Make Better Decisions Rank Your Portfolio Investments

Post on: 16 Март, 2015 No Comment

Edited by Damon Logiudice, Senior Information Services Engineer, CA Technologies This functionality applies to CA Clarity PPM Release 13.2 and newer.

CA PPM ranks the investments in a portfolio on the Waterlines page. You can use the rankings to prioritize investments, make better decisions, and improve overall portfolio management.

By default, a portfolio has no ranking rules defined. If you have not yet defined your own ranking rules, the contents of the portfolio are stored in a Portfolio Investment table. The default ranking uses the following portfolio investment field values in descending order: Status, Scheduled Finish Date, and then the investment code value.

To establish criteria for the investment rankings, you can define and run your own ranking rules. The steps are illustrated in the following graphic:

- Open Home and from Portfolio Management. click Portfolios .

- Open a portfolio and click Waterlines .

When you define your own ranking rules, the investment rank is calculated by establishing an initial raw score and then applying your weighting factors. First, the application normalizes each ranking attribute (RA) value for every investment into a temporary value or score between 0 and 10 using the following business logic:

If you selected Higher is better in the Ranking Method field, the following equation is used:

If you selected Lower is better in the Ranking Method field, the following equation is used:

- RAVALUE represents the current value of the ranking attribute for the investment

- RAMIN represents the minimum value of the ranking attribute for all investments in the portfolio

- RAMAX represents the maximum value of the ranking attribute for all investments in the portfolio

Note. The minimum and maximum values are based on all investments in the portfolio and are not limited by any filters that you apply.

For example, a cost attribute has a current value of $50,000 with the lowest investment showing a value of $25,000 and the highest investment showing $500,000. Relatively speaking, if higher is better. that value ranks low on our list; however, if lower is better, that value is very good.

After the ranking attribute values are normalized, the ranking system applies the values that you entered in the Attribute Weighting field for each attribute. You can also adjust your own custom weightings for lookup values. These simple multipliers establish a more meaningful relative score for each attribute.

Note. The default Attribute Weighting value is one (1).

The final ranking score for each investment is the sum of all the individual attribute ranking values or scores. The application sorts these scores to determine the final rank of each investment in the portfolio.

CA PPM Portfolio Investment Ranking Example

Our example portfolio contains ten investments. The following ranking rules are defined:

We want to rank the investments according to their Alignment and Priority values. A higher alignment value (for this attribute, a better value) generates a higher score than a lower alignment value. A lower priority value (for this attribute, a better value) generates a higher score than a higher priority value.

We also want to give more weight to the alignment values, considered three times more important than the priority values. We could have assigned a weight of 3 for Alignment and left Priority with its default value of 1; however, by establishing a range from 2 to 6, the relative weighting values of 3, 4, and 5 can be added to additional attributes later.

The ten projects in the portfolio have the following current alignment and priority values:

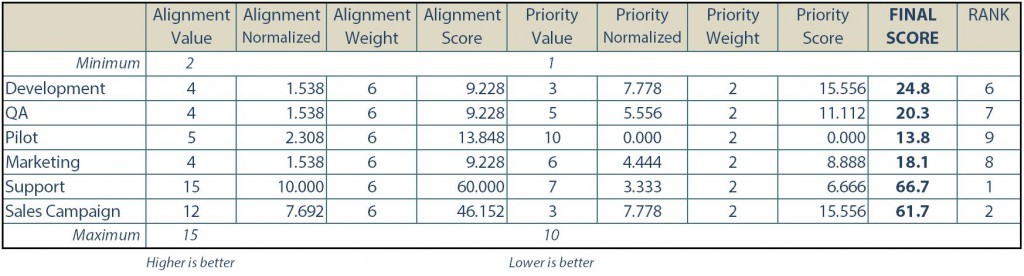

The application performs the following calculations for you and uses the final scores to rank the investments according to your rules:

For example, the Development project has an alignment value of 4 in a range from 2 to 15 where a higher value is better. The value of 4 is not good and the application assigns a low normalized score:

AlignmentNORMALIZED = [(4-2)/(15-2)] × 10 = 2/13 or .1538 × 10 = 1.538

Next, it multiplies this value by your weighting factor of 6 to yield an alignment score of 9.228.

Lower priority values are better so the Development value of 3 is a good score in the range from 1 to 10.

PriorityNORMALIZED = 10 [(3-1)/(10-1)×10] = 10 2.22 = 7.778

Next, it multiplies this value by your weighting factor of 2 to yield a priority score of 15.556.

The application adds the scores together to yield a final score that establishes the relative ranking of each investment in the portfolio. Running the rules over the entire portfolio yields the following ranked investments:

Since Support has the highest overall score, it is ranked first in the final rankings on the Waterline page.

Calculation Notes

- If the minimum and maximum values for an attribute across the portfolio are the same, the attribute score defaults to the value you enter in the Attribute Weighting field. This value is 1 by default.

- If there is only one ranking attribute defined and Higher is better is selected as a ranking method, then the value of that attribute is the relative ranking score.

- Lookups are supported and you can assign weightings to lookup values.

- Date attributes are supported. The value of the date attribute is the Julian day value as computed by the application date Java class. The routine creates the Julian day using the following algorithm, where the year, month, and day are standard numbers from the Java calendar instance:

Investments with Matching Scores

With ranking rules, the ultimate tie breaker is the primary key of the Portfolio Investment table as the default sort order is not used. To avoid ties or weak differentiation among investments, continue to define and refine your ranking rules.

Logging the Scores

As an administrator, you can configure the application to write the rankings with the portfolio investment contents primary key ID to the application log file.

Follow these steps :

- Log in to the CA PPM System Administration (CSA) application or navigate to the security.logs page (click Logs ).

- On the Edit Configuration page, click Add Category .

- In the Other Name field, enter

com.ca.clarity.ranking.RankSelector

For example:

The pk = 5015087 parameter corresponds to the internal record ID of the Portfolio Contents Investments table.

To get the name of the investment, use the following query: