Nine reasons to invest in real estate over share market or Gold

Post on: 30 Май, 2015 No Comment

India, a 2.04 trillion dollar economy and the third largest economy in PPP[1]. has been among the top investment destination for investors across the world. Along with the top performing sectors like Information Technology, Telecommunications and Consumer Products, Real Estate has also been chosen by investors as a secured investment option in the last decade. Confidence level in this sector is a outcome of its performance during global and domestic market downtrend in 2011, when the stock market was down by almost 25% and the commodity market was also under performing but the prices of homes remained firm in most of Indian cities.

investing in real estate

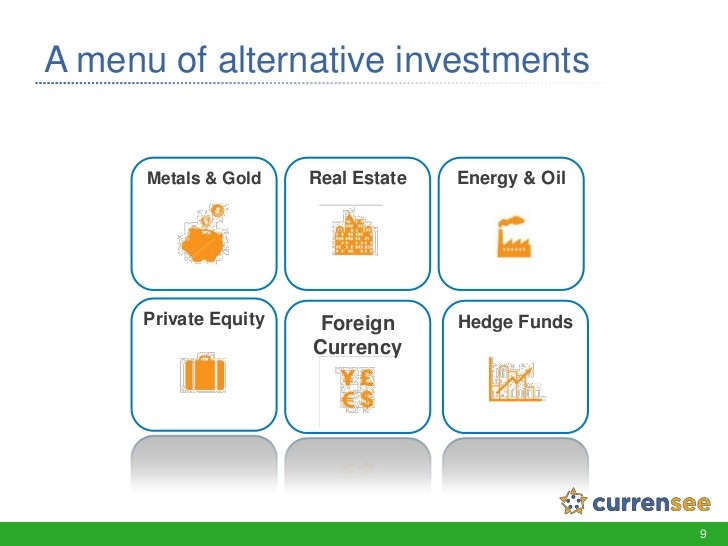

At times, it is always a point of concern for every investor that –“Where to invest…Real estate, Gold or Share Market ?” Or Why to invest in real estate? From traditional point of view, Real estate is always considered to be safer investment, but the stabilizing global economy, appropriate gold price and good performance of stocks in the last years has insisted investors to put their eggs in other baskets as well.

Data published by National Council for Applied Economic Research shows that, Real Estate is the top investment option chosen by the urban households in India. But why do people invest in real estate other than gold or share market?

1. Real Estate offers a safe option. It encompasses a touch and feel experience of the property which one can physically show up and inspect. Whereas, investment in shares is much more intangible and subject to ethics of management and auditor where shareholder posses a very less control.

2. Investing in real estate involves less risk because the average down payment of 20% for a property allows the investor to invest in several properties with less money and he can easily minimize the risk. But shares and commodity market are in chain and will collapse if a single pillar got damaged.

3. It is true that, historically investment in gold is considered as a great option of hedging, but for short runs only, because the inflation rate and levied taxes absorbs most of its returns in the long run. On the other hand real estate gives a better return in the long run. It is estimated that, in absolute term gold gives us a return of 0.8%, whereas real estate offers return at a rate of 11% in the long run while inflation and tax policies are considered as key value determining factors.

4. To play in the stock market, one needs to be very much educated and sound with the technical terminologies but a real estate investor does not require to be that much educated. For example, if a person invests in share market he needs to hire a broker to handle trades for him but the required knowledge is less in case of property. A person can directly own a property and have full control over it or in other words the investor can directly jump into the mud after done with some basic secondary research or learning a few technical terms.

5. Real estate not only gives a good return, but it also generates income in forms like renting or leasing property by securing a monthly cash flow into investor’s account. This opportunity no one can avail by investing in shares or gold.

6. Purchasing of share or gold is done at a fixed market price and it is equal to all, where the scope of negotiation is negligible, but a reverse case can be observed in the property market. Buying, selling or the pricing strategy completely depends upon the expertise of the marketer. A property can be sold at an appreciated price over market rate depending on the psyche of the buyer or one can get a decent property considerably below market price.

A property can always be mortgaged for personal or business loans. Senior Citizens can avail an option of reverse mortgage loans on its property to generate a regular income.On the other hand,recent RBI’s move to restrict banks in lending against gold coins beyond 50gms per customer has made it difficult to obtain a collateral loan against gold.

8. Buying an old property at a very low price and making a cosmetic and structural renovation can significantly be more profitable for small ingenious investors, which option cannot be imagined in the case of other two investment proposals.

Apart from all these reasons, government movement to bring Real Estate Regulatory Bill and introduction Real Estate Investments Trusts (REITs) will make property investment a safe and secure option, which will help to make market stable and a long term growth can be expected.Furthermore, stable domestic political scenario and surge in NRI investments which is estimated to be appx 35% against 18% in last fiscal year going to take on the confidence level higher in real estate sector.

An investor need to remember that all investments has its own merits and demerits and they are cyclical in nature. Moreover,Investment is totally dependent upon investment capacity, time or expected return period and the financial goals of the investor. It is always being suggested by financial advisors to make diversified investments and if one prefers more control, high transparency, less risk and higher return in the long term real estate can be a nice option to adopt.

[1] Purchasing Power Parity-An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currencys purchasing power.