Investment Calculator

Post on: 16 Июнь, 2015 No Comment

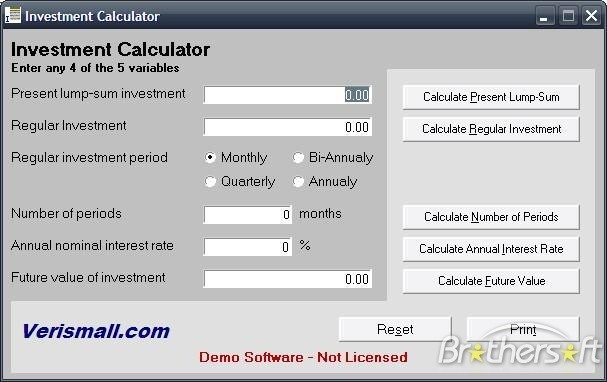

This investment calculator can be used to calculate a specific parameter for an investment plan. The tabs in the following represent the parameter to be calculated. For example, if you want to know the return rate needed to reach your investment goal with a investment schedule, please click the Return Rate tab to calculate that. This investment calculator is based on a fixed return rate.

Results

The Investment Calculator can help you to determine the return on investments with a fixed rate of return. A good example of this type of investment is a Certificate of Deposit, or CD, which is available at most banks. A CD is a low risk investment, because, up to the amount of $250,000, it is guaranteed by the Federal Deposit Insurance Corporation, a U.S. government agency. It pays a fixed rate of interest for a specified amount of time. The longer you leave your money in the CD, the better the rate of interest you can receive. Other low-risk investments of this type are savings accounts and money market accounts, which pay relatively low rates of interest.

Risk is a key factor when making investments. In general, one is paid a premium for taking the greater risk. So, for example, if you buy the debt of some companies, which is rated at a risky level by the agencies that determine levels of risk in corporate debt (Moody’s, Fitch, Standard & Poor’s), you will earn a very high rate of interest on it, but you run the risk that these companies might go out of business, and you could lose your investment.

There are, of course, less risky companies to invest in. Buying bonds from companies that are highly rated for risk by the agencies is much safer, but one earns a lower rate of interest. Bonds can be bought both for the short term and the long term.

Short-term bond investors want to buy a bond when its price is low and sell it when the price has risen, rather than holding the bond to maturity. Bond prices tend to drop as interest rates rise, and they typically rise when interest rates fall. Within different parts of the bond market, differences in supply and demand can also generate short-term trading opportunities.

When buying bonds for the long term, you invest in a bond and hold it to maturity. In this way, you will get interest payments, usually twice a year, and receive the face value of the bond at maturity. When you follow a long-term bond-buying strategy, you need not be too concerned about the impact of interest rates on a bond’s price or market value. If interest rates rise, and the market value of your bond changes, your strategy does not change unless you try to sell the bond. This is a conservative approach to bond investment.

One very special kind of bond is the United States Treasury inflation-protected securities, known as (TIPS). TIPS offer an effective way to handle the risk of inflation. They also provide a risk-free return guaranteed by the U.S. government. For this reason, they are a very popular investment, although the return is relatively low compared with other fixed-income investments.

TIPS are guaranteed to keep pace with inflation as defined by the Consumer Price Index (CPI). This is what makes them unique and defines their behavior. Their rate of return is tied to the index.

Still another form of investment is equity or stocks. While this is not a fixed-interest investment, it is one of the most important forms of investment for both institutional and private investors.

Stock is a share, literally a percentage of ownership, in a company. It permits you, as a part owner of that company, to share in its profits, and you receive those funds in the form of dividends for as long as you hold the shares (and the company pays dividends). Some company stocks are traded on exchanges, and many investors purchase stocks with the object of buying them at a low price and selling them at a higher one. Many investors prefer to invest in mutual funds, or other types of stock funds, which group a number of stocks. These funds are actively managed by a skilled trader who tries to bring together as many performing stocks as possible. The investor pays a small fee, called a load, for the privilege of working with the manager. Another kind of stock fund is the Index fund, which bases its strategy on the performance of indexes like the Dow Jones, the S&P 500, or the Russell 1000, groups of stocks that are selected on the basis of size and quality.

Still another profitable and popular investment is real estate. The most basic way of investing is to purchase low-valued property that you have reason to believe will appreciate in value over a reasonable period of time. Usually, an influx of people or an increase in development makes the property more valuable. Alternatively, land that you purchase can be built on and made more valuable in this way.

Another way to invest in real estate is to buy houses or apartment buildings and to rent them. The income from rental properties it is known as yield can rise to 30 percent or 40 percent per year if the properties are managed carefully, and the proper location is chosen.

Still another popular form of investment is in commodities. These can range from precious metals like gold and silver, to useful commodities like oil and gas. Investment in gold is complex, as the price of gold is not determined by any industrial usage. Gold is used in jewelry, but not in any other practical form. The price of gold is determined very largely by the fact that gold is valuable, and investors wish to hold it, particularly in times of insecurity. When there is war or crisis, investors buy gold, and the price goes up. Investing in silver, on the other hand, is very largely determined by the demand for that commodity in photovoltaics, in the automobile industry, and in other practical uses. Oil is a very popular investment, and demand for oil is strong as the need for gasoline is always considerable. Oil is traded around the world on spot markets, and its price goes up and down depending on the state of the global economy. Investment in commodities like gas, on the other hand, is usually made through the futures exchanges, of which the largest in the U.S. is the CBOT in Chicago. These trade options on quantities of gas and other commodities before delivery. A private investor can trade into futures and then trade out, always avoiding the terminal delivery point.

For investments with a fixed rate of return, this Investment Calculator will help you to determine interest payments and rate of return, as, for example with a bond investment. The investment calculator also shows how much you must invest each month to reach a given target.