MANAGING A PORTFOLIO OF MANAGERsatellite portfolio

Post on: 16 Март, 2015 No Comment

When developing an asset allocation policy, the investor seeks an allocation to asset classes that maximizes expected total return subject to a given level of total risk. The framework of optimizing allocations to a group of managers (in this context, equity managers within the equity allocation) takes a parallel form, but with the investor now maximizing active return for a given level of active risk determined by his level of aversion to active risk:

Maximize Ua = M — XaoA (7-2)

by choice of managers

where

Ua = expected utility of the active return of the manager mix r A = expected return of the manager mix

Xa = the investor’s trade-off between active risk and active return; measures risk

aversion in active risk terms oA = variance of the active return

The efficient frontier specified by this objective function is drawn in active risk and active return space, because once active or semiactive managers are potentially in the mix, the investor’s trade-off becomes one of active return versus active risk (the asset allocation decision determines the trade-off between total risk and return). How much active risk an investor wishes to assume determines the mix of specific managers. For example, an investor wishing to assume no active risk at all would hold an index fund. On the other hand, investors desiring a high level of active risk and active return may find their mix skewed toward some combination of higher active risk managers with little or no exposure to index funds.

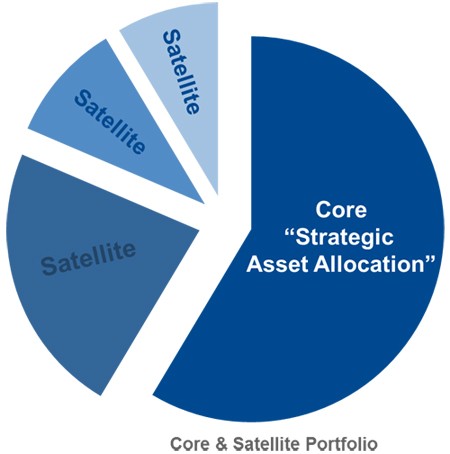

Core Satellite portfolio

The type of portfolio that Nakasone constructed in the previous section is referred to as a core-satellite portfolio. Specifically, 52 percent of the overall portfolio — the index and semiactive managers—constitutes the core holding, and the three active managers represent a ring of satellites around this core. When we apply the optimization shown in Equation 7-2 to a group of equity managers that includes effective indexers and/or enhanced indexers and successful active managers (as judged by information ratios), a core-satellite portfolio is a likely result.

Core-satellite portfolios can be constructed using Nakasone’s rigorous approach or much more simply, as demonstrated in Example 7-14 below. In either case, the objective is to anchor a strategy with either an index portfolio or an enhanced index portfolio and to use active mangers opportunistically around that anchor to achieve an acceptable level of active return while mitigating some of the active risk associated with a portfolio consisting entirely of active managers ( Equity Total Return Swaps ). The index or enhanced index portfolios used in the core generally should resemble as closely as possible the investor’s benchmark for the asset class. The satellite portfolios may also be benchmarked to the overall asset class benchmark, but there is greater latitude for them to have different benchmarks as well (e .g. having a growth or value focus rather than the more likely core benchmark for the asset class.)

EXAMPLE 7-14 A Pension Fund’s Information Ratio and Tracking Risk Objectives

Jim Smith manages the international equity portion of the pension portfolio of ACME Minerals, a large Australian mining company. Smith is responsible for a portfolio of A$700 million of non-Australian equities. Smith’s annual compensation is related to the performance of this portfolio versus the MSCI World ex-Australia Index, the benchmark for the pension portfolio’s international equity portion. He has hired the following managers with expected alphas and active risk shown (see Exhibit 7-25).

EXHIBIT 7-25 Portfolio Managers’ Characteristics