Protecting Your Portfolio Against Inflation_1

Post on: 15 Июнь, 2015 No Comment

Monday, 18 April 2011 03:53

Individual investors have some portion of their spending that grows with inflation. For those approaching retirement or in retirement, a crucial component of a well-constructed portfolio is investing in a manner that will help offset the risks of unexpected inflation. In this piece, we review strategies that historically have provided effective protection against inflation and those that have not.

At an annual inflation rate of 3 percent, a retiree who is currently spending $100,000 per year will find that spending has grown to approximately $134,000 within a 10-year period. Ideally, most investors want the growth in the value of their portfolio to track inflation as closely as possible and hopefully exceed it substantially. Inflation protection is also important because traditional asset classes such as stocks and nominal bonds have tended to do poorly when inflation is unexpectedly high.

As we discuss below, there are only a handful of asset classes that closely track inflation. Further, several strategies that are commonly thought of as being effective ways to protect against the risk of inflation have actually been ineffective, in particular over relatively short time periods.

Historically, the two most effective ways to protect against the risk of unexpected high inflation have been allocating a portion of your portfolio to Treasury inflation-protected securities (TIPS) and commodities. TIPS are bonds that are issued by the U.S. Treasury that have principal and interest payments that are directly linked to the U.S. Consumer Price Index (CPI). All else equal, this means that when inflation goes up, the value of the bond and the level of future interest payments will go up as well. From a held-to-maturity point of view, TIPS are virtually guaranteed to provide you with a return of realized inflation over the period that you held the TIPS plus an amount above the level of inflation (or minus an amount, as has unfortunately been the case for short-term TIPS over the past couple of years).

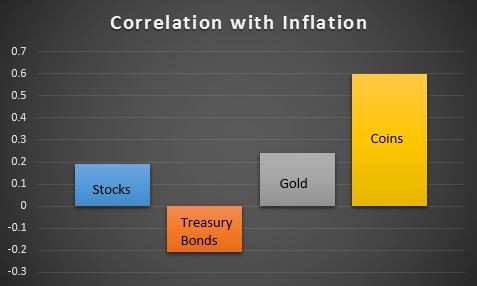

The two most well-known commodities indexes are the Dow Jones-UBS Commodity Index and the S&P GSCI Commodity Index. The Dow Jones-UBS Commodity Index had a correlation of about 0.50 with inflation over quarterly periods covering early 1991 through late 2010, and the S&P GSCI Commodity Index had a correlation of about 0.60 over the same time. What these numbers mean is that when inflation has been above its average, the returns of these diversified commodities indexes have tended to be above their averages as well. And while these numbers may not sound high, they are relative to all other broadly diversified asset classes that we have analyzed. For example, over this same period, the correlation of the S&P 500 Index with inflation was only 0.10.

Another strategy that has provided notable protection against expected inflation (but not unexpected inflation) is short-term fixed income such as Treasury bills or short-term government agency bonds. 1 While this is helpful, the fact that short-term fixed income provides very limited protection against unexpected inflation makes it less attractive than either TIPS or commodities.

Historically, two asset classes that are frequently viewed as providing protection against inflation that in practice have been ineffective are equities and gold. As mentioned, the S&P 500 Index, which is a diversified portfolio of U.S. large-cap stocks, has had a weak historical relationship with inflation, as has gold. The correlation of the returns of gold with unexpected inflation has been close to zero for the period 1978–2010. 2

However, the asset class that offers the worst protection against inflation risk is long-term bonds. The returns of long-term bonds tend to be below average when inflation is above average. There is a simple explanation for this: Because the interest and principal payments on most long-term bonds are fixed amounts, when inflation goes up, those payments are worth less and the market value of the bonds tend to go down.