More Volatility Ahead What to Do Now

Post on: 6 Июнь, 2015 No Comment

Recent Posts:

More Volatility Ahead: What to Do Now

The global stock market rout that was made in China has gotten a bit of a reprieve of late but I believe the rapid descent of

markets here and abroad is still causing jitters. We saw more of that today.

Either way, the bottom line for us is that very little of a fundamental

nature has changed—either in terms of the markets and the economies

here and abroad, or in terms of corporate earnings—that we didnt already know was happening months ago: the fact that were

seeing a slowdown across the board.

That doesnt mean recession.

It simply means a slowing. You dont go from 40 miles per hour in a car straight into reverse. (If you did, youd probably drop

your transmission—or worse, and thats called a wreck.) You slow down. But a car that was going 40 and slows down can still roll

forward for a very long time. I think the economy is going to continue to roll ahead, though the occasional speed bump is going to take some

momentum out, and unless we see a reason to push down on the gas or come to a downhill, well just mosey along for a while.

Is it possible the economy could speed up again? Absolutely. One thing that could do that would be rebuilding of inventories. Inventory depletion

was one reason fourth-quarter GDP was so punk. Rather than build more stuff, companies sold what they had on the shelves. They may still be

doing that now, as the first quarter of 2007 doesnt appear to be picking up much momentum. But eventually, inventories must be replenished,

and we might just see that happening in the next quarter or two.

The five-day selling spree that ended with last Tuesdays rally had some nasty repercussions for some Vanguard funds. Precious Metals & Mining lost

11.1%, as there was no flight to the supposed safe haven of gold, but rather a flight away from most commodities and precious metals. Emerging

Markets Index was down 10.5% over the period, and REIT Index dropped 8.5%. Small stocks were big losers, and big stocks were smaller

losers. But of course, everything went down.

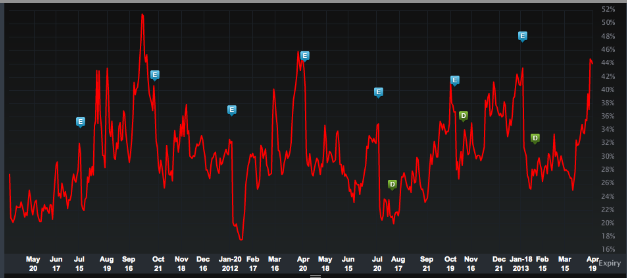

Despite recent rallies, it could go down again. As Ive said, I would not be at all surprised by a 10% decline from the market top,

which would put the Dow at about 11,500 and the S&P 500, which has yet to surpass its March 2000 high, at about 1,315 or so. Of course,

were not very close to that right now, so Id expect continued big swings, meaning more of the volatility that we hadnt

seen for a long time until just this past week or so.

Why You Need to Diversify Overseas

I want to comment briefly on the now increasingly common thought that international diversification is losing its oomph and that, because

global markets are operating in such lockstep, it almost doesnt matter if you diversify overseas or not. Hogwash! While the day-to-day

market moves, particularly of late, have seen quite synchronous movements between Asian, European and U.S. markets, and over long, long periods

its also clear theres greater correlation, the fact is that the correlation between foreign and domestic markets has actually

decreased over the past few years when looked at it on a rolling three-year, or 36-month, basis.

Just take a look at Total Stock Market and Total International Index. Over the past three years, these two funds correlation

has run about 60%, which is significantly less than it was in mid-2005, when the markets were much more closely correlated. Over the past five

years, the same broadening benefit of diversification can be seen. Its when you look over 10-year periods that you can see how markets

have become more closely correlated. But even then the correlation has moved to about 65%, not nearly 100%.

What this means is that you and I can benefit from diversification overseas when markets are not correlating, and will benefit less when they

are moving in greater lockstep—and we can adjust our allocations to these markets over time to take advantage of the shorter-term phenomenon.

In fact, thats what weve done with our foreign investments, taking less risk and earning greater returns over time than simply

plugging our money into a Total Stock Market or 500 Index type of fund.

Let Dan Weiner show you how to get started now. Dan is the leader of the worlds most effective team of mutual fund watchdogs. He

has helped Vanguard clients maximize returns and minimize risks since 1990. On average, subscribers earn 123% more than unguided Vanguard

clients, with 20% less risk! Start right away with your risk-free trial

subscription to The Independent Adviser for Vanguard Investors, and youll get immediate access to Dans current recommendations to make sure youre properly diversified and positioned for

long-term gains. PLUS, youll also get his brand-new report, Shedding Losers: Vanguard Funds You Must Sell. Click