Mutual Fund Hedge Fund Difference

Post on: 7 Май, 2015 No Comment

SEC.gov | Invest Wisely: An Introduction to Mutual Funds – Invest Wisely: An Introduction to Mutual Funds. Over the past decade, American investors increasingly have turned to mutual funds to save for retirement and other

Whats the difference between a mutual fund and a hedge fund? – For further reading on these two types of funds, please see our Mutual Fund Basics tutorial and our article Taking a Look behind Hedge Funds.

Getting To Know Hedge-Like Mutual Funds Investopedia – Hedge funds have enjoyed tremendous profits using alternative strategies, and these funds often outperform traditional investments such as stocks, mutual funds and …

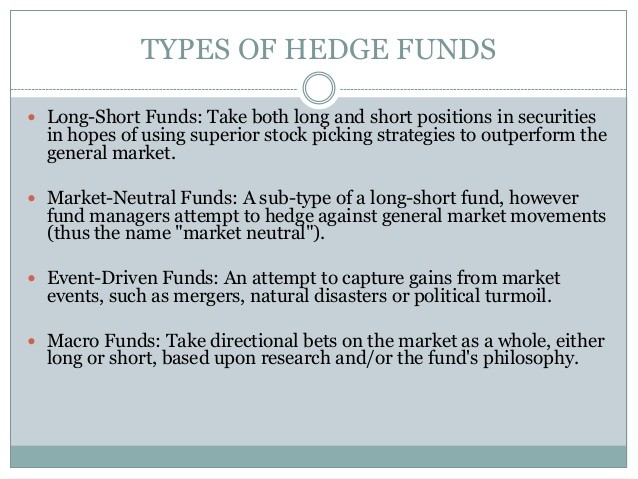

Hedge Funds What is a Hedge Fund About – What Are Hedge Funds? Understanding the Nature and Risks of Hedge Funds

Whats the difference between a mutual fund and a hedge fund? – These two types of investment products have their similarities and differences. Another key difference between these two types of funds is their availability. Hedge funds are only available to a specific group of sophisticated investors with high net worth. The U.S. government deems them as

Mutual Funds vs Hedge Funds From a practical and legal point of view, there are differences between mutual and hedge funds. A mutual fund is a collective

Hedge funds and mutual funds are both “pooled” vehicles, but there are more differences than similarities. For instance, a mutual fund is registered with the SEC

Mutual funds and hedge funds both invest in variety of stocks and bonds. Both types aim to make money for their investors, but some individual funds are more

The Differences Between Mutual Funds and Hedge Funds. Mutual funds and hedge funds differ in many ways, particularly the fees charged; leveraging, pricing, and

Assets are flooding into both liquid alternatives (alternative mutual funds) and hedge funds, Market neutral mutual funds have trailed their hedge fund counterparts over all periods, but the difference is within a reasonable allowance for survivorship bias.

At its most basic, a hedge fund is an investment vehicle that pools capital from a number of investors and invests in securities and other instruments. It is

When comparing hedge funds vs mutual funds, there are a number of similarities and differences to take note of. Despite the fact that both …

Hedge funds and mutual funds are both actively managed investment schemes that group together various stocks, bonds, futures, options and other such investment

Hedge funds are extremely flexible in their investment options because they use financial instruments generally beyond the reach of mutual funds, which have SEC

A mutual fund is a type of professionally managed collective investment scheme that pools money from many investors to purchase securities. While there is no legal

Fund Spy: Morningstar Medalist Edition. A Target-Date Series Diversifies Its Way to a Medal. Principals LifeTime funds make up most of the Morningstar Analyst

Hedge funds and mutual funds are both pooled vehicles, but there are more differences than similarities. For instance, a mutual fund is registered with the SEC, and can be sold to an unlimited number of investors.

Oct 12, 2011 · Mutual Funds vs Hedge Funds. From a practical and legal point of view, there are differences between mutual and hedge funds. A mutual fund is a …

What Is the Difference Between Mutual Funds & Money Market Funds. A mutual fund is a professionally managed investment that allows you to diversify your …

More Investments Articles.

- Silver Investment Newsletter Online Services. The Gold Report — Gold stock coverage from experts- … – Resolve to Do Better in 2015: Expert Edition As natural resource investors take stock of their 2014 portfolio shifts and make adjustments for 2015, The Gold. WHY THOUSANDS USE OUR GOLD FOR.

- Precious Metals Mutual Fund List. VGPMX — Summary of VANGUARD PRECIOUS METALS … – VGPMX: VANGUARD PRECIOUS METALS AND MIN — Fund Profile. Get the lastest Fund Profile for VANGUARD PRECIOUS METALS AND MIN from Zacks Investment Research. Precious metal — Wikipedia, the free encyclope.

- Corporate Bonds Outlook For 2010. PIMCO | Education – PIMCO.com · PIMCO · Your Global Investment Authority. · Change Country. iShares iBoxx $ High Yield Corporate Bond ETF | HYG – Why HYG? 1. Exposure to a broad range of U.S. high yield corporate bonds. 2. Access to the domestic h.

- Highest Return Mutual Fund 2008. Best Mutual Funds Companies in the Philippines 2014 – Complete lists of the best mutual funds companies in the Philippines 2014. Invest in these funds to make millions and become wealthier and richer than now. Hedge fund — Wikipedia, the free encyc.

- Municipal Bonds Are Not Taxable. The Best Tax — Free Municipal Bond Funds | eHow – Oct 03, 2010 · The Best Tax-Free Municipal Bond Funds. Funds specializing in municipal bonds, or munis, have performed well historically in comparison to other …. FMSbonds.com, Tax-Free Municipal Bo.