Mark Albarian discusses plunge in gold prices

Post on: 19 Август, 2015 No Comment

by Wilson

Share This Tweet This Comments

Earlier today, the price of gold began to plummet and if you looked at Drudge Report the message was clear: Panic everywhere. Glenn invited Mark Albarian, President & CEO at Goldline International, Inc (and sponsor of this program and website), to discuss the news and give his perspective on what is happening in the gold market.

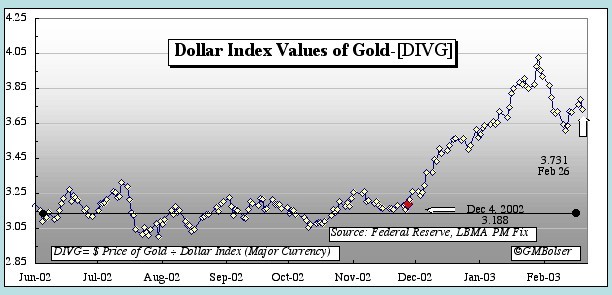

GLENN: Ive been e‑mailing back and forth with a lot of people over the weekend because some really significant things are happening with the U.S. dollar. I dont know how much time we have, but I will tell you the clock that we feared and told you would happen and would start clicking and ticking is, and its only a matter of time before the U.S. dollar is not supreme anymore. And theres something weird happening at the same time. For some unknown reason gold is now plummeting, and if Im looking at the Drudge Report, it says panic is everywhere. Mark Albarian is a sponsor of this program. He is from Goldline, and I wanted to call him and find out why is gold plunging. What is happening, Mark?

ALBARIAN: Well, I think people have reacted what Goldman Sachs said about a week ago where they said gold was going to go lower. And, you know, traders out there, if they get information like that, will sometimes sell gold, sell their gold or sell gold short to take advantage of a Goldman Sachs quote. Goldman Sachs basis for it is, Hey, the economys getting better. The worlds getting better. Everythings okay. Look at the stock market going up. Golds not as important.

GLENN: Can you tell me that ‑‑

ALBARIAN: Thats not something that I personally believe in the long run.

GLENN: I dont believe ‑‑ I mean, really? Goldman Sachs said it. So it must be so. I dont ‑‑ Im not one that actually believes that this is coincidence that the sovereign funds are buying up gold, or as countries collapse, they are dumping gold and then at the same time were being told that the economy is okay. I personally think that this is collusion. It is keeping the price of gold down for the sovereign central banks so they can store the gold. Do you think theres anything to that? Because thats just ‑‑ thats just me saying that. Is there anything that youve ever read ‑‑

ALBARIAN: Well, I think theres a lot to be said for that. First of all, theres some talk that Cyprus might sell its gold. Whenever a country or a central bank or theres rumors that a large amount of gold is going to hit the market, people panic. Remember Germany talked about selling their gold. Switzerland talked about selling their gold. Many, many times it just doesnt happen.

The other thing is as youve seen and Ive seen is that China and Russia have increased their gold reserves. So whenever theres been an opportunity to buy any quantity of gold, youve seen other countries. Its not just the big ones or the giant ones. You see India increasing gold reserves from time to time. So you see other countries taking advantage of these opportunities.

Right now that word panic, its, theres no panic at Goldline. Theres no panic in the physical market. I dont think investors that own gold are panicking. I think people that are on margin, that are speculating, that are traders, theyve made ‑‑

GLENN: They are panicking.

ALBARIAN: Yeah, they overreacted. How come nobodys talking about silver? Silvers down today almost 9%. So if golds going down, does it make sense that silver goes down? Does it make sense that platinum goes down? Does it make sense that palladium, which is almost purely an industrial metal. So if things are going ‑‑ getting better, does it make sense that palladium is down today 5%? It seems like its, you know, an overreaction in the trading markets. But who knows.

GLENN: Okay. So gold mining shares around the world were battered, and this is kind of what youre talking about and this is something that I have said dont do and that is buy paper gold. So the ‑‑

ALBARIAN: I would agree with you. Gold mining shares, what you are doing is you are investing in a business. If that gold mine makes money and the stock markets good, youll make money. But youre not betting specifically on the gold price. And shares can, you know, react up or down because people feel like golds going to go up or because of a particular mine.

GLENN: Okay. So when does ‑‑ because ‑‑ in fact, I got a call from a guy today. I got a call from a guy. And he said, Glenn, I just want you to know because I know youre a big gold guy. He said, youve got to get out of gold because its going to plummet. And I said, thank you very much. What do you think its going to hit? And he said, I dont know, but its going to go down and I said, great, because Im going to be planning on buying more. Because I just dont believe that the ‑‑ with what happened, Mark, this is whats so confusing. You followed the currency stuff that was happening over the weekend with Japan and Switzerland and France and Australia last week, with China and the currency, right?

ALBARIAN: Yes, all the currencies.

GLENN: Okay.

ALBARIAN: Its interesting because weve seen the dollar at a level now that, with all thats going on in the world, everybodys now saying the U.S. currency is the safest.

GLENN: Well, but China is making moves to basically set up, I think, the ultimate undermining of the U.S. dollar, and its only a matter of time I think before the dollar collapses or interest rates have got to be jacked up to be able to hold this thing together which would eventually mean our demise. But it doesnt make sense. Those things dont go together.

ALBARIAN: Yeah, I think thats a great point. Lots of things dont go together. So if gold is going down today, wouldnt you expect that the stock market might be going up? And the Dows down over 80 points. I mean, how is everything going down at one time? And China looking for world dominance? Clearly thats an issue, and its hard for us to be on an equal footing with China when we negotiate with them because we owe them so much money. When you owe somebody a lot of money, you have to be nice to them. Youre not really equal when you negotiate.

GLENN: One of my guys came in this morning and said that he had read a thing that it showed, it was a chart of all of the central banks, that all of the central banks in the last five years have made significant increases in their gold reserve. True or false?

ALBARIAN: True.

GLENN: By an unusual amount or is this the usual you kind of fluctuation?

ALBARIAN: Well, actually the usual thing is one of the things that caused gold to stay low for all those years was that the central banks were actually selling gold. They werent adding to their reserves. They were selling. And there was an agreement between the central banks, they were selling so much gold, it was hurting the gold miners. It was hurting the actual workers in South Africa that needed a job because they were in risk of closing mines. So they all got together around gold prices of $300 or even a little less and said, you know, lets stop selling gold so quickly. And they all agreed to do that.

Now, independent of that, we saw the financial crisis in 2007, 2008, 2009. And from that point on, central bankers have been adding to their gold reserves. People would have been happy if they just agreed to sell normally, but they went the other way. They started buying. And the people that have the most gold and the most power to move the gold market in my opinion are the central bankers.

GLENN: Do you think theres any gold in the United States?

ALBARIAN: I would guess that theres gold at Fort Knox. I would guess that theres gold at the Federal Reserve. I would guess also that theres a lot that I dont know and that we dont know and they are not telling us.

GLENN: Do you ‑‑

ALBARIAN: Because if it was completely transparent, they would call in one of the big four accounting firms and they would just do an audit and they would take pictures.

GLENN: Why would Illinois last week begin the passage of a bill to log everybodys gold, to make in the State of Illinois that if you have gold, you need to report it to the State of Illinois so they know exactly how much you have of physical gold?

ALBARIAN: I dont know where that bill went but Ill tell you Im very concerned when you get government asking that question. Even if it was just a proposed bill, even if it gets shot down quickly, that makes you nervous. I think an equally important question is why would the State of Texas be so concerned about getting their gold physically in their state. If the State of Texas doesnt trust somebody else to hold their gold, then I think that my view over all these years has probably been right: The people ought to buy gold and put it someplace safe and have complete control over it. Real gold, not paper, hold it themselves.

GLENN: All right. Thanks a lot, Mark. I appreciate it.

ALBARIAN: Thank you, Glenn.

GLENN: All right. Again, full disclosure. He is a sponsor. He is a friend of mine, but hes also a sponsor of the program and that was not a commercial. You ‑‑ I mean, its ‑‑ God only knows what is going to happen. You know, if you had gold, Id keep it to yourself. I would keep it to yourself. Now, in the future is it going to be ‑‑ I mean, do you see up on TheBlaze they have a new story out, where is it, hungry for some Hunger Games: See the first trailer released for the second film? How is it nobody can see that youre headed toward that kind of a world? Im not saying that were going to be hunting each other, but youre headed towards a rule ‑‑ a world where youre ruled over. I mean, is it un ‑‑ is it unreasonable to say right now that if the economy collapsed that the government could say, If you trade in gold, if you I mean, they are already doing it. They are arresting you if you have vegetables and you are trying to sell your farm fresh vegetables to a neighbor. Remember, they went in, where was it, in Colorado where they went with bleach to destroy all of it.

STU: Yeah.

GLENN: I mean, is it really that so unusual that we ‑‑ I mean, were headed toward some really spooky things if we dont wake up.