Investing in Global Commodities

Post on: 7 Май, 2015 No Comment

How to Invest in the World’s Raw Materials

You can opt-out at any time.

Global investors use commodities to diversify their portfolios or take advantage of specific macroeconomic opportunities. Investing in these commodities can be done through either commodity ETFs or, more directly, through futures trading. In this article, we’ll take a look at how commodities fit into a global portfolio and the easiest way to invest in them.

Why Invest in Commodities?

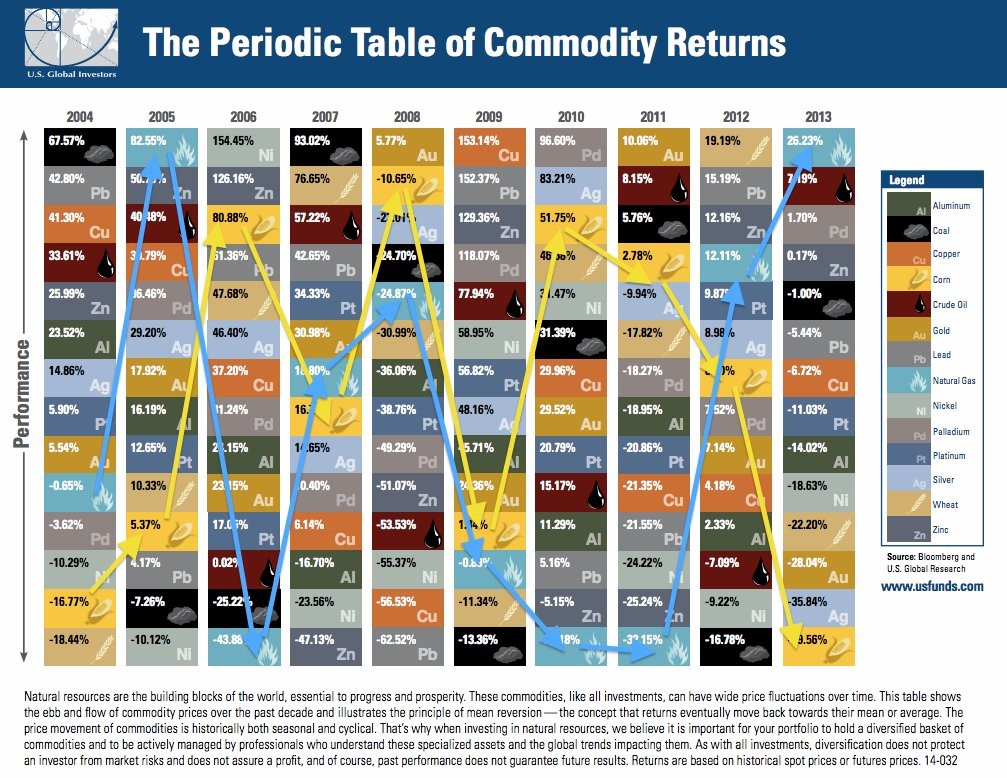

Commodities are widely considered by many experts to be a necessary component of a diversified portfolio. Several studies have shown that commodities exposure will increase risk-adjusted returns via their negative correlation with stocks and bonds. Building in exposure to commodities can therefore help offset losses in a down market.

Some commodities can prove to be very risky with high volatility (beta coefficients ). For instance, natural gas prices surged to nearly $14.00 in late 2007 before falling to $2.80 now. Others, like gold, are considered safe-havens during tough economic times, having risen from $800 in 2009 to $1,500 by mid-2011 amid the global economic crisis.

Aside from diversification, commodities can also be used to trade macroeconomic events that can affect supply and demand. For example, a new oil embargo by an oil producing country could increase the price of crude oil by reducing supply, while a new import tariff on steel could lower demand in a given country and reduce the price of the commodity.

Investing in Commodity ETFs

The easiest way to invest in commodities is through exchange-traded funds (ETFs). Since they trade on U.S. stock exchanges, investors can purchase the stocks through a traditional brokerage account rather than through specialized futures account. Investors can also purchase ETFs covering either a broad range of commodities or individual commodities.

Popular general commodity ETFs include:

- PowerShares DB Commodity Index Tracking Fund (DBC)

- iPath AIG Commodity Index (DJP)

- iShares GSCI Commodity Index Trust (GSG)

Popular precious metal commodity ETFs include:

- SPDR Gold Trust (GLD)

- iShares COMEX Gold Trust (IAU)

- iShares Silver Trust (SLV)

Popular energy commodity ETFs include:

- United States Oil Fund LP (USO)

- United States Natural Gas Fund LP (UNG)

- PowerShares DB Oil Fund (DBO)

Popular agricultural commodity ETFs include:

- PowerShares DB Agriculture Fund (DBA)

- iPath AIG Grains Total Return ETN (JJG)

- iPath AIG Agriculture Total Return ETN (JJA)

Popular base metal commodity ETFs include:

- PowerShares DB Base Metals Fund (DBB)

- iPath AIG Copper Total Return ETN (JJC)

- Elements ETN International Commodity Index (RJZ)

Investing in Commodities Directly

Investors looking for more direct exposure can also purchase commodities directly on a futures exchange. Futures contracts are agreements to buy or sell a specific commodity at a specific price at some point in the future. While most participants in the futures market are producers or consumers, speculators can also try to profit from the changes in commodity prices.

To invest in futures contracts, investors must open a futures brokerage account that includes a form acknowledging that they understand the risks associated with trading commodities. Each commodity contract may also require various minimum deposits, with the majority of the trade being placed on margin, which means that investors can suffer from margin calls.

Key Takeaway Points

- Commodities are widely considered by many experts to be a necessary component of a diversified portfolio.

- Commodities can also be used to trade macroeconomic events that can affect supply and demand.

- The easiest way to invest in commodities is through exchange-traded funds (ETFs).

- Investors looking for more direct exposure can also purchase commodities directly on a futures exchange.