Investor Beware Leverage Accounts

Post on: 16 Июнь, 2015 No Comment

The Sun-Sentinel of Southern Florida reports that over the past 18 months, clients and creditors of 7 local precious metals businesses have claimed losses of more than $54 million!

How is it possible in this great 21 st century gold and silver bull market, this many folks are losing that kind of capital?

Well the answer lies somewhere between investor ignorance, a lack of proper due diligence, poor silver and gold investment vehicle choices, investor greed, and perhaps electing and entrusting the wrong parties to do business with.

Today we would like to tackle one of the biggest silver and gold investor killers out there -> Leverage Accounts.

Over the years, leverage accounts have been responsible for transferring hundreds of millions of dollars of capital away from investors and into the pockets of dealers who offer levered financing for silver or gold speculation.

Simply put, when you introduce leverage you introduce risk .

Leveraged investing is when you borrow money in order to invest. With a leveraged investment, you would invest a large sum up-front, then make regular payments to pay back the amount you borrowed, plus the interest. The potential advantage of the leveraged investment is that there is a larger amount earning returns over a longer period of time. If the return on your investment is greater than the principal borrowed plus the interest, your leveraged investment has outperformed a traditional investment.

Leverage generally enables the investor to own more of a stock or commodity without paying full price for it. The downside to it is, if your investment loses money, your losses are exponentially greater. In the case of leverage, you are going up against a mathematical formula plus compounding fees engineered to work against you.

Leveraged silver and gold accounts are pitched to investors based on their upside potential, the problem is the downside-devil in their detail. These types of accounts are typically designed to aggressively drive wealth away from investors when large short-term swings occur. If you dont know what youre doing (and many times even if you do), leverage can also magnify your losses to 100% and beyond!

The following excerpt is from the aforementioned report out of Southern Florida:

3/19/2011

Customers are also told they can buy on leverage meaning they can obtain financing so they can purchase more metal.

For example, a customer could put down $1,000 to buy $5,000 worth of gold. The financing comes from separate businesses called clearing firms or clearing houses, that have pre-existing relationships with the precious metals firms.

Under such leveraged arrangements, if metal prices fall by a certain amount, clients are subject to a margin call, meaning they must pony up more cash or risk losing their money.

A Federal Trade Commission official testified before Congress last year that the agency has seen a rise in unscrupulous telemarketers pitching highly leveraged precious metals sales to consumers who dont understand how the deals work or the risks involved.

The telemarketers charge hefty commissions and other fees that significantly reduce or completely eliminate the value of the consumers initial investments, Lois Greisman, an associate director in the FTCs Bureau of Consumer Protection, told the House Subcommittee on Commerce, Trade and Consumer Protection.

Frank Widmann, director of securities for Floridas Office of Financial Regulation, told the Sun Sentinel that the volatility of this market can make it treacherous territory for inexperienced gold buyers.

This is an area where its real easy to mess with investors, he said.

In July 2010, Mike Maloney wrote the following in a WealthCycles.com article entitled — Beware of Fools Gold — Leverage :

When I first started accumulating gold and silver, I purchased a small quantity from a dealer. Naturally, when I was ready to purchase more, I went back to that same dealer. Over time, I developed a good relationship with that dealer, and I trusted him.

But as my purchases became larger, I decided to shop around to see if I could save some money. I called a dealer I saw on a TV ad, and, low and behold, his price was a couple percent less than my original, trusted dealer. While I was making my purchase from the new dealer, the salesman there convinced me that I could do a lot better with a margined account, where I could leverage my gold and silver at five to one.

Now I was no novice. I had used margin for quite some time and was already quite well informed regarding its asymmetrical leverage. So I didnt buy immediately; instead, I investigated the opportunity for a couple of days, then calculated the interest Id be paying and the storage fees, determining exactly how much the metals would have to rise for my account to show a profit. Then I made my buy, but put more money down than I needed to, so that my equity would be much higher and my interest payments much smaller. With this position, my leverage would only be 3 to 1. This gave me a lot of headroom to accommodate the large price swings that silver is prone to, without getting a margin call and the last thing I wanted was a margin call.

For more than a year I babysat my position, all the time readjusting my equity to approximately 33%, keeping my leverage at 3 to 1. Every time my equity would get over 50%, I would use some of the equity to buy more ounces and get my leverage back to 3 to 1, and I never got a margin call. I had stellar results, as silver moved up from the $4.40 area to a peak of $8.50. But then, in April of 2004, in just seven trading days, silver fell by the largest percentage of any month in over 20 years.

Two days after the silver price hit bottom, I got two letters from my dealer in the mail. The first letter I opened informed me the price drop had caused the equity in my account to fall below the margin call limits, and it gave me the opportunity to send in a payment to cover my margin call.

The second letter informed me that, due to recent price fluctuations, the equity in my account unfortunately had fallen below minimum required levels, causing the dealer to liquidate my position. Both of these letters were dated and postmarked on the same dayone offering me the opportunity to cover my position, the other telling me I had no position to cover.

Had I had the opportunity to cover, I would have done so in a heartbeat. You see, when you cover a margin call on precious metals, you are simply buying the extra ounces that your equity no longer covers. I knew, even back then, that silver was headed for the moon, and on the day my position was liquidated, I could have bought all those extra ounces for less than $6 each.

When I opened my account with the new dealer, the salesman assured me I would have 48 hours to cover any margin call. I guess helike menever ever read the fine print.

In the end, my attempt to save that couple of percent off the cost from my trusted dealer had cost me 100% of my investment.

About six months before writing this, a customer called me to buy some silver, and in our conversation I cautioned him against using leverage. He responded with a 20-minute story that was almost identical to mine. He called the same dealer to purchase silver and was sold a leveraged account. He, however, kept his leverage at 5 to 1. The story ended with him losing half a million dollars, with no opportunity to cover his margin call.

Then just a few days before writing this, a friend with whom I hadnt spoken with for quite some time told me that she had called the same dealer to buy silver and was talked into the same type of account. Like the customer above, she also had put down only the minimum amount required, so her leverage was 5 to 1. The first time the price fell, her position was liquidated, and she was never given the opportunity to cover.

I think I see a pattern here.

In November 2010, the Los Angeles Times also covered a story echoing Mikes earlier warnings on gold and silver leverage account risks and the types of dealers who offer them.

Bottom Line > Leave the Leverage to the Losers

We understand, the fundamental arguments for investing in silver and gold are so strong it is hard to not get over emotional and yes perhaps even a bit overzealous.

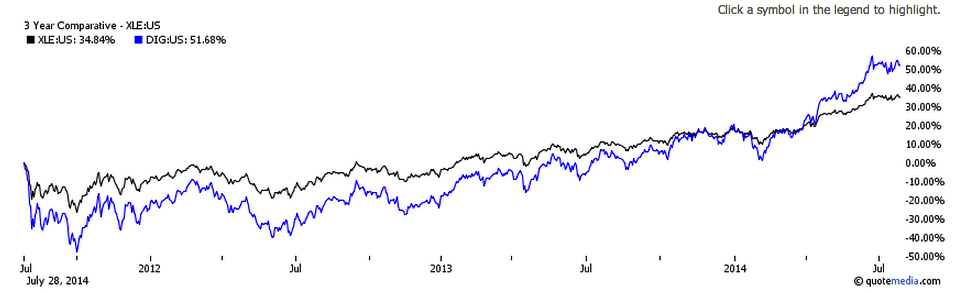

As long-term levelheaded investors, one thing we must always keep in mind is that no bull market goes up in a straight line.

Every bull market must ride its wall of worry. Short-term swings are the norm, but long term, intelligent physical silver and gold investors should win out.

For us, as the dollar and the rest of the worlds fiat currencies waste away, physical silver and gold bullion investing has the lowest and most limited downside risk versus huge potential upside returns.

We believe having bullion in ones hand or in fully insured third party segregated vault storage facilities to be the most intelligent one-two punches in taking advantage of this great 21 st century gold and silver bull market.

Well continue to take our bullion investments delivered physically and leave the chances, leveraged or not, to the rest.

The information, opinions, and financial data presented are for educational purposes only and are not intended as investment advice. No guarantees are made as to the accuracy of the information provided herein. Situations can change from day to day. Every investor should do their own due-diligence to determine which investments are best for them.