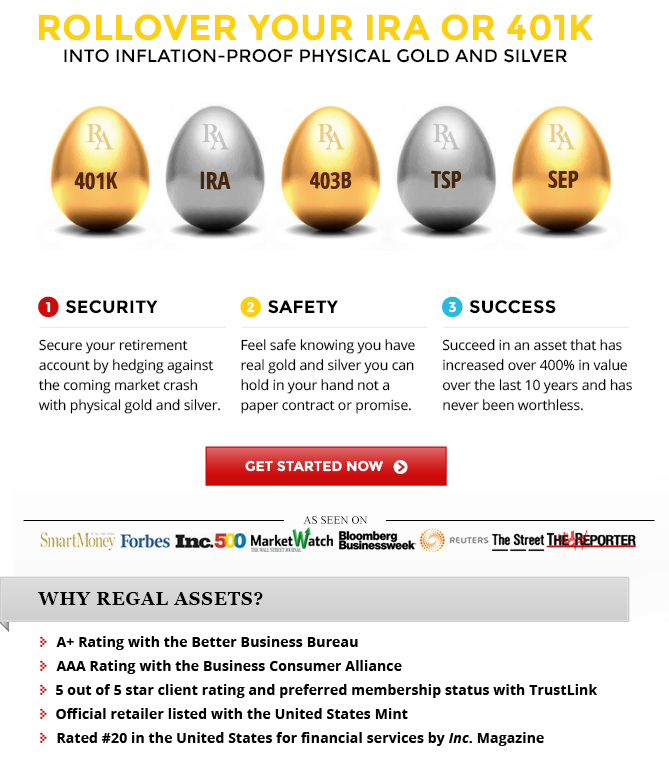

REGAL ASSETS REVIEW The Beginners Guide to Precious Metals

Post on: 3 Апрель, 2015 No Comment

by Kevin

Click Here for Regal Assets

In this section of our Regal Assets Review site, we will talk about precious metals and the differences between each.

Since time immemorial, gold and silver have always been considered as valuable metals. They are well sought after and their value has never diminished through time. Today, gold and silver have found a place in the portfolios of savvy investors. Aside from gold and silver, there are varieties of other precious metals. but which one of them makes a great investment? If you are a beginner, you need to have an idea of the important characteristics of metals and how they affect the metals investment potential.

Gold

Because of its impressive characteristics, gold is the most famous among precious metals . It is a sturdy metal that does not rust or corrode. It is malleable and a good conductor of heat and electricity. Although gold is known for its industrial uses, such as in electronics and dentistry, it is best known to many as a base for jewelry and a widely acceptable form of currency.

The main factor that qualifies gold to become a part of your investment portfolio is its stability. The different systemic financial concerns we witness around us have proven the volatility of money, banks and governments; but it has also given emphasis on the enduring value of gold through tough economic times. Negative rates of return in the bond, equity and real estate markets drive people to invest in gold since they are certain that gold will always maintain its value. Make sure to check out Regal Assets website for more information on gold.

>> Check Out Our Official Regal Assets Review <<

Silver

Silver has a different value from gold. The price of silver sways between its storage value and its role as an industrial metal. Because of this, the prices in the silver market are more unpredictable than gold. While silver trades roughly in line with gold as a metal for hoarding, its industrial supply and demand equation for the metal wields a strong influence over its price.

The equation is largely affected with the dawn of new inventions. The birth of the digital camera for example has greatly eclipsed silvers once principal role in the photography industry. Emerging economies in the East which has paved way for the explosive demand for medical products, electrical appliances and other industrial items make silver a desired commodity. The extent of how these developments affect the overall noninvestment demand for silver is unclear. However, the fact that remains is that the price of silver is affected by its industrial applications and that it is not solely used in the world of fashion or as a store of value. If silver is what you are interested in, Regal Assets will help you get started investing in silver.

Platinum

Just like gold and silver, platinum is another precious metal that is traded 24/7 on global commodities markets. In times of economic stability, platinum usually fetches a higher price than gold. The reason for this is that platinum is much more rare and a far lesser amount of the metal is mined annually.

Another factor that influences the price of platinum is that it is considered an industrial metal. The largest use for platinum is for automotive catalysts, a device fitted in vehicles to control the harms of dangerous emissions. Next to this, jewelry accounts for the greater demand for platinum. It also has a number of industrial uses such as electrical components, silicones, hard discs, dental and medical uses. All these factors make platinum as the most unpredictable among precious metals . Regal Assets is one of the few companies that will get you started investing in this specific metal.

Precious metals are very effective in diversifying your portfolio. They have an intrinsic value, and a genuine upheaval insurance, as they carry no credit risks and the metals themselves cant be inflated. Precious metals are effective in terms of diversifying your portfolio. Just keep in mind that in order to be successful in your investment the secret is to lay out your goals clearly and analyze your risk profile before making the leap.

Now that you have a basic understanding of the different types of precious metals and now you’re ready for the next step in getting further information on investing in precious metals. please be sure to check out our Regal Assets Review .