Reliance Gold Savings Fund Review – Should you Invest

Post on: 13 Август, 2015 No Comment

Reliance Mutual Fund has launched the Reliance Gold Savings Fund & there is a big buzz in market around this product. What a great time to launch such fund when gold is rising and equities are a bit in problem. Investors are tempted to open a Systematic Investment Plan (SIP) in Reliance Gold Savings Fund. First let’s understand this product, its benefits, taxation, how it’s different from Gold ETFs & later we will see if is Worth Investing or not. (You will be shocked Guaranteed)

What is Reliance Gold Savings Fund

Reliance Gold Savings Fund is a bit of a new concept of investing in gold as it allows you to invest in gold without a demat account. Reliance Gold Saving fund is a Fund of Fund & it endeavors to near the returns of Reliance Gold Exchange Traded Fund which in turn invests in physical gold. But unlike a ETF the fund does not require a demat account and the stock market route for buying and selling the units.

Reliance Gold Savings Fund is a passively managed fund suitable for a long term investors, who can invest through SIP or lump sum. As a long term investment it gives an opportunity to invest in the GOLD commodity, in a convenient way, which is one of the fancied assets for any investor. (fancied asset)

Features & Benefits of Reliance Gold Savings Fund

Reliance Gold Savings Fund opens a new avenue for investing in gold. This fund enables to reap returns closely to returns provided by Reliance Gold ETF.

- No need for having demat account: so no need to open a demat account and pay the annual maintenance charges.

- Systematic Investment Plan (SIP). Benefit your investment by investing through small amount over a period of time. Even Small Amount like Rs 100 or Rs 500

- Systematic Transfer Plan & Systematic Withdrawal Plan: A benefit of STP and SWP makes it a convenient mutual fund product.

- Easy to Invest & Liquidate: similar to investing in a mutual fund scheme.

- Purity & Safety: investment is in highest quality gold with no theft or warehousing problems.

Taxation on Reliance Gold Savings Fund

- Long Term Capital Gain Tax(after 1 year) of 10 % or 20 % with indexation will be applicable

- Short Term Capital Gains (before 1 Year) applicable as per tax slab for the investor

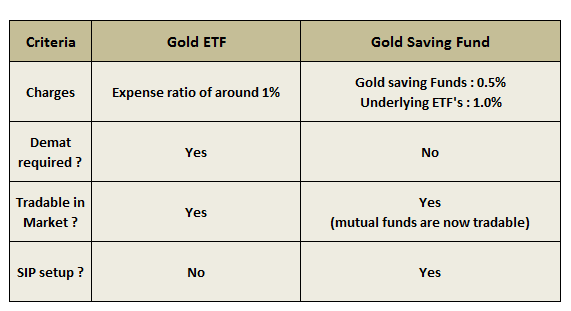

Reliance Gold Saving Fund Vs Gold ETF Fund

A Gold ETF is an ETF that has gold as the underlying security. So, the value of the ETF is derived from the value of underlying gold. Gold ETF would be a passive investment; so, when gold prices move up, the ETF appreciates and when gold prices move down, the ETF loses value.

In ETF incur charges like annual maintenance charges for demat account, delivery brokerages charges, transaction charges incurred for investing through the dematerialized mode. The investors will be bearing the recurring expenses of the scheme, in addition to the expenses of underlying Scheme.

Is Gold Saving Fund a unique idea

If we talk about launching of a fund – yes it is but if we talk about thinking no. Quantum Mutual Fund applied for Quantum Gold Saving Fund with SEBI in May 2010 but never launched it.

How to Invest in Reliance Gold Saving Fund

Read Next point before reading this

- Call your mutual fund agent – put down your phone he will himself call you in 3-4 days.

- You can also purchase it online.

Now comes the warning sign board which normally is hidden in the scheme related documents – so here it is…

“The investors of the Scheme will bear dual recurring expenses and possibly dual loads. viz, those of the Scheme and those of the underlying Schemes. Hence the investor under the Scheme may receive lower pre-tax returns than what they could have received if they had invested directly in the underlying Schemes in the same proportions.”

- Dual Loads: Reliance Gold ETF is having no Load but Reliance Gold Savings Fund is having a load of 2% for 1 year. So if you exit before 1 year you have to pay 2% load. I know you are long term investor & will save your loads but what about expenses.

- Dual Recurring Expenses: Their lies bigger problem – they say “Investors may please note that they will be bearing the expenses of the relevant fund of fund scheme in addition to the expenses of the underlying schemes in which the fund of fund scheme makes investment.” Oh! Dual expenses – let’s check how much:

- Reliance Gold ETF 1%

- Reliance Gold Savings Fund .5%

So there are total of 1.5% charges (and Reliance is free to change

- Reliance Gold Savings Fund & even Reliance Gold Exchange traded funds are passive funds so 1.5% charges are too high. In passive funds there is no role of fund manager – internationally ETF (including gold ETF) average yearly charges are less than .5%.

- Most important point of the whole article – Gold as an asset class has given returns close to inflation. So we are talking about 6-7% OK assume 8% that it’s going to deliver in next 10 years. So now compare expenses ratios

- Reliance Gold Savings Fund 1.5% on 8% this comes to 19% and if we get lower return this ratio will increase

- Diversified Equity Mutual Funds 2% on 15% this comes to 13% and here there is active involvement of fund management team.

Why I quoted Quantum Mutual Fund in this article because they mentioned a great point in their offer document “These are the fees and expenses for operating of the Scheme. The annual recurring expenses of the Scheme shall be borne by the AMC. The AMC shall not charge any investment management fees.”

Should you buy Reliance Gold Savings Fund

Everyone is ready to convince you that gold price will only go higher but we just want to say gold should be small part of asset allocation and the reason of buying gold should not be rise in price. I think I have already expressed my views on Gold Prices & also shown you expenses in this product. End of the day it’s your hard earned money.

Agents will come to you & show you 5 Year & 10 year return charts – ask them for 20 years & 30 years chart. You will find gold have even underperformed Fixed Deposits.

Have you ever wondered where were these guys 5 years back when gold was 1/3rd of its current price??

What do you think – should one buy Reliance Gold Savings Fund ?