Mark to market losses are not notional

Post on: 16 Март, 2015 No Comment

I could not understand why we are not accepting the reality. When financial markets across the world are melting down, we are confirming our growth story. Our recent poor IIP data shows that, we cannot keep aloof once we have integrated to the world and we cannot expect our economic performance to be different from the rest of the world.

Recently, ICICI Bank had announced that it suffered losses on account of exposure in sub prime in US. Surprisingly, our government (through a junior minister in finance ministry) along with ICICI Bank, had told that these losses were mark to market losses and were only notional losses.

If ICICI Bank exposure can be treated as only a notional exposure without having any repercussion on the balance sheet then certainly, Bear Stearns exposure should also have been treated as notional loss too. Then why was the talent pool of Bear Stearns not able to convince its investors that the entire story prevailed in market are notional only and in reality, their balance sheet is full of mortgages, that guarantees costliest land and costliest housing property in the worlds richest country.

A common judgment cannot accept the story of mark to market, declaring its loss as notional loss. Anything can be drawn on paper viz strong company, strong asset, live assets, and so many other rosy things. But, the tools of accounting will reveal the foul play of the companies. Sooner or later companies may turn into Enron or World Tel or most recently Bear Stearns.

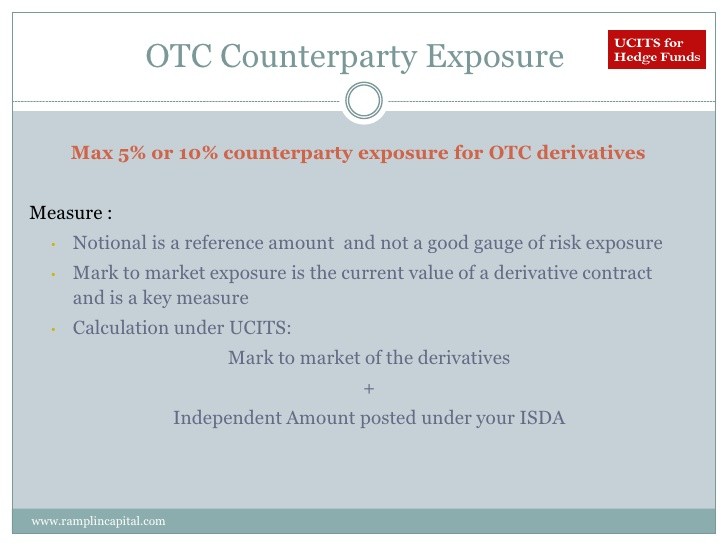

Mark to market is a concept under, which you are declaring the actual value of your assets at the market rates. Its quite a good and healthy concept. Let us say, I have purchased some 100 stock two years back at Rs 20 and so at the time of purchases, value of my asset was Rs 2000(Rs 20×100=Rs2000). But, suppose as on today, the market value of my stock has declined to Rs 10, then today I am holding assets worth Rs 1000 (Rs10x100=Rs1000) only.

If I had taken a loan from a bank of Rs 2000 by surrendering those 200 shares to bank, then today the bank will be facing shortfall in its security value as it has advanced Rs2000 against a security of Rs 1000 only (present value). So in that case, the bank will immediately call the balance (the margin) from me and I have to make provision out of my present income for the call of my bank. If I am not paying my loan and the bank is forced to sell my share in the market then, the bank will incur a loss of Rs 1000 and the bank needs to provide Rs 1000 for that loss, which means that the bank only has to reduce Rs 1000 from its profit and for the accounting year that Rs 1000 will be termed as loss.

This is actually what has happened with Bear Stearns or ICICI Bank. The exposure or the mortgages to which these banks/financial institutions have financed, have been depreciated in its market value and to that extent the banks/companies have to provide. Provision of any amount hits only the companies net profit. Hence, provision arising due to mark to market is not notional; rather it is real.

Critics are of the opinion that in case the value of sub prime properties are not known then, the assets should be treated in the books on historical cost i.e. at purchase price. It cannot be accepted as it will lead to widespread cheating and transparency will not be there in accounting. Company will be holding assets of real value of zero (as on date of financial result) but may show in its financial statement worth crores.

If tomorrow, the value of my asset has regained its original value, we cant say anything. But where is the guarantee that value of your share will regain its original value? But true accounting cannot run on assumption.

It is true that, we have yet to see the growth that the other (read developed and few emerging countries) countries have already seen, while domestic as well as foreign companies target our huge population as untapped market. But, we cannot forget the dependency of any open country on the rest of the world. If companies from abroad can invest in India at a click of a button, then these can also easily withdraw funds from India. Declaring mark to market losses as notional losses, amounts to misleading the people and should be corrected immediately.