Outside the Box Hoisington Quarterly Review and Outlook Fourth Quarter 2014

Post on: 10 Июнь, 2015 No Comment

— Posted Thursday, 12 February 2015 | | Disqus

By John Mauldin

Forecasting is a singularly difficult task and is more often than not fraught with failure. The Federal Reserve has some of the smartest economists in the world, and yet their forecasts are so wrong so often (as in, they almost never get it right) that some have pointed out that it’s almost statistically impossible to be as bad as the Fed. Yet they continue to issue such forecasts and to base economic and monetary policy on them. Go figure.

Their forecasts, like most economic predictions, are based on past performance. Intricate economic models look at history to try to determine the future relationships among economic determinants. I really shouldn’t pick on the Fed so much as point out that almost all of us in the forecasting business have dismal track records. The world has grown so complex that it is singularly difficult to understand the interrelationships of the million-odd factors that determine the outcome of an economy.

This is especially true during those periods when we see economic regime change. Not only is using past performance and relationships difficult, it can actually be misleading, as what is going to happen in a uniquely turbulent future has not been modeled in the past. I have been suggesting for some time that we are coming to the end of a long cycle and entering a period where past relationships will no longer hold. I have likened this to what happens when one approaches the boundary of a black hole in space. All known physical relationships are turned on their heads, and the math that works in the rest of the universe no longer applies.

For me, the massive amount of debt we have accumulated in our own planetary confines is the ecoomic equivalent of a black hole, and we are approaching the point at which that debt will implode if it is not resolved. As with Greece, the ability of players large and small to pay debt off in a global deflationary environment has been greatly compromised. I’m not certain how this will end. Maybe everyone will sit down and hammer out something like a Plaza Accord to resolve the debt, by which I mean dilute it, destroy it, make it go away, restructure it – whatever it takes. Of course, history suggests that we will do such a thing only in the middle of or immediately following a crisis.

Today’s Outside the Box is from our old friend Dr. Lacy Hunt of Hoisington Asset Management. He muses on the effects of debt and takes us back to the ’20s and ’30s, when there were similar problems with debt in countries that had engaged in currency wars for over a decade.

Clearly the policies of yesteryear and the present are forms of “beggar-my-neighbor” policies, which the MIT Dictionary of Modern Economics explains as follows: “Economic measures taken by one country to improve its domestic economic conditions … have adverse effects on other economies. A country may increase domestic employment by increasing exports or reducing imports by … devaluing its currency or applying tariffs, quotas, or export subsidies. The benefit which it attains is at the expense of some other country which experiences lower exports or increased imports.… Such a country may then be forced to retaliate by a similar type of measure.”

The existence of over-indebtedness, and its resulting restraint on growth and inflation, has forced governments today, as in the past, to attempt to escape these poor economic conditions by spurring their exports or taking market share from other economies. As shown above, it is a fruitless exercise with harmful side effects.

This is an important OTB, and it behooves us to pay attention, because Lacy has been one of the most accurate forecasters of interest rates for the last 20 to 30 years. He will also be at our conference in San Diego, where he is always one of the most highly rated speakers. And I want to express my appreciation to Lacy for once again letting us reproduce his work.

I send this Outside the Box to you from Little Cayman Island, where I am visiting my friend Raoul Pal at his beach house, which he just finished building. It is at the “far end” of a ten-mile-long by one-mile-wide island that is a libertarian paradise in that there is no government. Just some hundred-odd neighbors taking care of what needs to be done. With 10 MB broadband. Little Cayman is a bit of an island oddity, in that it is the tippy-top ridge of a very tall undersea mountain; just off the beaches, the Cayman Trench plunges to a depth of 25,000 feet, the deepest water in the Caribbean and one of the deeper trenches in the world. It is a scuba diver’s paradise, which pretty much drives the economy of the island.

While I was working, my companion went snorkeling some 20 feet off the beach from Raoul’s home. After she raved about the beauty and all the fish, I donned a little gear and for the first time in my life went snorkeling. I need to work on my snorkeling technique, but if Raoul invites us back, I will be better prepared. It was indeed a beautiful experience.

Raoul will also be presenting, along with his partner Grant Williams (of Things That Make You Go Hmmm… fame) at my conference, and he outlined what he thinks their presentation will cover. As is typical with Raoul and Grant, their approach to this talk is very fresh and different, focused on where global growth will go in the next few decades. Not exactly were you might expect it to go. I will be in the front row.

Raoul and Grant are the founders of RealVision TV, where they present in-depth interviews with famous investors. One of their concepts is to create a chain letter of sorts, by having a person who is interviewed find another fascinating person to interview. The interviewee then becomes the interviewer in the next round, and one great mind leads to another. Raoul led off by engaging Kyle Bass in a long-form interview that is fascinating. You can see it for free right here. There is also a special introductory price for Mauldin Economics readers to subscribe to RealVision.

Finally, I know there are many people who wonder about the lives of those of us who write about macroeconomics and investments for a living. Here is a picture of two of us (Raoul would be the handsome one) in typical working attire. It’s a hard-knock life.

As it turns out, I am actually hitting the send button from Grand Cayman Island, as we were summoned and rushed to the “airport” on Little Cayman to take a helicopter flight over to a nearby island where larger planes could land, because the small plane that usually services Little Cayman had broken down. Not a big deal, and as a bonus we had a helicopter tour of Little Cayman. I speak at the iCIO gathering this afternoon (hosted by Mark Yusko) and then speak at the Cayman Alternative Investment Summit tomorrow morning, where my good friend Nouriel Roubini and I will trade ideas in front of 650 attendees. It should prove to be fun. Then we’ll have a few days of R&R (hopefully) and then head back to Dallas on Sunday. You have a great week.

Your wondering why I don’t work from a beach sometimes analyst,

John Mauldin, Editor

Stay Ahead of the Latest Tech News and Investing Trends.

Each day, you get the three tech news stories with the biggest potential impact.

Hoisington Quarterly Review and Outlook – Fourth Quarter 2014

Deflation

“No stock-market crash announced bad times. The depression rather made its presence felt with the serial crashes of dozens of commodity markets. To the affected producers and consumers, the declines were immediate and newsworthy, but they failed to seize the national attention. Certainly, they made no deep impression at the Federal Reserve.” Thus wrote author James Grant in his latest thoroughly researched and well-penned book, The Forgotten Depression (1921: The Crash That Cured Itself).

Commodity price declines were the symptom of sharply deteriorating economic conditions prior to the 1920-21 depression. To be sure, today’s economic environment is different. The world economies are not emerging from a destructive war, nor are we on the gold standard, and U.S. employment is no longer centered in agriculture and factories (over 50% in the U.S. in 1920). The fact remains, however, that global commodity prices are in noticeable retreat. Since the commodity index peak in 2011, prices have plummeted. The Reuters/Jefferies/CRB Future Price Index has dropped 39%. The GSCI Nearby Commodity Index is down 48% (Chart 1), with energy (-56%), metals (-36%), copper (-40%), cotton (-73%), WTI crude (-57%), rubber (-72%), and the list goes on. In some cases this broad-based retreat reflects increased supply, but more clearly it indicates weakening global demand.

The proximate cause for the current economic maladies and continuing downshift of economic activity has been the over- accumulation of debt. In many cases debt funded the purchase of consumable and non- productive assets, which failed to create a future stream of revenue to repay the debt. This circumstance means that existing and future income has to cover, not only current outlays, but also past expenditures in the form of interest and repayment of debt. Efforts to spur spending through relaxed credit standards, i.e. lower interest rates, minimal down payments, etc. to boost current consumption, merely adds to the total indebtedness. According to Deleveraging? What Deleveraging? (Geneva Report on the World Economy, Report 16) total debt to GDP ratios are 35% higher today than at the initiation of the 2008 crisis. The increase since 2008 has been primarily in emerging economies. Since debt is the acceleration of current spending in lieu of future spending, the falling commodity prices (similar to 1920) may be the key leading indicator of more difficult economic times ahead for world economic growth as the current overspending is reversed.

Currency Manipulation

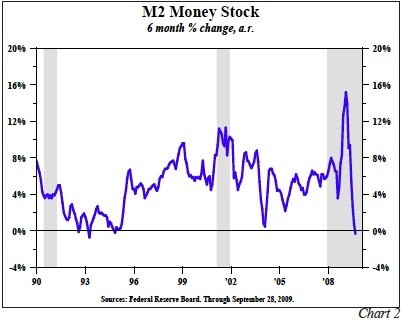

Recognizing the economic malaise, various economies, including that of the U.S. have instituted policies to take an increasing “market share” from the world’s competitive, slow growing marketplace. The U.S. fired an early shot in this economic war instituting the Federal Reserve’s policy of quantitative easing. The Fed’s balance sheet expansion placed downward pressure on the dollar thereby improving the terms of trade the U.S. had with its international partners (Chart 2).

Subsequently, however, Japan and Europe joined the competitive currency devaluation race and have managed to devalue their currencies by 61% and 21%, respectively, relative to the dollar. Last year the dollar appreciated against all 31 of the next largest economies. Since 2011 the dollar has advanced 19%, 15% and 62%, respectively, against the Mexican Peso, the Canadian Dollar and the Brazilian Real. Latin America’s third largest economy, Argentina, and the 15th largest nation in the world, Russia, have depreciated by 115% and 85%, respectively, since 2011.

The competitive export advantages gained by these and other countries will have adverse repercussions for the U.S. economy in 2015 and beyond. Historical experience in the period from 1926 to the start of World War II (WWII) indicates this process of competitive devaluations impairs global activity, spurs disinflationary or deflationary trends and engenders instability in world financial markets. As a reminder of the pernicious impact of unilateral currency manipulation on global growth, a brief review of the last episode is enlightening.

The Currency Wars of the 1920s and 1930s

The return of the French franc to the gold standard at a considerably depreciated level in 1926 was a seminal event in the process of actual and de facto currency devaluations, which lasted from that time until World War II. Legally, the franc’s value was not set until 1928, but effectively the franc was stabilized in 1926.

France had never been able to resolve the debt overhang accumulated during World War I and, as a result, had been beset by a series of serious economic problems. The devalued franc allowed economic conditions in France to improve as a result of a rising trade surplus. This resulted in a considerable gold inflow from other countries into France. Moreover, the French central bank did not allow the gold to boost the money supply, contrary to the rules of the game of the old gold standard. A debate has ensued as to whether this policy was accidental or intentional, but it misses the point. France wanted and needed the trade account to continue to boost its domestic economy, and this served to adversely affect economic growth in the UK and Germany. The world was lenient to a degree toward the French, whose economic problems were well known at the time.

In the aftermath of the French devaluation, between late 1927 and mid-1929, economic conditions began to deteriorate in other countries. Australia, which had become extremely indebted during the 1920s, exhibited increasingly serious economic problems by late 1927. Similar signs of economic distress shortly appeared in the Dutch East Indies (now Indonesia), Finland, Brazil, Poland, Canada and Argentina. By the fall of 1929, economic conditions had begun to erode in the United States, and the stock market crashed in late October.

Additionally, in 1929 Uruguay, Argentina and Brazil devalued their currencies and left the gold standard. Australia, New Zealand and Venezuela followed in 1930. Throughout the turmoil of the late 1920s and early 1930s, the U.S. stayed on the gold standard. As a result, the dollar’s value was rising, and the trade account was serving to depress economic activity and transmit deflationary forces from the global economy into the United States.

By 1930 the pain in the U.S. had become so great that a de facto devaluation of the dollar occurred in the form of the Smoot-Hawley Tariff of 1930, even as the United States remained on the gold standard. By shrinking imports to the U.S. this tariff had the same effect as the earlier currency devaluations. Over this period, other countries raised tariffs and/or imposed import quotas. This is effectively equivalent to currency depreciation. These events had consequences.

In 1931, 17 countries left the gold standard and/or substantially devalued their currencies. The most important of these was the United Kingdom (September 19, 1931). Germany did not devalue, but they did default on their debt and they imposed severe currency controls, both of which served to contract imports while impairing the finances of other countries. The German action was undeniably more harmful than if they had devalued significantly. In 1932 and early 1933, eleven more countries followed. From April 1933 to January 1934, the U.S. finally devalued the dollar by 59%. This, along with a reversal of the inventory cycle, led to a recovery of the U.S. economy but at the expense of trade losses and less economic growth for others.

One of the first casualties of this action was China. China, on a silver standard, was forced to exit that link in September 1934, which resulted in a sharp depreciation of the Yuan. Then in March 1935, Belgium, a member of the gold bloc countries, devalued. In 1936, France, due to massive trade deficits and a large gold outflow, was forced to once again devalue the franc. This was a tough blow for the French because of the draconian anti-growth measures they had taken to support their currency. Later that year, Italy, another gold bloc member, devalued the gold content of the lira by the identical amount of the U.S. devaluation. Benito Mussolini’s long forgotten finance minister said that the U.S. devaluation was economic warfare. This was a highly accurate statement. By late 1936, Holland and Switzerland, also members of the gold bloc, had devalued. Those were just as bitter since the Dutch and Swiss used strong anti- growth measures to try to reverse trade deficits and the resultant gold outflow. The process came to an end, when Germany invaded Poland in September 1939, as WWII began.

It is interesting to ponder the ultimate outcome of this process, which ended with World Ware II. The extreme over-indebtedness, which precipitated the process, had not been reversed. Thus, without WWII, this so-called “race to the bottom” could have continued on for years.

In the United States, the war permitted the debt overhang of the 1920s to be corrected. Unlike the 1930s, the U.S. could now export whatever it was able to produce to its war torn allies. The income gains from these huge net trade surpluses were not spent as a result of mandatory rationing, which the public tolerated because of almost universal support for the war effort. The personal saving rate rose as high as 28%, and by the end of the war U.S. households and businesses had a clean balance sheet that propelled the postwar economic boom.

The U.S. in turn, served as the engine of growth for the global economy and gradually countries began to recover from the effects of the Great Depression and World War II. During the late 1950s and 1960s, recessions did occur but they were of the simple garden-variety kind, mainly inventory corrections, and they did not sidetrack a steady advance of global standards of living.

2015

As noted above, economic conditions, framework and circumstances are different today. The gold standard in place in the 1920s has been replaced by the fiat currency regime of today. Additionally, imbalances from World War I that were present in the 1920s are not present today, and the composition of the economy is different.

Unfortunately, there are parallels to that earlier period. First, there is a global problem with debt and slow growth, and no country is immune. Second, the economic problems now, like then, are more serious and are more apparent outside the United States. However, due to negative income and price effects on our trade balance, foreign problems are transmitting into the U.S. and interacting with underlying structural problems. Third, over- indebtedness is rampant today as it was in the 1920s and 1930s. Fourth, competitive currency devaluations are taking place today as they did in the earlier period. These are a combination of monetary and/or fiscal policy actions and also, with floating exchange rates, a consequence of shifting assessments of private participants in the markets.

Clearly the policies of yesteryear and the present are forms of “beggar-my-neighbor” policies, which The MIT Dictionary of Modern Economics explains as follows: “Economic measures taken by one country to improve its domestic economic conditions. have adverse effects on other economies. A country may increase domestic employment by increasing exports or reducing imports by. devaluing its currency or applying tariffs, quotas, or export subsidies. The benefit which it attains is at the expense of some other country which experiences lower exports or increased imports. Such a country may then be forced to retaliate by a similar type of measure.”

The existence of over-indebtedness, and its resulting restraint on growth and inflation, has forced governments today, as in the past, to attempt to escape these poor economic conditions by spurring their exports or taking market share from other economies. As shown above, it is a fruitless exercise with harmful side effects.

Interest Rates

The downward pressure on global economic growth rates will remain in place in 2015. Therefore record low inflation and interest rates will continue to be made around the world in the new year, as governments utilize policies to spur growth at the expense of other regions. The U.S. will not escape these forces of deflationary commodity prices, a worsening trade balance and other foreign government actions.

U.S. nominal GDP in this economic expansion since 2008 has experienced the longest period of slow growth of any recovery since WWII (Chart 3). Typical of the disappointing expansion, the fourth quarter to fourth quarter growth rate slowed from 4.6% in 2013 to 3.8% in 2014. A further slowing of nominal economic growth to around 3% will occur over the four quarters of 2015. The CPI will subside from the 0.8% level for the period December 2013 to December 2014 (Chart 4), registering only a minimal positive change for 2015. Conditions will be sufficiently lackluster that the Federal Reserve will have little choice in their overused bag of tricks but to stand pat and watch their previous mistakes filter through to worsening economic conditions. Interest rates will of course be volatile during the year as expectations shift, yet the low inflationary environment will bring about new lows in yields in 2015 in the intermediate- and long-term maturities of U.S. Treasury securities.

Van R. Hoisington

Lacy H. Hunt, Ph.D.

Like Outside the Box?

Sign up today and get each new issue delivered free to your inbox.