Is Pan American Silver (USA) the Best Way to Bet on a Rebound in Silver

Post on: 23 Июнь, 2015 No Comment

Is Pan American Silver the Best Way to Bet on a Rebound in Silver?

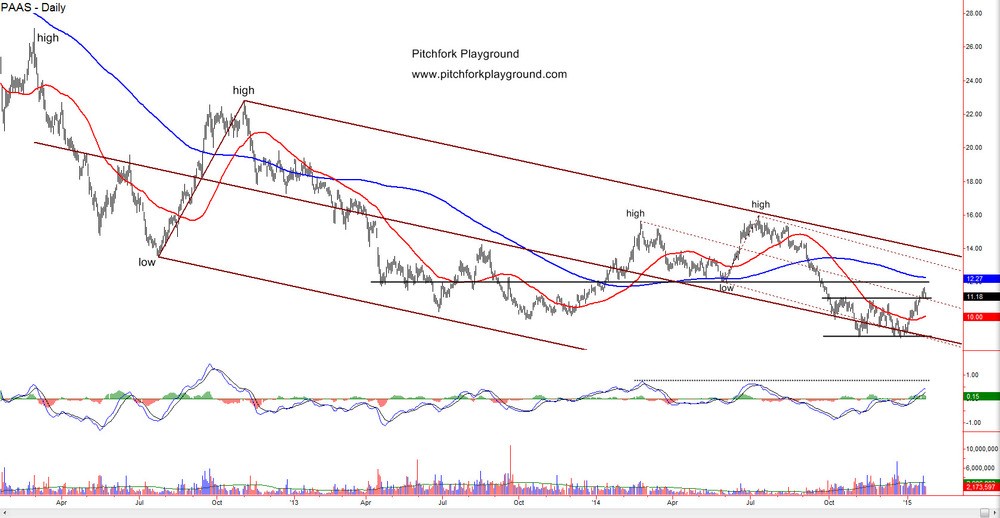

Earlier this week TD Securities downgraded the world’s second largest primary silver miner Pan American Silver Corp. (TSX: PAA) (NYSE: PAAS) to hold from buy because of weaker silver prices. But despite this I remain bullish on the prospects for Pan American Silver, with a range of indicators highlighting silver prices are set to rebound. Let’s take a closer look at why it is still a meaningful opportunity for investors to cash in on a rally in silver.

Despite recent weakness silver is set to rebound

A key pressure on Pan American Silver’s share price is the recent decline in the price of silver, with the precious metal down 10% for the year-to-date and a massive 20% from its February 2014 peak. But in stark contrast, Pan American Silver’s share price has held up well, softening a mere 1.5% since the start of 2014, which can be attributed to the company’s strong fundamentals.

Despite weaker silver prices at this time, I believe a rebound is imminent with a range of indicators highlighting silver is now extremely undervalued, particularly in comparison to gold.

The gold-to-silver ratio has widened further, now requiring 69 ounces of silver to buy one ounce of gold, compared to 62 ounces at the start of 2014. It is also increasingly clear the demand for silver is set to outstrip supply for the second year running, which according to analysts will continue into a third consecutive year in 2015.

Why I like Pan American Silver

Unlike many of its peers, Pan American Silver weathered the silver price crunch at the end of 2012 relatively well, maintaining its dividend and continuing to invest in developing its assets, while other miners were slashing dividends and closing mines. This has allowed it to retain the loyalty of investors, while continuing to boost production allowing it to overcome any shortfall in silver prices.

More importantly the company is aggressively cutting costs and enhancing productivity to ensure it remains profitable, in what is now a difficult operating environment dominated by softer precious metal prices. These measures caused Pan American Silver’s all-in-sustaining-costs per ounce of silver sold in the second quarter 2014 fall 15% compared the second quarter 2013, while silver production grew a healthy 3%.

Clearly, boding well for Pan American Silver to not only remain profitable should silver prices remain depressed, but significantly boost its financial performance as they rebound.

With signs of a looming market correction, which will drive investors to safe haven assets like silver, and growing industrial demand and yet another supply shortfall, a rebound in silver is imminent and Pan American Silver shapes up as a solid leveraged play for investors seeking to cash in on this rebound.

Don’t miss our TOP PICK for 2014 and beyond

Constructing a portfolio is like building a house, chief analyst Iain Butler says. You want to build it on a foundation of rock solid, proven, long-term money makers. And do we have a winner for you. click here now for our FREE report and discover 1 top Canadian stock for 2014 and beyond!