Jobs at University Endowments

Post on: 20 Сентябрь, 2016 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

University Endowments Overview: Most colleges and universities, both public and public, have endowments that provide income to supplement other sources of operating revenue, such as tuition, donations, government grants and taxpayer funded assistance. Additionally, many private secondary schools, and even some elite private primary schools, also may have significant endowments.

Both educational endowments in general, and university endowments in particular, require some degree of in-house money management. For the most part, the larger the endowment, the more likely the university or other educational institution is to employ in-house money managers who actually make investment decisions down to the level of buying and selling specific securities. The smaller the endowment, the more likely it is that most investment decisions will be delegated to outside money management firms. However, even in the latter case, the educational institution will have in-house staff who select the outside money managers and monitor their performance.

Careers with University Endowments: Jobs with university endowments can range from entry-level jobs that will help launch a career in these fields to positions at the larger endowments for people experienced in these areas:

Compensation at University Endowments: Compensation can be highly lucrative for positions at university endowments. For example, the Harvard Management Company, a subsidiary of Harvard University that managed its endowment, was embroiled in much controversy several years ago over its multi-million dollar performance bonuses for key employees. This eventually led most of the senior staff to quit the HMC and found their own firm, where they expected to earn even more.

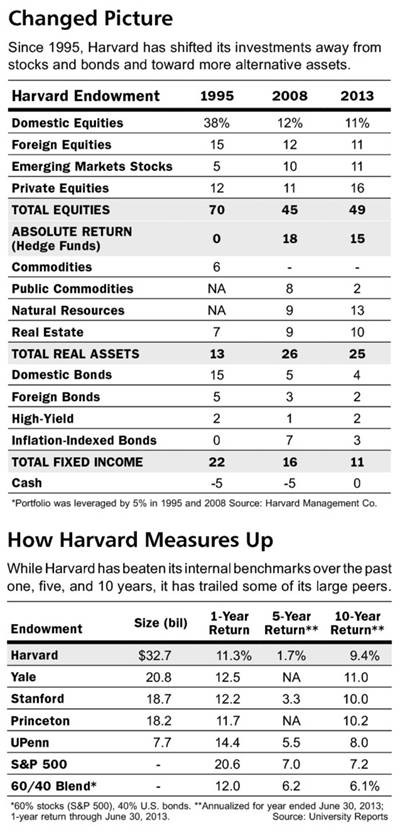

The Harvard Management Company Case: During his 1990-2005 tenure as head of the Harvard Management Company (HMC), Jack Meyer oversaw growth of the university’s endowment from $4.7 billion to $25.9 billion. Rather than being a cause for unalloyed celebration in university circles, this achievement spurred acrimonious debate.

The reason was that Meyer and his team were paid for performance, with some members enjoying annual bonuses as high as $25 million. This outraged more than a few faculty, alumni and students.

Not that these bonuses were giveaways. Instead, they were paid only if the manager in question exceeded his or her benchmark. Moreover, a large portion of each bonus was held back, subject to clawback provisions if the manager in question underperformed in a subsequent year. In this regard, HMC under Meyer was far ahead of the curve, given that the issue of bonus clawbacks on Wall Street is still largely a matter of talk in most firms.

Tired of catching flak for their performance pay, Meyer and his team got the message and left for greener pastures, founding five major Boston-based investment funds that, as of early 2011, collectively manage $43 billion, compared to Harvard’s $27.6 billion. According to Bloomberg Businessweek (Cashing In On Harvard’s Cachet, 3/14/2011), the HMC exiles have been outperforming their replacements by hefty margins.

In a final set of ironies, the exiles not only are earning more than they did at HMC, but HMC also now outsources some of its portfolio to them.

Investment Management Outsourcing: As of the end of 2010, U.S.-based endowments and non-profit foundations of all types (not just university endowments) held nearly $1.5 trillion in assets (TIAA-CREF backs fund with $1bn, Financial Times. 3/29/2011). An increasing number of the smaller ones, especially those that rely on investment committees composed of volunteers, are outsourcing their money management. Estimates are that the amount thus outsourced has grown from $20 billion in 2005 to $105 billion at the end of 2010, and will reach $215 billion by 2015. TIAA-CREF is an established investment firm with ties to the educational and non-profit market that is making a major play for this outsourced endowment and foundation money.