Latin America Emerging Market Stocks and ETFs To Buy For 2013 (NYSEARCA GML NYSEARCA ILF NYSEARCA

Post on: 6 Август, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

But several of the emerging markets of Latin America should perform much better than the regional average.

For example, the IMF estimates the gross domestic product (GDP) of both Chile and Colombia will grow 4.5% in 2013, while Perus GDP will rise 5.8%, Panamas 7.5% and Paraguays an eye-popping 11%.

Investors in search of growth clearly need to consider the emerging markets in Latin America.

Latin America as a whole has averaged 4% real growth in the last decade, far more than you would have gotten in Europe, North America or even much of Asia outside of China and India, said Money Morning Global Investing Strategist Martin Hutchinson.

Still, investors need to research the region before going shopping. Not every Latin American country is a winner.

The region remains a minefield for investors, Hutchinson said, noting that many of its governments are left-leaning and prone to policies that hurt business.

The Wall Street Journal recently described the emerging markets of Latin America as a tale of two economies with the philosophy of the political leadership determining which is which.

The global slowdown of the past two years has created a divide in the region between countries that pushed a more aggressive free-market agenda and kept a tighter grip on the public purse and those that used the swell in coffers from rising commodity prices to embrace a bigger role for government in the economy, the Journal said .

The key to investing in the emerging markets of Latin America in 2013, then, is looking at the countries government policies to sort out which are the darlings and which are the dogs.

Lucky for you, we already did the research

Latin America Emerging Markets to Avoid in 2013

First, here are the countries you want to avoid:

- Argentina. Dont be fooled by last years nearly 9% pop in GDP. The populist government of President Cristina Kircher has stepped up growth-slowing policies, such as restrictive trade controls and a trend toward nationalizing industries like oil and mining. Hutchinson believes such policies will starve Argentina of foreign investment, sending its economy into a tailspin.

- Venezuela. President Hugo Chávez has already nationalized most of the private sector in Venezuela. His policies, like those in Argentina, are hostile to foreign investment, said Hutchinson, and are undermining that nations economy. Venezuela does have oil money, but that wont stop it from running out of money eventually. Avoid investing in either one of these black holes, Hutchinson said of Argentina and Venezuela.

- Brazil. Latin Americas biggest country is no longer the shining star among emerging markets that it was just a couple of years ago. The run-up in commodities that fueled its growth has leveled off. The IMF sees growth in Brazil slowing to just 1.5% this year. Whats more, it too has made policy choices damaging to its economy. Brazil is passé because of its huge, out-of-control government, Hutchinson explained.

Emerging Markets 2013: Latin Americas Hot Spots

These emerging markets in Latin America tend to have governments pursuing free-market economic policies:

- Chile. Chile remains the best-run country in Latin America, with high scores on integrity indexes and a strong mineral sector, Hutchinson said. Two exchange-traded funds (ETFs) that focus on Chile are iShares MSCI Chile Investible Market Index Fund (NYSEARCA:ECH) and the Aberdeen Chile Fund, Inc. (NYSE:CH). Those daring enough to seek equities should look at Chiles strong banking sector, particularly Banco Santander-Chile (NYSE:BSAC), Banco de Chile (NYSE:BCH), and A.F.P Provida SA (NYSE:PVD).

- Colombia. Colombia recently signed a free-trade agreement with the United States and is enjoying an oil and infrastructure boom, said Hutchinson, calling the countrys government strongly pro-market. Colombia-focused ETFs include the Market Vectors Columbia ETF (NYSEARCA:COLX) and the Global X FTSE Colombia 20 ETF (NYSEARCA:GXG). Hutchinsons favorite individual stock here is Ecopetrol SA (NYSE:EC).

- Peru. While Hutchinson is not as enthusiastic about Peru and Mexico as he is about Colombia and Chile, he also sees opportunity in those emerging markets. Perus government is relatively small, and the market sector dominant, although current policy is to increase government participation, he said. An ETF for Peru is the iShares MSCI All Peru Capped Index Fund (NYSEARCA:EPU). A good individual stock choice would be Compania de Minas Buenaventura SA (NYSE:BVN), a gold-mining company that should also benefit from the rise in gold prices.

- Mexico. Mexico Im reasonably positive on, but cautious as we dont really know what President Enrique Peña Nieto will do, Hutchinson said. Theres actually huge upside for investors if Peña Nieto pursues reform and carries it through Mexicos Congress. Hutchinson advises against buying a Mexican ETF, instead recommending four stock possibilities: Homex Development Corp. (NYSE:HXM), Grupo Casa Saba, S.A. (NYSE:SAB), Grupo Simec S.A.B. de C.V. (NYSE:SIM) and Empresas ICA SA (NYSE:ICA).

Somewhat more cautious investors who want to add Latin America emerging markets to their portfolios may want to use broader-based ETFs.

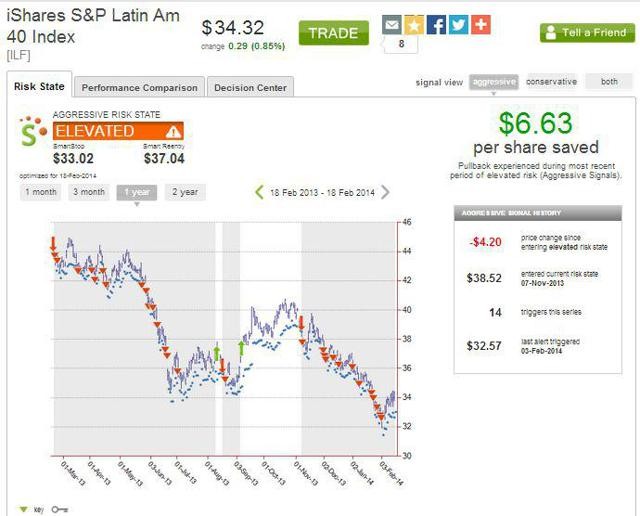

Two ETFs that cover the Latin America emerging markets in general are the iShares S&P Latin America 40 Index (NYSEARCA:ILF) and the SPDR S&P Emerging Latin America ETF (NYSEARCA:GML).

Written By David Zeiler From Money Morning

We’re in the midst of the greatest investing boom in almost 60 years. And rest assured – this boom is not about to end anytime soon. You see, the flattening of the world continues to spawn new markets worth trillions of dollars; new customers that measure in the billions; an insatiable global demand for basic resources that’s growing exponentially; and a technological revolution even in the most distant markets on the planet. And Money Morning is here to help investors profit handsomely on this seismic shift in the global economy. In fact, we believe this is where the only real fortunes will be made in the months and years to come.