Philadelphia Fed Survey

Post on: 21 Октябрь, 2015 No Comment

US: Philadelphia Fed Survey

Highlights

Slow growth is February’s signal from both the Empire State report, posted on Tuesday, and today’s manufacturing report from the Philly Fed where the general conditions index held little changed at 5.2 vs January’s 6.3. Something else both reports have in common is substantial cooling in optimism with the Philly Fed’s 6-month outlook falling to 29.7, which is still impressive looking but not compared to December’s 50.9.

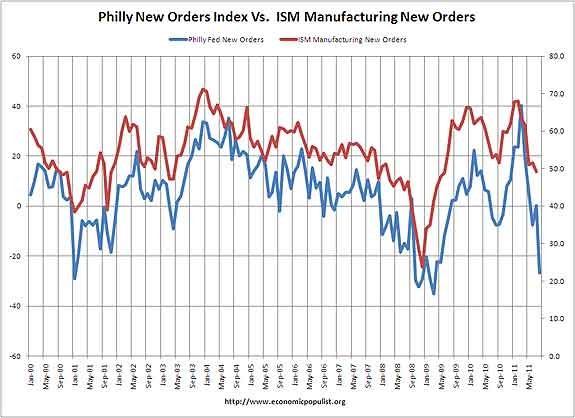

The new orders index is a positive in today’s, still on the plus side at 5.4 vs January’s 8.5. And unfilled orders are a special positive, rising to 7.3 from January’s contraction of minus 8.6. Employment also is back in positive ground, at 3.9 from minus 2.0. Price indications are flat with inputs showing only marginal monthly growth and finished goods very slight contraction for a 2nd month in a row.

The sudden falloff in outlook is a peculiar twist in this week’s manufacturing reports, perhaps hinting that manufacturers are less confident in their order books this year. Otherwise, the reports point to steady, non-accelerating growth at a moderate pace.

Market Consensus Before Announcement

The general business conditions index of the Philadelphia Fed’s Business Outlook Survey for January fell to plus 6.3 from December’s plus 24.3 (revised from 24.5). Growth in new orders, however, does remain solid at plus 8.5 though down from December’s plus 13.6. The 6-month general outlook also was a positive, at a very strong 50.9 versus December’s 50.4.

Definition

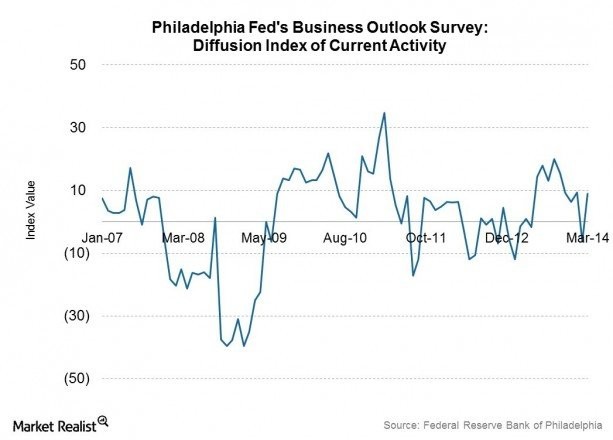

The general conditions index from this business outlook survey is a diffusion index of manufacturing conditions within the Philadelphia Federal Reserve district. This survey, widely followed as an indicator of manufacturing sector trends, is correlated with the ISM manufacturing index and the index of industrial production.

Description

Investors need to monitor the economy closely because it usually dictates how various types of investments will perform. By tracking economic data such as the Philly Fed survey, investors will know what the economic backdrop is for the various markets. The stock market likes to see healthy economic growth because that translates to higher corporate profits. The bond market prefers more moderate growth so that it won’t lead to inflation. The Philly Fed survey gives a detailed look at the manufacturing sector, how busy it is and where things are headed. Since manufacturing is a major sector of the economy, this report has a big influence on market behavior. Some of the Philly Fed sub-indexes also provide insight on commodity prices and other clues on inflation. The bond market is highly sensitive to this report because it is released early in the month and is available before other important indicators.