Is It Time to Invest in Australia (EWA FXA BHP)

Post on: 28 Май, 2015 No Comment

Australia is a developed country with a population of about 22 million people. It is also a country rich in natural resources and one increasingly gaining attention from investors. Is it time to put some of your international allocation to work in Australia?

The History of Australia

Australia has a vibrant early history of cheap land and rich resources. Gold was discovered in New South Wales, for example, in 1851. By the time Australia became a nation in 1901, two important commodities, wool and gold, had attracted immense outside investment into the cities of Melbourne and Sydney.

Australia’s economy has seen steady growth throughout its history. Demand for Australia’s major exports: metals, meat, wheat and the aforementioned wool — has been steady or growing. In 1947, only 40% of Australians owned their own homes. By the 1960s, the figure was more than 70%.

Economic reforms, including deregulation of the banking system. along with tax reform have led to a better standard of living for Australians. Then, in 2007, the Labor Party, led by Kevin Rudd, mounted a reform agenda aimed at Australia’s industrial relations system, climate change policies, and health and education sectors.

According to Heritage.org. Australia’s economic freedom score is 82.6, making it the third freest in the 2013 Index, behind Hong Kong and Singapore. For comparison, the United States ranks tenth. Economic freedom, as defined by Heritage, is “the fundamental right of every human to control his or her own labor and property.”

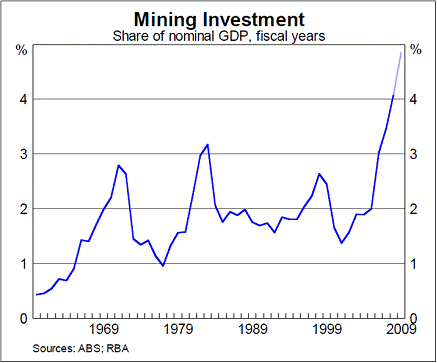

Index Mundi points out that Australia’s abundant natural resources (coal, iron ore, copper, gold, natural gas, and uranium) already attract significant foreign investment. In addition, the country is home to extensive renewable energy sources.

Historically, the Australian economy grew for 17 consecutive years before the global financial crisis. Government reform policies under the Rudd administration, along with continued demand for commodities, especially from China, helped the Australian economy rebound after just one quarter of negative growth.

The nation’s economy grew by 1.4% in 2009 — the best performance in the OECD. This was followed by growth of 2.5% in 2010, 2.1% in 2011 and 3.3% in 2012. Unemployment, which was originally expected to reach 8 to 10% following the financial crisis, peaked at only 5.7% in late 2009 and fell to 5.2% in 2012.

Because of an improved economy, the budget deficit dropped to 0.8% of GDP in 2012 and the government now believes it could return to budget surpluses before 2015.

Why Invest?

With a strong economy as the backbone, companies like AAG Investment Management tout Australia’s record of accomplishment in agricultural production as one important reason to consider investing in the country.

In addition, AAG says Australia’s geographic location makes it extremely well placed with regard to the emerging markets of Asia, which have many emerging nations that investors cannot ignore. As global food prices rise, investing in Australia offers distinct advantages.

In addition, the Australian government website, Austrade. points to growing foreign investment, a democratic and politically stable government, a business-friendly regulatory environment, and a sophisticated financial services sector as some of the many reasons investors should consider putting their capital to work in the Land Down Under.

Australia’s attractiveness as an investment destination has not been lost on its Asian neighbors. The Wall Street Journal reports that the country has attracted 170 applicants, mostly from China, to a new program that offers overseas millionaires the right of residency in return for a portion of their wealth.

Also, Indonesian businesses, including some backed by the government, are now poised to spend tens of millions of dollars buying up and investing in Australian cattle stations.

On the other hand, the country has seen low credit demand and soft economic growth, yet the Australian dollar continues to hold firm, hurting exports. As a result, the Bank of Australia lower interested rates to a record low of 2.75% — the first time rates have fallen below 3%. Some investors may see that as a sign of increasing pressure while others will view it as a precautionary move.

How to Invest

After “why,” the next questions regarding investment in Australia are “how” and “what.”

One of the easiest and safest ways to invest is through an ETF — which has many benefits. One popular Australian ETF is the iShares MSCI Australia Index (ARCA:EWA ). The fund contains most large Australian companies and has an asset base of about $2.2 billion.

Others may prefer to play the Australian Dollar. The CurrencyShares Australian Dollar Trust ETF (ARCA:FXA ) is a favorite among investors. Finally, investors that are more adventurous may want to consider direct investment in Australian equities. One of the best known is BHP Billiton Limited (NYSE:BHP ).