Is there a subprime auto loan bubble

Post on: 16 Март, 2015 No Comment

Vehicle Sales agreement with pen (Photo: Getty Images/iStockphoto)

Subprime mortgage lending shouldered much of the blame for the last financial crisis.

Now some observers are concerned that a recent jump in subprime auto loans could also mean disaster for markets.

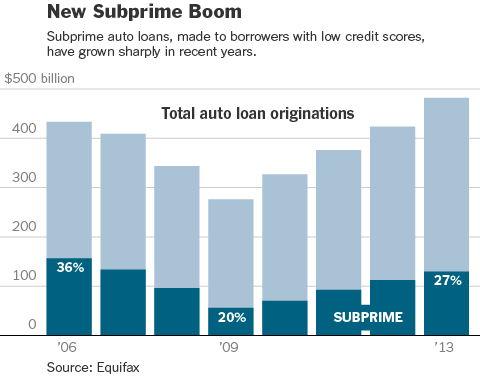

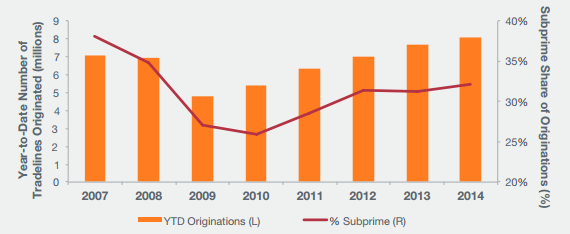

According to the Federal Reserve Bank of New York. the number of auto loans made to borrowers with credit scores below 660 has nearly doubled since 2009 – a much greater increase than in any other loan type. Other studies find repossessions climbing as well.

Will these trends precede another stock market crash? Experts say no, but there are still reasons for those with subprime loans to be cautious.

Why are people concerned about subprime auto lending?

It’s not just the number of loans to borrowers with low credit scores that has analysts on edge, but also allegations of dealer misbehavior and subprime auto loans’ involvement in the stock market.

Not all subprime loans are inappropriate, said Lawrence White, a professor of economics at New York University’s Stern School of Business. But no lender should put a borrower into a loan he or she can ill-afford.

Chris Kukla, senior vice president at the Center for Responsible Lending, notes that common practices – like rolling warranties and other products into auto loans. offering longer loan terms and loosening underwriting criteria – seem to be fueling other disturbing trends.

Between the second quarter of last year and the second quarter of this year, Experian has reported a 70% increase in the repossession rate, Kukla said.

Subprime auto loans are also being bundled into risky securities, like subprime mortgage loans were in the late 2000s. We’ve seen a lot of Wall Street money chasing these loans, said John Van Alst, an attorney for the National Consumer Law Center.

Are we in another subprime lending bubble?

Most are hesitant to call the rise in subprime auto lending a bubble.

Mike Schenk, senior economist with the Credit Union National Association, thinks the increase is to be expected. The downturn pushed a lot of people who weren’t subprime into that category. If you sat down with a lot of these people now, you’d find that they’re back on track.

Scale is also a factor. The overall size of the auto loan market is less than one-tenth of the overall size of the mortgage market, White said. The magnitude is smaller. Nobody expects the price of the underlying collateral to be always going up.

He added,I can’t imagine the same economy-shaking consequences that the collapse of subprime mortgage lending had.

A higher rate of auto loan defaults probably won’t tank the markets.But questionable lending practices are still hurting some of the most vulnerable auto loan borrowers.

It’s different than the mortgage market in absolute dollar amounts, but we’re talking about an awful lot of people, Van Alst said.

More than half of consumers in most states have subprime credit.

Predatory loans put low-income borrowers at risk for repossession, jeopardizing their ability to get to work. They also stress other parts of borrowers’ budgets. You might start to see delinquency in their other debts, Kukla said.

What’s being done about deceptive loan practices?

Subprime auto loans are certainly something that we’re looking at, said Malini Mithal, assistant director of the Federal Trade Commission’s Division of Financial Practices. In the past few years, we’ve brought more than 20 cases to protect consumers in auto-related actions. Many of these have addressed issues affecting subprime consumers.

Last January, the agency cracked down on a group of dealerships found to be misrepresenting customers’ monthly payments. Other cases have addressed dealerships that allowed customers to trade in cars on which they still owed money, requiring them to pay off their old car and their new car at the same time.

A car is one of many consumers’ biggest purchases, and drivers often figure the amount they can pay down to the dollar. Illegal lending practices can have a big impact on their bottom line, said Mithal.

One issue that still concerns Kukla and the Center for Responsible Lending is dealer interest rate markup. Lenders often allow dealers to add to a buyer’s interest rate as a form of compensation. People who bought a car in 2009 paid $25.8 billion in interest over the lives of their loans associated with dealer markup, Kukla said.

Kukla points out that the practice is disallowed in mortgage lending and hopes to see the same happen with auto loans. There’s a lot of ways you can compensate a dealer without the fair lending risk. It would have a huge impact on consumers, he said.

NerdWallet is a USA TODAY content partner providing general news, commentary and coverage from around the Web. Its content is produced independently of USA TODAY.