John Paulson and the Dangers of Gold Investing (AU GLD MTG NG RDN)

Post on: 16 Июль, 2015 No Comment

One of the first lessons beginning investors learn is the value of diversification in preventing big losses. But in order to reap the largest gains when they make the right call, aggressive investors often use concentrated portfolios to tap into trends they see as potentially providing explosive growth opportunities.

Unfortunately, those big bets don’t always work out. Hedge fund giant John Paulson has learned that lesson well this year with his gold-oriented fund, which has lost 65% of its value so far in 2013. Let’s take a look at what happened to Paulson and what it can teach you about taking concentrated positions in your own portfolio, especially in volatile investments like gold.

The Paulson story

John Paulson made his name by making investments that gained in value when subprime mortgages crashed in the lead-up to the financial crisis. Even now, Paulson is keeping a close eye on housing, but lately, he’s been playing the space from the other direction with bullish bets on mortgage insurance companies MGIC Investment ( NYSE: MTG ) and Radian Group ( NYSE: RDN ). His argument is basically that as long as the housing market has hit bottom, prospects for further losses are minimal, allowing mortgage insurers to make up for past losses.

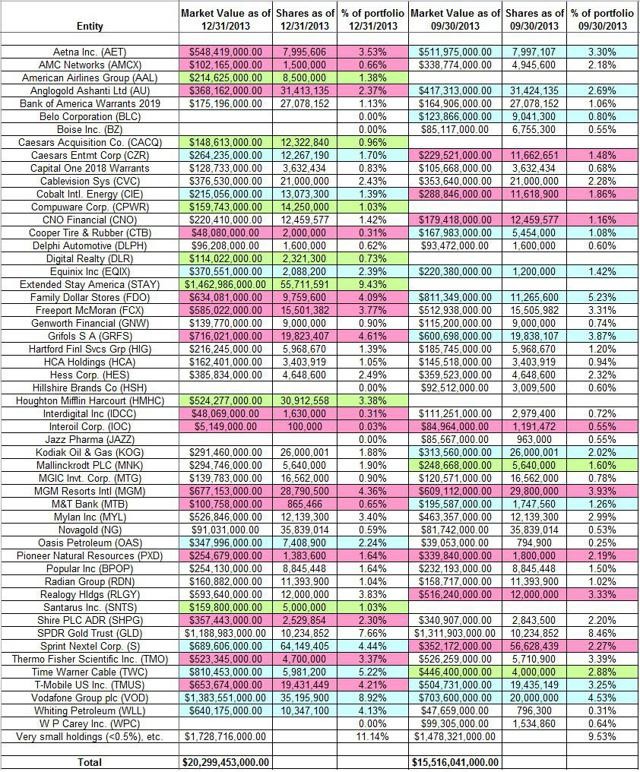

Nevertheless, even though gold makes up only 2% of his overall assets under management, Paulson’s PFR Gold Fund remains in the limelight as investors boggle at the scope of the losses the hedge fund has taken. In Paulson’s most recent 13F SEC filing of holdings across his entire hedge-fund empire as of March 31, SPDR Gold ( NYSEMKT: GLD ) remained his largest overall position at $3.4 billion, and with the price of gold having sunk more than 25% this year, that has likely created some of the drag on the gold fund’s performance.

But even bigger damage came from gold-mining stocks. AngloGold Ashanti ( NYSE: AU ) has lost almost 60% of its value in 2013, with the drop in gold prices having an outsized impact on the gold miner’s prospects. AngloGold has also suffered from investors moving away from emerging markets like South Africa in favor of U.S. stocks. as fears of the Federal Reserve’s exit from its quantitative easing program have reduced overall risk tolerance among many investors.

Moreover, highly speculative miners have also done badly. NovaGold Resources ( NYSEMKT: NG ) represented a $130 million investment for Paulson as of March 31, and it has lost more than 55% year-to-date as investors question whether the company will successfully get its Donlin Gold project in Alaska off the ground.

What’s next for Paulson?

Based on reports of a letter Paulson sent to investors earlier this month, it’s unlikely that Paulson will change his overall strategy for the fund. The hedge-fund manager argued that the gold fund still offers the potential for strong returns in the long run, citing the need to protect against macroeconomic factors that could reduce the purchasing power of the U.S. dollar and major foreign currencies.

In Paulson’s case, much of the assets managed within the fund belong to Paulson himself, so he likely doesn’t have to worry about outside investors seeking to make withdrawals. That should help the fund stick to its long-term strategy, as it’s usually pressure from outside investors that forces hedge funds to liquidate positions after big losses.

Is gold safe?

The lesson Paulson’s experience has for gold investors is that no matter how convincing an investment thesis might be, making aggressive bets based on that thesis can result in huge losses if you turn out wrong. Gold investors might well have their views proved right in the long run, but putting too much of your money behind your beliefs can put your entire financial future at risk.

On the other hand, now might be the perfect time to look at gold as an investment, after longtime investors have suffered big losses. The Motley Fool’s new free report, The Best Way to Play Gold Right Now , dissects the recent volatility and provides a guide for gold investing, with specific recommendations to take advantage of the yellow metal’s recent losses. Click here to read the full report today!