Purpose Monthly Income Fund February Commentary

Post on: 17 Апрель, 2015 No Comment

Fund Commentary

The Fund has an income allocation to bonds and high-dividend equities, and has a real asset allocation for purchasing power protection.

The Fund was positive in February. The best performing equity sectors were materials, staples and financials, while real estate, utilities and energy were the weakest sectors. The Fund completed a quarterly rebalance, and improved its diversification by increasing the number of real estate holdings. The Fund added Pure Industrial, Brookfield Canada Office Pro, CBL & Associates, Cedar Realty, Mack-Cali Realty, Cyrusone, Coresite Realty, Corrections Corp, Darden, GE, Geo Group, Granite Real Estate, Home Properties, Hospitality Properties, Innvest Real Estate, Investors Real Estate, Liberty Property, Mid-America Apartment, Morguard Real Estate, Northern Property, One Liberty, Penn Real Estate, Rayonier, Select Income Telus and Thomson Reuters. The deletions were Allied Properties, Bombardier, Can Apartment, Crombie Real Estate, Finning, Mattel, McDonald`s, Pfizer, AT&T and George Weston.

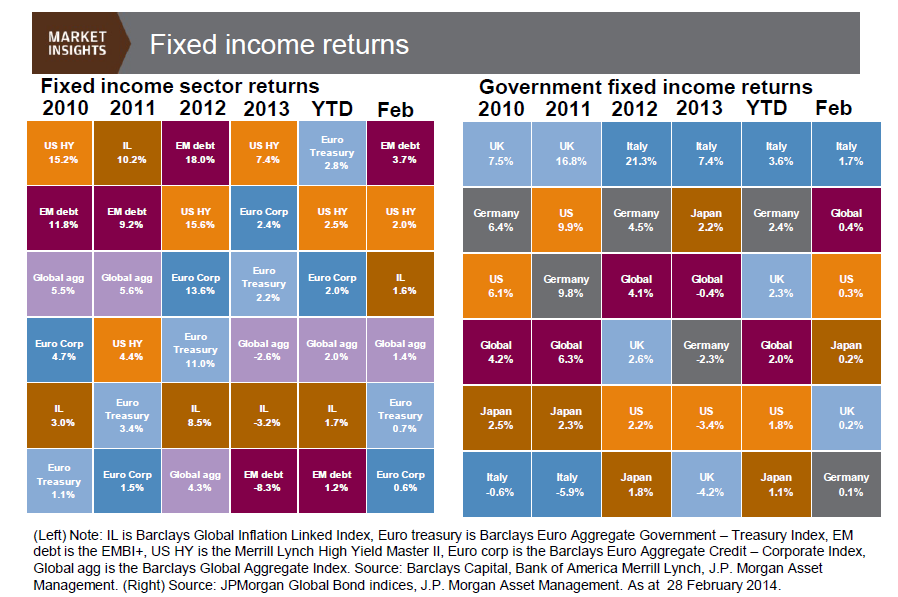

Bond positions saw gains as credit spreads tightened across high yield and investment grade holdings. Government bond holdings sold off slightly from the highs and were negative on the month. The Fund rebalanced high yield holdings from 9.5% to 19.3%, corporate investment grade from 33%to 29.5% and government debt from 7.1% to 1.4%.

Real assets were positive with gains coming from energy and agriculture positions. Gold and silver were the weakest performers. The Fund improved diversification across commodities and added holdings in cocoa, heating oil, live cattle, gasoil, soymeal and wheat. The deletions were crude oil and corn.

The Fund continued to hedge its USD currency exposure, maintaining a net USD exposure of approximately 10% of the Funds NAV.

Market Commentary

Markets rebounded higher in February with dip buyers emerging on waning geopolitical concerns and optimism on the global growth outlook. Concerns over Greece’s ability to meet its fiscal pledges receded as bailout provisions were extended by the ECB. Generally positive U.S. earnings, strong jobs data and supportive Fed comments helped the S&P close up 5.7% on the month. European equities outperformed other developed markets as inflows increased on the back of the ECB’s supportive actions from the previous month. U.S. 10 year yields squeezed quickly back above 2% as safe haven demand declined, and the market began to price in a higher probability of a June rate hike.

In commodities, oil managed to recover off the lows with prices buoyed by news of cuts in production and the potential for supply disruption in the Middle East. Gold gave back its January gains retreating lower as safe haven demand declined.

The U.S. dollar continued to exhibit selective signs of strength notably against Japanese yen, Swiss Franc and emerging market currencies. CAD was able to recover higher buoyed by signs of oil recovery and better than expected trade deficit numbers. However, the BOC’s recent dovish comments continued to provide an overhang on the loonie with further rate cuts expected in the coming months.