rising and does not always rise rapidly as more stress builds in financial markets.

* * *

Public vs. private debt

CME Group is obviously interested in the futures aspect of trading strategies. One of the strategies they presented was through swap spreads for which futures contracts are available.

Finally, let us consider so-called swap spreads or the spread between the fixed interest rate associated with over-the-counter (OTC) interest rate swaps (NYSE:IRS ) vs. U.S. Treasury securities of similar maturity. This spread may be considered a form of credit spread to the extent that it compares private vs. public credit risks.

This cannot be perfectly mirrored using ETFs, but you could hedge the Investment Grade Corporate Bond Fund (NYSEARCA:LQD ), which holds corporate debt, with the 20+ Year Treasury Bond Fund (NYSEARCA:TLT ), which holds treasuries.

Although it does represent a spread between private and public credit risk, this is not a perfect hedge because the maturities are somewhat different, but the trade would be:

- Risk on: Short TLT / Long LQD

- Risk off: Long TLT / Short LQD

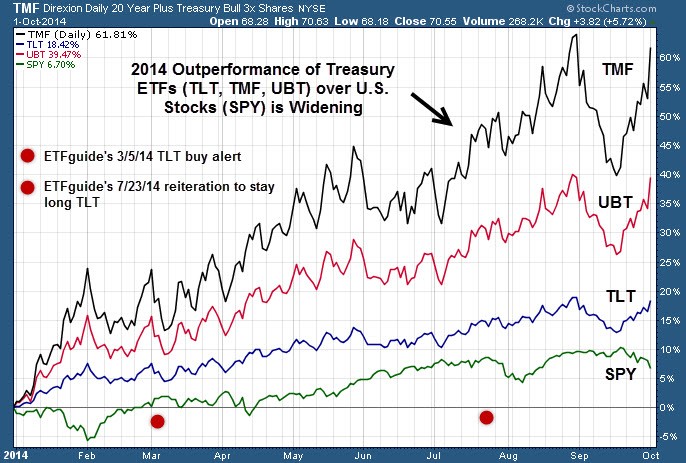

This would have been a great move earlier in the year and reversing the trade a couple of months ago would have worked out pretty well, too.

* * *

As the CME Group paper concludes:

The concept of risk-on, risk-off trading has won increasing interest and popularity in recent years. There are, of course, many ways to construct transactions that are sensitive to these macroeconomic conditions.

I’m not sure following increasing popularity is necessarily a road to big profits, nor does a white paper provide a ‘holy grail investment guide. But it may be worth reading because it does illustrate some positions that can become key indicators for your trading.

From among these examples, the Australian dollar/Japanese yen currency carry trade and the spread between corporate and treasury bonds have offered the best view of the risk landscape this year. They may be worth following on an ongoing basis, but both tell me that risk is off for the time being.