Mutual funds best to build retirement kitty Money Today

Post on: 29 Май, 2015 No Comment

It’s a question that has foxed financial planners for ever — how to beat inflation and generate the desired wealth over long periods.

Inflation, we know, can upset calculations by eroding the value of savings. At 5% inflation, an expense of Rs 10,000 will become Rs 40,000 in 30 years. For a person saving for retirement, generating returns that can beat inflation seems difficult. It’s not, provided he invests wisely in mutual funds.

For a long time, retirement planning meant investing in small saving schemes like the Public Provident Fund (PPF), the National Saving Certificate Scheme and the Employee Provident Fund (EPF). Some also bought traditional insurance policies. However, the problem was that these seldom beat inflation. Then came mutual funds in 1964, when UTI was launched, but these were seldom used for retirement planning. Things picked up slightly from 1993 with the advent of private sector mutual funds. Now, they are changing fast.

Know yourself

Before investing, there are some questions you need to ask yourself. How many years are left for your retirement? How much money will you need at retirement? What is your risk-taking ability? What is the monthly income you will need to sustain your current lifestyle? Once you have answered these, planning becomes simple. No matter what your investment horizon is, no matter what your risk-taking ability is, no matter how much your investment is, there are mutual fund products for every need.

You can invest in equity funds for capital appreciation, debt funds for regular income or gold funds for securing your future. In terms of risk, not only can you choose funds which are safe (liquid funds), you can also invest in funds that are highly risky (sectoral funds), or hybrid funds, which invest in both equity and debt and are moderately risky. Abhinav Angirish, founder, www.InvestOnline.in, says apart from versatility and convenience, mutual funds are the lowest cost options for wealth creation when compared to unit-linked insurance plans and structured products.

Time it right

Building a corpus for retirement is most likely your last goal after others such as child’s education or buying a home. This means you have more time to plan and invest for retirement.

This, experts say, is why equity schemes are the best vehicles to build a retirement corpus. Anil Rego, CEO & founder, Right Horizons, says large-cap and blend-cap (which invest across market caps) funds can be used.

In fact, over long tenures, most equity risks are ironed out, says Swapnil Pawar, chief investment officer, Karvy Private Wealth. Also, equity as an asset class tends to be adequately hedged against inflation, the biggest risk in the long run, says Pawar.

Although the choice between blue-chip and mid-cap or sectoral schemes depends on your risk profile, Pawar recommends well-diversified equity and index schemes to begin with.

Top 10 Diversified Equity Schemes

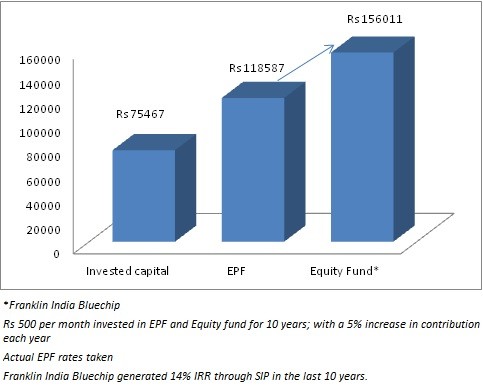

If you take a look at the chart (See How various asset classes have moved), the only asset class that has generated exceptional wealth over the long run is equities. In fact, the best performing equity mutual fund over the last 10 years, Reliance Growth Fund, has delivered a return of 36% a year on a compounded basis. If you had invested Rs 1 lakh in the scheme in August 2001, your money would have grown to Rs 22 lakh. The top 10 diversified equity schemes have returned more than 25% a year on a compounded basis in the last 10 years (See box on Top 10 Diversified Equity Schemes ).

If had you invested the same amount in the Sensex, it would have grown to Rs 5 lakh, a compounded annual growth rate of 18%. A debt mutual fund would have taken your investment to Rs 2.5 lakh, a compounded annual growth rate of 9.5%. The same investment in gold would have risen to Rs 6.5 lakh by giving 20% a year on a compounded basis.

The choice of fund depends on your objective and risk-taking ability. Each asset offers funds that enable you to meet specific goals. While planning, take help from a financial advisor to decide the asset allocation. Pick funds that have a good record, performance and lineage. Stick to funds that are simple to understand.

Starting out

Equity funds are ideal during accumulation/earning years as equities tend to outperform most assets over long periods, says Angirish. A simple way to start is to invest in a systematic investment plan (SIP) of an equity mutual fund. SIPs smoothen unpredictable market movements by accumulating more units when the markets fall. You should start moving towards debt when your retirement is 5 years away by investing 20% corpus each year in debt instruments, says Pawar. You can use a Systematic Transfer Plan for this. The idea is to reduce risk and build the debt portfolio, which will give consistent income after retirement with little or no loss of capital.

SAVE FOR RETIREMENT WITH EASE