Investing in Emerging and Frontier Markets market research report

Post on: 16 Март, 2015 No Comment

nvesting in Emerging and Frontier Markets is a practical compendium drawing together the unique and invaluable insights, wealth and knowledge and perspectives of leading experts, market practitioners, academics, consultants, lawyers, accountants and regulatory authorities into challenges and opportunities of investing in different emerging and frontier markets across business and industry sectors.

The experts in emerging markets provide wide-ranging insights into these opportunities and focus on:

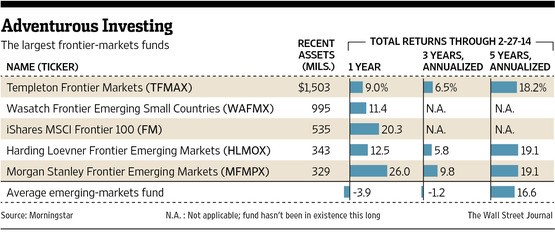

- The growing weight and influence of frontier markets which are a subset of emerging markets and display many of the characteristics that emerging markets did in 1987

- The mechanisms of the fund flows and how they have affected the market

- The outlook for emerging and frontier markets and relates the growth of markets around the world to the levels of debt, currency values and other variables

- The role of sovereign wealth funds

- Small and medium enterprises and their importance in emerging markets. Their performance has often been outstanding

- The regionalisation of both bond and equity markets

- The growth of private equity in emerging markets and the changing patterns in that area

- The role, the advantages and disadvantages of family businesses in emerging markets

- The patterns of project finance including infrastructure, energy, and oil and gas projects

- The selection of the right investment

What are the key benefits of the book?

• Provides you with a better understanding and appreciation of the risks and challenges of investing in a range of business and industry sectors across emerging markets

• Enables you to navigate through the economic, financial, legal and regulatory frameworks and keeps you in-the-know on market developments

• Enables you to access and connect with investors and capitalize on opportunities in emerging and frontier markets

• Enables you to grasp the specific particularities and differences between regions and countries within emerging markets

• Enables you to connect the dots by focusing on the inter-connectedness and trade links within emerging markets

• Provides a spotlight on frontier markets, which are drawing increased investor interest

What are the key features of the book?

• Explores trends and outlook in a range of business and industry sectors across emerging markets

• First-hand experience of specialists on-the-ground

• Focus on key issues such as political risk management, corporate governance, local business practices, availability of infrastructure, transparency and disclosure and reporting standards

• Timely case studies, practical examples and scenarios

• Spotlight on specific emerging and frontier markets

Table Of Contents

Investing in Emerging and Frontier Markets

Contents

Foreword xv

About the contributors xxvii

1 The growing weight and influence of frontier markets 1

Long-term growth potential 2

Africa — a continent of opportunity 3

2 The outlook for emerging and frontier markets 8

Issues and challenges facing the SME sector in emerging markets 41

First mover advantage: Bank Muscat targeted Oman’s unbanked SME market 50

Serving the female-headed SME segment: Access Bank Plc Nigeria 50

ICICI Bank 51

5 The regionalisation of emerging debt and equity capital markets 53

Julian Perlmutter and Piers Summerfield, Simmons and Simmons LLP

Recent developments and emerging trends in the dim sum bond market 53

Steady growth of the young dim sum bond market 53

8 Looking beyond external emerging market debt 95

Michael Gomez, PIMCO

Local debt will continue to stand out 98

Investment implications 100

9 Exchange-traded funds and the opening up of emerging markets 101

Manooj Mistry, Deutsche Bank

The general benefits of accessing emerging markets via ETFs 101

The challenges of creating ETFs on emerging markets indices 102

11 Growing power of emerging market titans 114

Sohail Jaffer, FWU Group

Role reversal in emerging market foreign direct investment flows 114

The growing importance of emerging market-based transnational corporations 114

Go out 117

Private equity and sovereign wealth fund drivers of FDI 117

Outlook for increased €˜south-south’ investment flows 118

Commodity security as a driver of FDI 119

Risks impacting FDI flows 120

The risk of resource nationalisation 121

Security concerns: real or imagined? 121

12 Private equity in growth markets: changing patterns, emerging trends 124

Sarah Alexander, The Abraaj Group

Lessons from the first generation 125

A fundamental and lasting shift 125

Global growth markets opportunity 125

Private equity — access to the growth economy 126

Institutional investor goals 126

Industry maturation — delivering returns 127

Local support and participation 128

Looking ahead — market and fund-size diversification 129

13 Doing valuations in emerging markets 130

Pr-Ola Hansson, Ernst and Young

The preferred approach to emerging-market valuation 130

Why the DCF model is preferable for emerging markets 131

Consistency and building in advantages 133