Is it time to sell your oil stocks

Post on: 28 Май, 2015 No Comment

Is it time to sell your oil stocks?

The International Energy Agency (IEA) appears to have been king hit by the sudden drop in global demand for oil with the peak body now forecasting oil demand to grow by 900,000 barrels per day in 2014. The updated forecast is over 350,000 barrels below what the IEA had been expecting as recently as June.

The updated view has led the agency to ‘revise down sharply’ its forecast expectations for global demand not just in 2014 but also in 2015.

IEA didn’t see it coming

According to a report by the Australian Broadcasting Corporation (ABC) the IEA has described the drop in demand as ‘nothing short of remarkable’, with the IEA singling out a weak Eurozone as being partially responsible for the downgrade to projections.

Hedge funds are selling, should you?

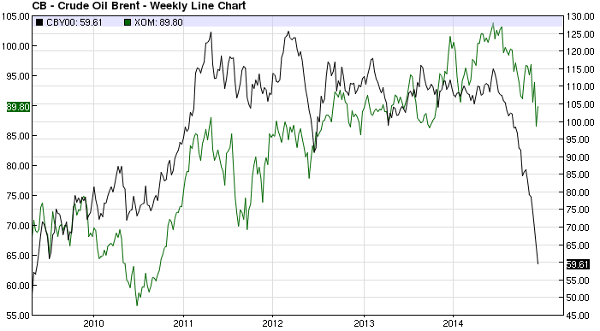

The ABC also reported that hedge funds have been slashing their exposure to the ‘liquid gold’ in response to the outlook, with the oil price now trading below US$100 a barrel for the first time in over 12 months.

The outlook could spell bad news for oil investors – when it comes to commodities, small changes in the supply and demand dynamics can have a profound effect on prices, a point iron ore producers are not fully awake to!

Luckily for Australian investors, many of the widely-owned oil companies operate diverse business models which sees them producing both oil and gas.

Woodside Petroleum Limited (ASX: WPL) , Santos Ltd (ASX: STO) and Oil Search Limited (ASX: OSH) all provide some protection to shareholders thanks to their expansive LNG interests. For investors in these major oil and gas producers the fall in oil price is something to monitor, but as yet it’s probably no cause for alarm.

LNG projects should help to boost the cash flow of Woodside, Santos and Oil Search — this will go at least some way to protecting them from the effect of declining oil prices. Growing cash flows should also mean growing dividends for shareholders, however, there is a simpler way to achieve a solid dividend yield.

Every year, Motley Fool investment advisor Scott Phillips hand-picks 1 ASX dividend stock with outstanding potential. Just click here to download your free copy of The Motley Fool’s Top Dividend Stock for 2014-2015 today.

Motley Fool contributor Tim McArthur does not own shares in any of the companies mentioned in this article.

The International Energy Agency (IEA) appears to have been king hit by the sudden drop in global demand for oil with the peak body now forecasting oil demand to grow by 900,000 barrels per day in 2014. The updated forecast is over 350,000 barrels below what the IEA had been expecting as recently as June.

The updated view has led the agency to revise down sharply its forecast expectations for global demand not just in 2014 but also in 2015.