No Free Lunch From Equal Weight S P 500_1

Post on: 18 Июнь, 2015 No Comment

Timing is everything. You’d be basking in glory today if you launched a mutual fund 10 years ago that concentrated on mid-cap stocks because they outperformed. You’d be a dunce if you did the same thing in the 1990s because they lagged. Those are the facts behind the recent outperformance of the S&P 500 Equal Weight Index (S&P 500 EWI) and the funds that follow it.

An equal-weighted (EW) stock index gives the same weight to each stock in an index. The smallest companies are given equal weight to the largest companies. The S&P 500 Equal Weight Index (S&P 500 EWI) is the equal weight version of the S&P 500. It has the same constituents as the capitalization weighted S&P 500, but each company is allocated a fixed weight of 0.2 percent quarterly.

Taking a cap-weighted index and turning it into an equal-weighted index will change the average market capitalization of securities held in a fund. The average market capitalization of the S&P 500 is about $58 billion while the average market capitalization of S&P 500 EWI is only $16 billion. Nearly 50 percent of the holdings in the S&P 500 are categorized as mid-cap stocks according to Morningstar.com .

The Guggenheim S&P 500 Equal Weight ETF (NYSEArca: RSP) was the first exchange-traded fund (ETF) to track the S&P 500 EWI. It turns 10-years old this week. According to Cinthia Murphy of IndexUniverse.com. the ETF has returned about 87 percent more in total than a market-capitalization-weighted competitor, the SPDR S&P 500 ETF (NYSEArca: SPY) since its launch in 2003.

The excess return is easy to explain. It has to do with the difference in the average market capitalization of the two indexes. Figure 1 highlights the difference between the S&P 500 and S&P 500 EWI from 2003 to 2012. The large cap CRSP 1-2 Index and the mid-cap CRSP 3-5 Index are also included for comparison.

Figure 1: 2003-2012 Annualized Return of S&P Indexes Plus CRSP Size Deciles

Sources: CRSP US Stock and Index Database, S&P Dow Jones Indexes

Figure 1 shows the S&P 500 EWI annualized return falling where one would expect, between the S&P 500 Index and the mid-cap CRSP Deciles 3-5 index. The equal weight index also delivered higher risk-adjusted returns than the S&P 500 over this particular 10-year period.

Fund providers would like to cut the story line for equal weighting at ten years because it appears to turn lead into gold. Astute investors will look back further to see if this is real alchemy or just another Wall Street trick.

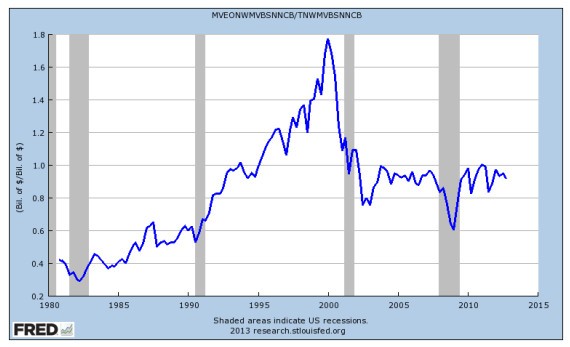

S&P Dow Jones provides annual return data for the S&P 500 EWI going back to 1990. Figure 2 compares this data to the S&P 500 cap weighted returns from 1990 to 1999 along with two CRSP size indexes.

Figure 2: 1990-1999 Annualized Return of S&P Indexes Plus CRSP Size Deciles

Sources: CRSP US Stock and Index Database, S&P Dow Jones Indexes

Reshuffling S&P 500 weights didn’t result in gold during the 1990s. The S&P 500 EWI underperformed the cap-weighted S&P 500 by about 3.1 percent annually from 1990 to 1999. What’s surprising is that the S&P 500 EWI also underperformed the mid-cap CRSP Deciles 3-5 Index of mid cap stocks, although it did perform slightly better on a risk adjusted basis.

Figure 3 is a truth-teller chart. It shows the Capital Markets Line (CML) for a 23-year period from 1990 to 2012. The vertical axis is the annualized return over the period and the horizontal axis is the annualized risk measured by standard deviation. The CRSP 6-10 Index is also included to represent U.S. small-cap stocks.

Figure 3: 1990-2012 U.S. Stock Index Risk and Return Along the Capital Market Line

Sources: CRSP US Stock and Index Database, S&P Dow Jones Indexes, Federal Reserve

Most asset classes fall very close to the CML over the long-term. The S&P 500 EWI returns fell exactly on the CML over the past 23 years. The equal-weighted index earned no more and no less than what was expected based on its risk.

This index analysis is based on raw data. No one gets actual index returns. Management fees and trading costs drag down performance over time. Guggenheim charges 0.40 percent in expenses for RSP while a majority of cap-weighted index funds charge a fraction of that amount. Higher fees mean lower returns for equal-weighted products.

The S&P 500 EWI and the ETFs that track it had a good run over the past 10 years, but let’s not make more out of this than there is. Risk and return are closely related in the long-term. Reshuffling the cards doesn’t change the relationship. There’s no free lunch from equal weighting the S&P 500 index.