JPM Corners Gold Time to Go Long

Post on: 21 Июнь, 2015 No Comment

August 12, 2013

Gold was manipulated down

so the Big Boys

could cover their shorts.

Now they are long.

(Editor’s Note — We are not providing investment counsel but rather presenting one investor’s unconventional view. Make up your own mind.)

henrymakow.com/2013/04/Goldbugs-Can-Expect-More-Losses.html#sthash.MDYVCwuA.dpuf

Update from Thom- August 14 — Gold is hanging tough. Silver is looking really good, and just put in a new breakout high. The miners are finally trying to breakout as well. Unless the reports that I referred to are a total lie, it seems the big boys are buying. JPM is the most important one. I hear traders continually talking about how JPM is taking off as much COMEX gold and silver as possible. That stuff is difficult to fudge. Perhaps JPM will sell it 100-200 higher toward November to clients, but only time will tell.

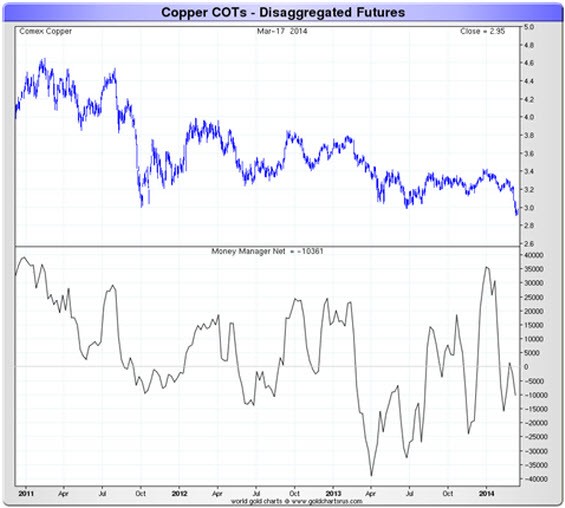

Copper is lifting silver, and a lot of traders are caught short right here and are sweating. Silver is lifting gold. Next week, gold could breakout and carry silver upwards. Every time gold tries to take a dive, someone big is buying. As a trader I would like to see a dive to a sub 1,300 number as prices generally fall faster than when they rise, but it is looking more remote.

If Bernanke came out and said something out of left field we could see a fall. But over the past month, whenever he said anything gold bearish, gold came right back up again — like a beach ball held under the water. JPM probably knows what the Fed will do and say, since they are the largest single shareholder of the Fed.

The catalysts are here for a continued rise. The seasonal demand is in the fall and new year, the hedge funds and small speculators are still very short by historical standards, and the miners are now hedging. I found that the miners are very poor market timers. They removed their hedges above 1,500 and are putting them back on from 1,200 to insure them from a total price implosion, which for now seems remote. If I were in charge of hedging at a mining company, I would have looked at my cost to mine an ounce, and the spot price and resulting profit, and continually locked in at ever higher prices. Miners should be like farmers — they should use futures to lock in a price and some of their profit. They should not be speculators. The shareholders are to blame for that. Everyone got excited at the prospect of 3,000 gold and 100 silver, and shareholders demanded that the miners remove their hedges or they would sell their shares.

The only way that I invest in precious metals is via physical gold with a small silver position. I trade futures, but I sold most of my mining shares in 2006, when their prices rose much higher that the prevailing gold and silver prices. I haven’t owned any mining companies since 2010. The gold mining business is the absolute worst business, but the miners are relatively cheap here. A contrarian can make a strong case for buying. I may even buy here on any weakness.

Sinclair said the bullion banks would look to pull gold down one last time to allow them cover to reverse their own huge short positions in the market. Once this is safely accomplished they will go fully long in their own positions and take the gold price far higher.

Regarding the timing of this move by the bullion banks, ArabianMoney.net wrote:

Right now the preoccupation in the bullion market is over a short-term correction, and the more alarming potential for a repeat of the 30 per cent price crash of 2008-9. Mr. Sinclair seems to be hinting that this will provide precisely the environment for the shedding of shorts and the creation of long-only positions in the market. (Feb 28 when gold was $1700)

by Thom Beecham

(henrymakow.com)

Beecham is a self-employed investor and trader with 17-years trading and investing experience.

Since gold and silver plunged to their lows back in the end of June, there has not been a serious retest of those prices.

I, as a professional gold and silver trader, was anticipating this to happen, and continued trading from the short side.

However, over the past week or two, I began to analyze the order flow differently and wondered if perhaps my overall strategy should be revisited.

Specifically, I had noticed that there seemed to be a floor of support — a floor that only official intervention could provide. With some fascinating data that came out this past weekend, my intuition seems to have been proven correct.

Notice that just about everyone has been bearish on gold and silver, including me. Hedge funds and large speculators have been shorting into the market the whole time, yet they have been unsuccessful in cracking gold further.

Thus, after analyzing this weekend’s important data flow, I decided to cover the remainder of my short position last night on Globex open. For the first time all year, I have actually started to trade gold from the long side, and have left my physical position unhedged.

Why? It has been determined by the COMEX Bank Participation Report that JP Morgan (JPM) has gone from being net short 50,000 COMEX gold contracts (100 oz for each contract) when gold was 1,700 to being net long 85,000+ contracts as of last week. This works out to about a 265 ton long position just on the COMEX. If JPM previously took physical delivery off the trading floor, their potential profit on a rise in gold could be much larger.

Based on total open interest, JPM has literally cornered the gold market on the long side. This completely upends the gold bear story, and could have explosive implications to the gold market going into the fall and winter months.

A position change this large cannot occur overnight. It takes months of careful trading for JPM to position itself for moves this large. I would bet JPM worked with the media to make this happen. For instance, the gold miners have begun to hedge forward production in the futures market.

Who do you think took the other side of those trades? It is safe to assume it was JPM. Basically, JPM has even fooled the miners into handing over their gold and silver at lower prices.

Remember, the globalists control all the markets. If it is inevitable that a particular market is going to destruct (i.e. sovereign debt), the globalists will control its destruction to their benefit.

Of course, I could be wrong with gold. Only time will tell. But don’t be surprised to read about gold’s resurgence over the next several months.

Here are two links to the analysis from the TF Metals Report and Silverseek discussing the potential game changing data.

Based on today’s price action, I am sure some big players have already analyzed what I have discussed and are covering their positions.