Investing in Precious Metals Investment U

Post on: 25 Май, 2015 No Comment

The Party in Precious Metals And Currencies is Heating Up.

Look for This Major Bull Market to Push Prices Even Higher in 2006

by Michael Checkan, Investment Advisory Panelist

It’s a cold, crisp January day. You step off the Metro in Washington, D.C. and scurry over to the gold corner at 18th and K Street. All too soon, you realize that you were not early enough. The line extends around the city block long before the company opens. The marquis is flashing the gold close of yesterday. Once the markets open, nobody knows how high it will jump.

You hurry to your place in line and immediately make offers to buy your way closer to the front. Five days ago, gold jumped $76 an ounce in a day. Spending a few bucks to get closer to the front of the line seems like a good investment.

The day was Monday, January 21, 1980. The previous Friday, gold went up another $85. By day’s end, gold would peak at its all-time high of $850 per ounce.

This is a true story. My partner, Glen O. Kirsch, and I saw it firsthand. We were senior managers with a company called Deak-Perera at the time, selling precious metals and foreign currencies. The fervor was intoxicating and absolutely compelling.

Two days after gold peaked, President Jimmy Carter addressed the nation on its State of the Union. I’ve bulleted the key statements from his address and other headlines of the day below. Do you get a feeling of deja vu?

The similarities to today’s events are unnerving, and many lessons from the past are about to replay this year. So let’s take a look at what to expect in 2006, starting with investing in precious metals and then moving on to foreign currencies.

The Major Bull Market in Precious Metals Investing Is Confirmed

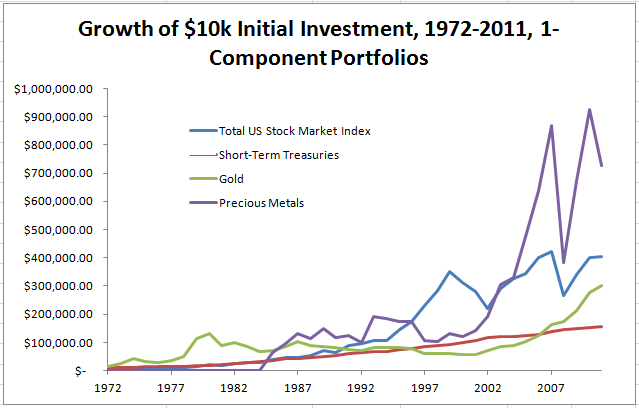

As predicted, 2005 brought a change from the mini-bull market in precious metals that began in January 2001 to a major bull market. The key indicator in this regard was an appreciation of precious metals against all currencies, not just the U.S. dollar. In fact, the precious metals outpaced a U.S. dollar that was itself surging against the euro and the Swiss franc (more on that in a moment).

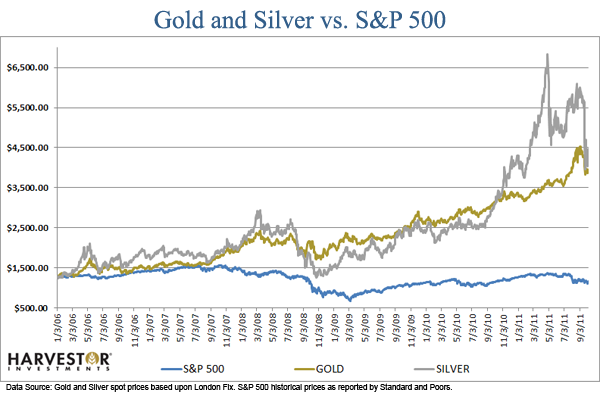

In 2006, I see a continuation of appreciation as the major bull market matures. In my estimation, precious metals are appreciating because, fundamentally, they should. Let’s look at precious metals gold and silverand what to expect from investing in them in 2006.

Gold — Increasing Demand Pushing Up Price

After hovering near the cost of production for years, the effect on supplies is being felt. With insufficient revenue, many mines were forced to close down or consolidate, and mining companies had to curtail new exploration. The funds just were not available. The pipeline slowed.