Lower Your Tax with Index Funds and ETFs

Post on: 5 Апрель, 2015 No Comment

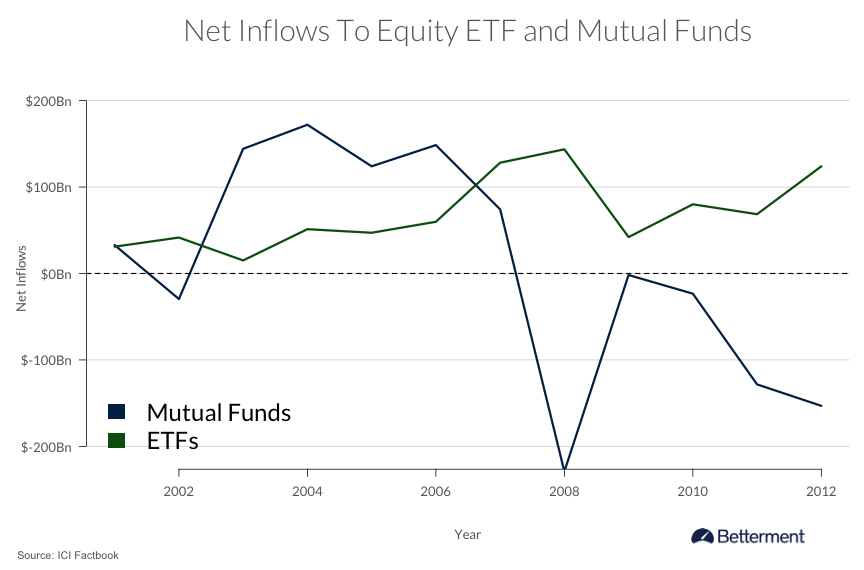

If your actively managed equity mutual funds distributed capital gains taxes last year, perhaps it’s time to consider index funds or exchange-traded funds (ETFs). Besides low fees, these investments are more tax efficient than actively managed funds because security turnover is low. This makes index funds and ETFs very appealing when the taxman cometh.

There are tax differences when owning ETFs versus traditional index mutual funds. Understanding these differences gets straight to the fundamental difference between ETFs and mutual funds.

ETFs trade on an exchange (like stocks) at the prevailing market price, which means youre buying shares from an investor who already owns them, or selling shares to an investor who wants to own the ETF. When you sell ETFs on an exchange to another person, the number of ETF shares outstanding does not change. The ETF doesnt get involved in the transaction at all. The cash comes from the other investor.

In contrast, traditional fund shares only trade directly with a fund company. It’s done once a day, at the end of the day, at a net-asset value price. Cash comes into the fund from shareholders who want to buy and goes out to shareholders who are redeeming. When there’s more money going out than in, the fund manager has to sell securities to meet redemptions. These share sales can trigger a tax consequence for all remaining fund shareholders who aren’t selling.

Investors in equity ETFs typically don’t have to deal with other investors triggering a tax consequence for them. This is due to the way securities come into a fund and leave a fund. Individual investors don’t deal directly with an ETF. Only authorized participants (AP) are allowed to add to an ETF or take from it. APs are typically brokerage firms and large institutional investors.

When adding to a fund, an AP buys a basket of securities based on the ETF manager’s requested list. The AP turns in these securities to the fund and receives new ETF shares in return. The AP then sells those new ETF shares to investors for cash through the stock market.

The reverse occurs when redeeming shares. The AP turns in ETF shares to the fund and the manager delivers a known basket of securities. The AP can then sell the individual securities in the market for cash to deliver to redeeming investors. Since the AP is selling securities rather than the fund manager, remaining ETF shareholders are not affected by the sales and have no tax consequence. This process gives ETFs a tax advantage over traditional mutual funds.

The figure below illustrates the ETF creation and redemption process:

Source: Morningstar

Dont confuse tax-efficient ETFs with tax-free investing. ETFs are not tax free. They can and do generate taxable income and possibly capital gains. Stock dividends paid by companies held in an ETF are distributed to shareholders regularly and those dividends are taxable. Also, when companies in an index are bought out for cash, any capital gain is a taxable event for ETF shareholders. Finally, you are personally responsible for paying taxes on capital gains when you sell ETF shares at a gain.

A cost comparison between ETFs and index funds can get very complicated. The unique method for creating and redeeming shares translates to an after-tax performance edge for ETFs. However, brokerage commissions and trading spreads are involved in buying ETFs, which adds cost. There are also esoteric issues. For example, many Vanguard ETFs are a share class of an open-end fund, which means there’s no added tax-advantage to buying the ETF over the fund. See my article To ETF or Not To ETF for some clarity on this unique Vanguard structure.

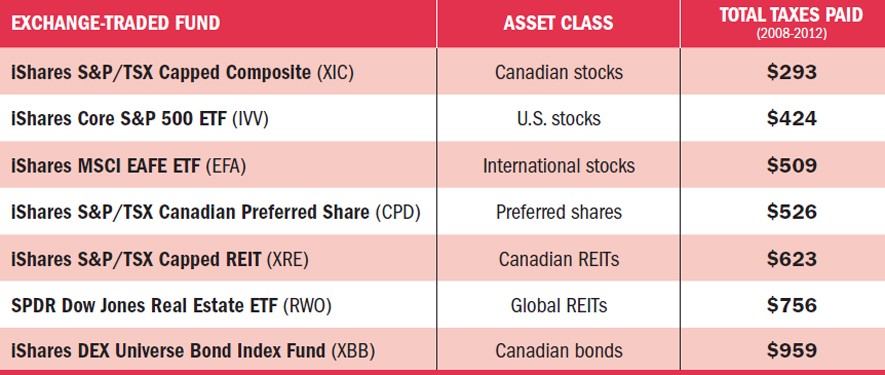

One more point, the tax advantage of ETFs is mainly in equities and not other asset classes. Bond funds have much less of a tax advantage because the return comes mostly from interest income rather than capital gains. There’s no difference in taxation on interest between an ETF and an open-end fund. Be very careful with commodity ETFs. Many commodities funds are inherently tax inefficient because they’re created using derivatives, which are taxed quite differently than stocks and bonds. Finally, gold bullion and other physical commodity ETFs are taxed at a higher capital gains rate than other securities.

In summary, there is no contest when comparing the tax benefits of ETFs and index funds to actively managed funds. Most actively managed funds have higher fees, higher turnover, and a higher tax burden. Odds are very good that your performance on an after-tax basis will be significantly lower with an actively managed fund than it will be with a comparable index fund or ETF.

Some people in the media get all hyped up about whether ETFs or index mutual funds are the best choice. I’m indifferent. You can do quite well in both. There are some added tax benefits to owning equity ETFs, but there’s added trading cost. Equity index funds tend to have low turnover anyway, so the added tax benefit in ETFs may be rather small in the long-term.