Modern Portfolio Theory Investment Risk and Return

Post on: 16 Март, 2015 No Comment

by KenFaulkenberry

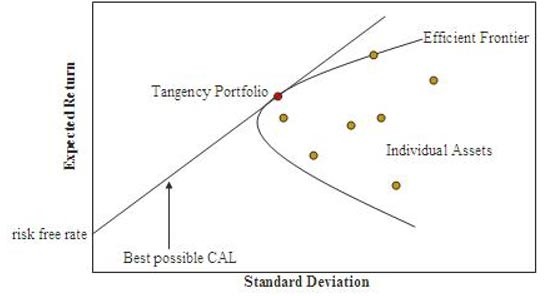

Modern Portfolio Theory was developed in the 1950’s with the belief that portfolio returns could be maximized for a given amount of investment risk by combining assets in a particular manner. The theory is that, using relationships between risk and return such as alpha and beta. and defining risk as the standard deviation of return, an “efficient frontier” for investing can be identified and exploited for maximum gain at a given amount of risk.

Much of Modern Portfolio Theory is now questioned. So why should you care? Why learn about something that is not 100% accepted as fact? The reason you should care is the principles and theories are foundations for building sound portfolio management strategies. There is no “perfect” model. Those who believe they have perfect models find out that markets change, correlations change, people change, business changes; you get the idea.

What have we learned from Modern Portfolio Theory?

Asset allocation investing works by reducing portfolio risk and/or increasing long term returns when non-correlated asset categories are combined.

Proper investment diversification reduces volatility risk by nearly eliminating specific or unsystematic risk.

Standard deviation provides a credible model for analyzing the probability of outcomes far away from the mean.

Portfolio management tools such as Alpha and Beta, Standard Deviation, the Sharpe ratio, Capital Asset Pricing Model (CAPM), Regression, and R-squared have provided a foundation for further investment research that has continued to provide additional insight into investment risk and returns.

How to Use Modern Portfolio Theory

One of the first lessons that should be learned from Modern Portfolio Theory is to not have too much faith in any model. Nothing is a sure bet; that is why it is called investment risk! Modern Portfolio Theory provides a foundation for learning and developing portfolio management skills.

Use investment portfolio theory to build your own foundation of beliefs and strategies for sound investing. Don’t buy into “trading systems” or theories that offer rewards that are too good to be true; because they will be too good to be true. Even the best and brightest believed they had theories that would stand the test of time; only to be proven wrong over time.

Investment Risk and Returns

We have learned the importance of investment risk and explored some of the portfolio management tools to measure and mitigate risk when possible. Nobody will be right all the time; but we can greatly increase our chances to succeed by accepting only prudent risk.

The successful investor will take these investing principles and portfolio management tools to build discipline and employ investment strategies with high probabilities to succeed. Risk management and proper diversification will improve your portfolio rates of return.