Market Indexes The Dow Jones Industrial Average Financial Web

Post on: 17 Июль, 2015 No Comment

Market indexes show the general direction of fluctuations in the securities markets and reflect the historical continuity of security price movements. While this information will not necessarily reveal whether individual securities are up or down, it’s nevertheless useful to understand how indexes operate because they’re commonly used as benchmarks for judging the performance of stocks. bonds and mutual funds. In actuality, market averages are no longer truly averages. The term index is more appropriate, because the numbers givenusually called points are not dollar-per-share prices of stocks. Points refer to units of movement in the average, which is a composite of weighted dollar values.

Indexes track stocks in particular industry sectors, markets or capitalization ranges. For instance, one index tracks gold stocks; a different index tracks stocks of companies engaged in the distribution and transmission of natural gas. An index exists for each of several exchanges where stocks are traded, including the New York Stock Exchange (NYSE). the American Stock Exchange (AMEX) and the Over-the-Counter Bulletin Board (OTCBB). One index tracks small capitalization stocks, one tracks large capitalization stocks and another tracks all stocks traded in the United States.

An index is referred to as price-weighted when it’s weighted by the market price of each security included in the average. Thus, securities with high market prices will be more heavily weighted and have more influence on changes in a price-weighted average. The Dow Jones averages are examples of price-weighted indexes. Conversely, an index is said to be market value-weighted when it’s adjusted according to the market value of each security included in the average. The greater a firm’s number of shares outstanding and the higher the price of the shares, the greater the weight of that security in a market value-weighted average. The S&P 500 index is a market value-weighted index.

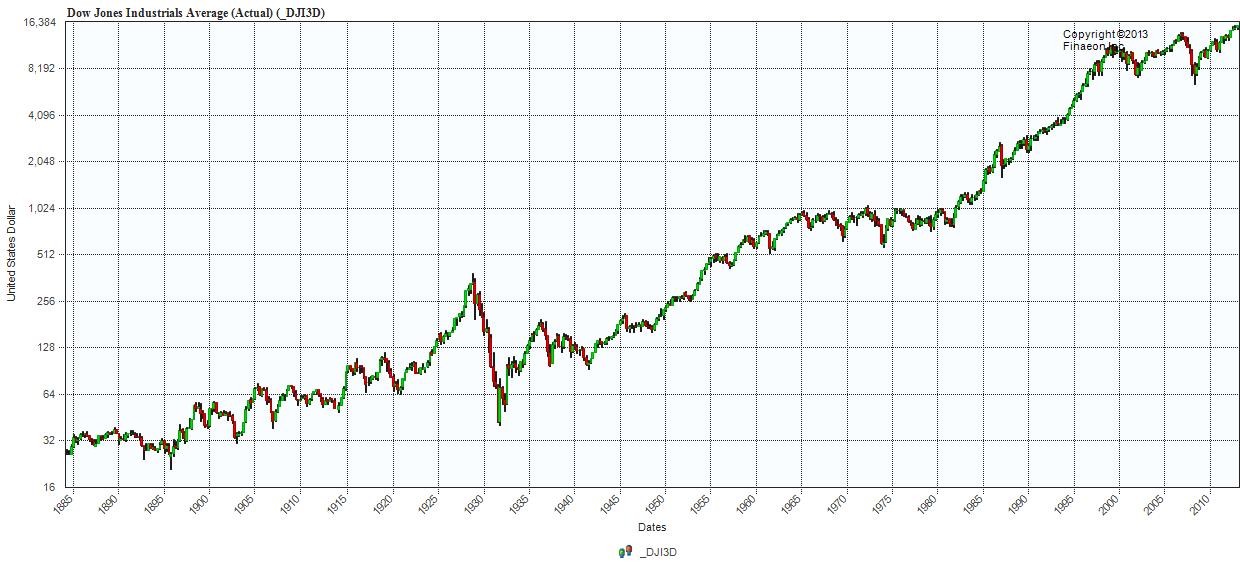

The best-known and most widely quoted index is the Dow Jones Industrial Average (DJIA), published by Dow Jones & Company, often referred to simply as the Dow. It’s also the most widely used stock market indicator, although the S&P 500 has also become an important standard for many.

The DJIA is a price-weighted average of 30 actively traded blue chip stocks consisting primarily of industrial companies. The components represent between 15 and 20 percent of the market value of NYSE stocks. It’s calculated by adding the closing prices of the component stocks and using a divisor that’s adjusted for stock splits and dividends, as well as for substitutions and mergers. The average is quoted in points, not dollar values. As of this writing, the Dow Jones Industrials includes the following companies: