Retirement Investing Today Why I Hold Gold in my Portfolio

Post on: 4 Июнь, 2015 No Comment

Why I Hold Gold in my Portfolio

In my experience if youre discussing UK Equities as part of an investment portfolio its validity is unlikely to be challenged and any response is likely to be fairly passive. A typical response might be something like what percentage allocation do you have. If you say to somebody that you hold Gold then the responses can be far more variable. At the extreme they can range from I dont believe in Gold as an investment as it doesnt pay a dividend because it just sits there looking shiny to Im 100% invested in Gold, guns, ammo and tinned beans.

Within my own portfolio I target a holding of 5%. So why do I hold gold? Its for the same reason that I buy property or gilts on top of my equities. To quote Bernsteins The Intelligent Asset Allocator its simply because Dividing your portfolio between assets with uncorrelated results increases return while decreasing risk which is a key concept within Modern Portfolio Theory (MPT). Bernstein continues with Mixing assets with uncorrelated returns reduces risk, because when one of the assets is zigging, it is likely that the other is zagging. The keyword in the first quote is uncorrelated. In the book he works up some examples to validate these statements.

Lets run a simple analysis looking to see if we can find an example of gold being uncorrelated with another asset class.

My first chart shows how the Monthly Gold Price in Pounds Sterling (s) has changed since 1979. Over the past year its Price has fallen by 0.6%. We looked in detail at the FTSE100 last week so lets use that as a different asset comparator as that dataset is up to date. Over the past year the Price of the FTSE100 has risen 7.0%.

Click to enlarge

Diverting quickly for completeness, as I always like to show charts in Real terms to remove the emotion that comes with the unit of measure continually being devalued by inflation, let me quickly also show the Real Gold Price in Pounds.

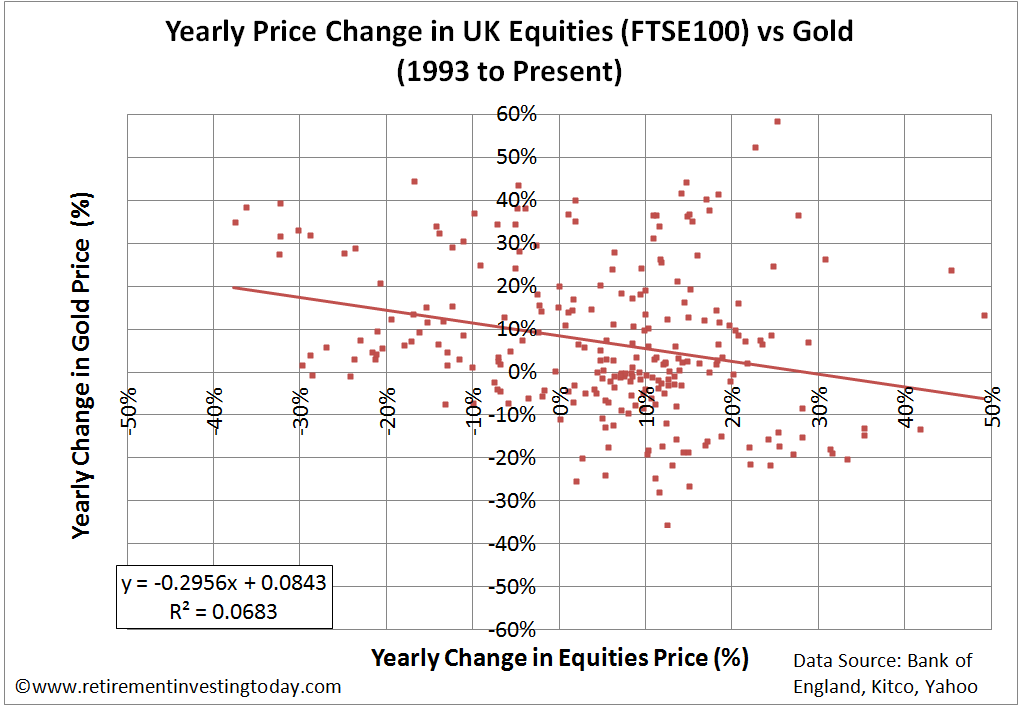

Back on track lets now expand on the return relationship between the two asset classes. My FTSE 100 dataset only goes back to 1993 so lets plot the annual return of the FTSE 100 to Gold Priced in Pounds Sterling () on monthly increments.

Click to enlarge

Even over this young dataset I can see a number of examples of one zigging while the other is zagging. The correlation of the annual return of Gold Priced in Pounds to the annual return of the FTSE100 is actually -0.261. This is a weak negative correlation. So the two are not perfectly uncorrelated but the correlation is weak.

So does this Modern Portfolio Theory lark really work? As regular readers will know I’m not an investment professional but what I can say on the matter is that 7 years in to my DIY ride to Financial Independence my diversified portfolio of different asset classes doesn’t keep me awake at night, nor cause me to buy/sell frequently, while at the same time has provided me with an annualised real return after inflation of 4.1%, so its working for me. That said you also dont have to go far to find detractors.

Finally, given I’m looking for a 5% Gold allocation lets look at my current allocation within my portfolio. Increases in the stock market, falls in the price of Gold and some new money entering the portfolio which hasnt been invested in gold means that my Gold allocation is now down to 4.4%. In percentage terms Im 12.8% underweight which is my second most underweight asset class after cash. A top up could soon be on the cards which will be a novelty given my last Gold investment was a purchase back in February 2014.