Pairs Trading Entry Point Confirmation Using Technical Indicators MetaTrader Expert Advisor

Post on: 4 Август, 2015 No Comment

Trading pairs without adequate confirmation is like building a house without a structural engineer. In the short term the design may be stable and safe, however over a longer period of time, the sensitivity to weather conditions and other factors could be hazardous.

Systems that are based on one factor alone will invariably have a shelf life and will need to be retrained to accommodate shifts in market conditions. As discussed in our previous article on cointegration. the degree to which a trader does not adhere to these strict guidelines, can greatly affect his/her profitability.

Technical indicators for entry signals on a pairs trade

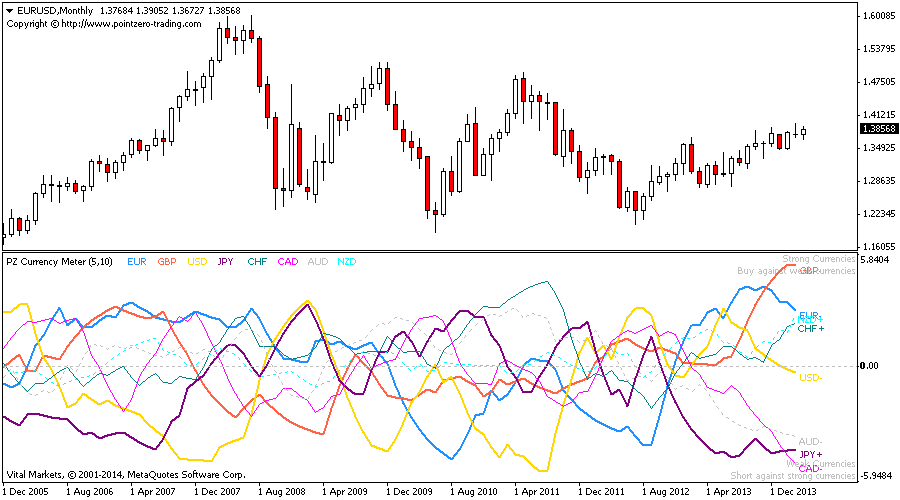

Some of the key technical indicators and patterns that can work well for confirming entry signals include the Relative Strength Index (RSI), Market Facilitation Index (MFI) and Candlestick charting. Each has a unique attribute, and can assist in defining key entry and exit points.

Relative Strength Index (RSI)

Although this is a relatively common indicator that does not stand the test of time by itself, the RSI can be an effective tool in pairs trading. Defined as the change in momentum, this technical indicator will range from 100 (extremely overbought) to 0 (extremely oversold). Traditionally the trigger points are 70 for a short and 30 for a long. With respect to pairs trading, this strength index allows the trader to confirm overbought and oversold scenarios.

RSI shows how a technical indicator can be used to spot entry opportunities

The sppread between Gold and Silver is considerable, with the cointegration still above the required 80 mark (according to catalyst corner). The relative strength index has confirmed that silver is trading in the oversold bracket (at 75), providing the trader with a valid entry for a short position .

Market Facilitation Index (MFI)

Invented by technical analyst Bill Williams, the MFI identifies the momentum of a movement based on the volume. Depending on the strength of the buying and selling pressure, the indicator will price in an estimate of whether the trend is strong or weak.

Commonly used with longer time frames, the Market Facilitation Index is calculated by using the high, low and volume bars. Unlike RSI, the indicator is represented by a bar graph with coloration. Green highlights strong volume and momentum, whilst blue, brown and light brown indicate indecisive volume reactions. In pairs trading, the MFI can identify long term momentum patterns and which cross to buy or short.

Included below is a table from Wikipedia, which visually highlights the degree to which an adjust in volume can influence the market facilitation index.

The money flow index uses basic bar information to create a colored graph

Source: Wikipedia,2013

Gold has crossed below silver on a linear regression basis. The Market Facilitation Index however has indicated that volume and momentum are rising, and there will be a rebound in the price. The trader would look at going long gold and short silver.

Candlesticks

During the month of April, the spread between Gold and Silver is relatively tight. A morning star formation appears on the Gold price, indicating a potential bullish reversal. The trader in this case, would open a Long Gold, Short Silver to capitalize on a sudden breakout in the price.