Investing in Actively Managed Mutual Funds

Post on: 11 Июнь, 2015 No Comment

Mutual Fund Managers Face New SEC Rules

Comments ( )

By Joseph Cafariello

Friday, September 12th, 2014

More than five years after the 2008-09 financial crisis gave us some harsh lessons in liquidity and risk management, regulators including the Securities and Exchange Commission (SEC) are still hard at work ensuring the lessons learned are not forgotten.

Having already revamped the banking and mortgage lending industries, the focus now is on the asset management industry which includes mutual funds, hedge funds, and private-equity funds as the SEC is preparing new rules governing account disclosure, data dissemination, and stress testing.

Yet while the SECs newest demands of the asset management industry will make many of their funds safer to invest in, investors need to note that there is one major risk factor which no rule, regulation or stress test could possibly protect us from: a fund managers limitations.

Lets take a quick look at how the SEC is attempting to decrease investment risk, followed by some ways in which fund managers inadvertently increase it.

SEC Turns Its Attention to Funds

The SEC is in the early stages of developing requirements, including that asset managers such as Fidelity Investments and BlackRock Inc. give regulators more data about their mutual-fund portfolio holdings, and conduct stress tests on their funds to determine how they would weather economic shocks such as a sudden change in interest rates, reports the Wall Street Journal.

Why such scrutiny now? Because we are about to enter a period of rising interest rates in a year or two which could incur serious losses for investment funds that are ill prepared.

The problem is that the recent low interest rate environment we have enjoyed for over five years has not only reshaped investment fund holdings and strategies, but has also retrained fund managers to trade on higher risk with less backup cash. For over five years, they simply havent needed a lot of backup in a market that has been moving up relentlessly with remarkable order and calm.

The SEC fears that too many funds are not prepared for the transition to a normal investment atmosphere of higher market volatility. Moreover, changing interest rates will affect sector performance. Sectors which are hot now may not be so hot when interest rates start to rise.

The same can be said of many investment funds, which will require not only shifting their sector allocations, but also shifting away from riskier investment vehicles such as high-leverage futures contracts.

Among the agency’s concerns is some mutual funds’ use of derivatives to boost returns, a practice that SEC officials believe warrants closer scrutiny, the WSJ reveals. The use of derivatives such as futures contracts have enabled funds to multiply returns by controlling large positions with as little as 5 to 10% cash margin.

Yet such leverage is like curved tire spikes stretched out across the road — youre fine when youre moving forward, but when you reverse direction the spikes will blow the tires right out from under you.

For futures holders, a market correction of just 5 to 10% would trigger the dreaded margin call, scrambling managers to locate additional cash to keep the positions alive, while a drop of 20 to 30% or more can wipe them out completely.

Another risk the SEC is wanting to address is the spiralling effect of mass-liquidation during market corrections, which can grow like a snowball rolling down the side of a mountain. As the correction continues, not only does the fund lose more and more money, but more and more investors start withdrawing more and more cash until the only thing left to distribute to investors are the losses.

SEC Giveth, Industry Groups Taketh Away

But while the SECs efforts to increase regulation of and reporting by investment funds may make investors feel a little more secure, opposition from interest groups quickly takes such security away. Industry groups such as the Investment Company Institute (ICI) and investment fund firms themselves have successfully fought back against regulation in the past, and are expected to step up their fighting now.

ICI, which has been effective in warding off regulation in the past, is critical of living wills or resolution plans, WSJ adds. The group says they are unnecessary, largely because funds don’t fail the way that banks do, with investment losses borne by shareholders in funds operated by asset managers, rather than by the companies themselves. In a July paper, ICI said funds and their managers exit the industry routinely without creating any distress in the financial markets.

While it is true that hedge funds and mutual funds are too small and secluded to bring down the entire financial system like the failure of major banks could, fund failures do cause a severe amount of disruption to peoples lives nonetheless, to the point of reducing their lifes savings to zero and potentially destroying their retirement plans.

Given the constant struggle between the investment industry and its regulators, investors must always remember that after all is said and done, we must be our own regulators. This requires conducting our own research and scrutiny of an investment fund before we invest in it, ensuring we understand how the funds managers make their investment decisions, what strategies they use, what instruments the invest in, and how much leverage they use.

In some cases, such investigative research may return limited information, especially from hedge funds which are not obligated to reveal very much of their strategies or holdings if they choose not to. Investors may be better off simply sticking with the tried and tested passively-managed funds, such as an index ETF which tracks a broad market, or a sector ETF which holds a basket of companies grouped by sector.

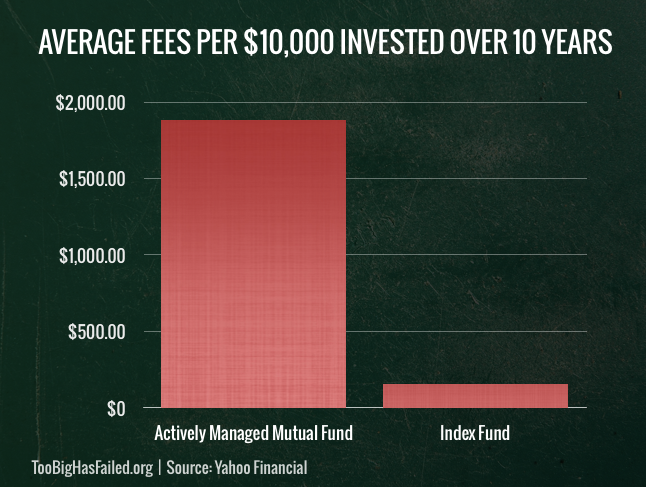

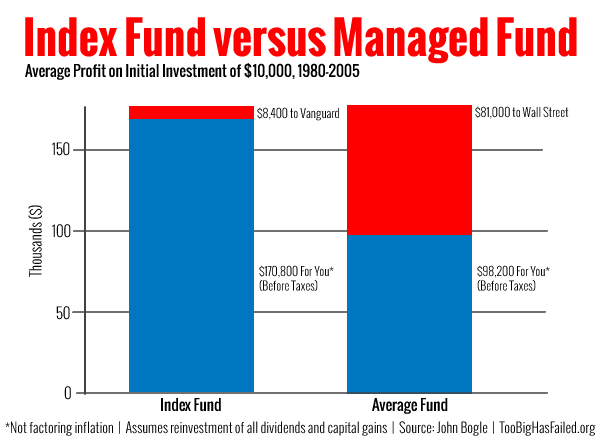

In fact, a recent analysis of the performance of actively-managed funds makes the case for passively-managed funds all the more potent.

The Best Free Investment You’ll Ever Make

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Gold & Silver Mining Stocks.

Enter your email:

Passively-Managed Versus Actively-Managed

The main difference between passively-managed funds and actively-managed ones is obvious: people are in control of actively-managed funds, while the markets are in control of the passive ones.

That is, a passive fund will track an index or sector simply by holding its component companies and then letting the markets do their thing. Whereas the composition of an actively-managed fund rests on the shoulders of individuals who are left to do their own thing.

Associated Press business reporter Stan Choe recently tabulated another difference between passively-managed and actively-managed funds their performance.

Most mutual funds are failing to keep up with broad market indexes again, Choe begins. It’s a trend that’s gone on for years.

Through the end of June, 60 percent of large-cap stock funds fell short of the Standard & Poor’s 500 index for one-year returns The numbers are starker for funds that focus on small-company stocks: Nearly three quarters of small-cap funds — 73 percent — failed to keep up with the S&P 600 index, while 58 percent of mid-cap funds underperformed the S&P 400.

Just why are active funds at such a disadvantage compared to passive index or sector funds? It all comes down to this: when investing in a passive fund, youre investing in its market; when investing in an active fund, youre investing in its manager.

Its the same with any occupation, really, where the worker brings a number of additional variables to the job, some of which are advantageous while others are liabilities.

In the case of an actively managed fund, the fund manager adds at least four additional variables that affect the funds performance which are not present in a passive fund, these being:

Knowledge and experience: such as education, the number of years managing a fund, etc.,

Market of expertise: as no manager understands every sector or market, managers perform better in markets they are intimately familiar with,

Preferred strategies: managers have certain investment strategies which they use more than others, with each strategy performing differently; as one example: in a rising market some managers add to their positions while others trim, and vice-versa in a falling market,

Interpretational skills: managers will interpret financial data differently based on the three factors noted above plus others; as one example: a company releases one financial report which all managers consult, only to have some managers conclude they should buy the stock while others conclude they should sell.

These and other skills and attributes combine differently in each fund manager, producing not just a uniquely performing manager but also a uniquely performing fund. Yet because humans introduce more liabilities than advantages, an actively managed fund will most often struggle against a passive index.

Remember that there is only one way to beat the broader market, and that is to deviate from it in some way at some point. For instance, to beat a market index, a fund has to have a slightly different mix than the index, holding more winners and fewer losers; or the fund has to tweak its leverage, holding more shares than the index going up and fewer shares coming down.

While such deviations from an index can pay off at times, they usually do not over the long run. Why? Because such deviations require the mastery of one very difficult skill market timing, something which no mortal human can succeed at for long.

The active manager needs to be overweight or underweight a stock or sector at the right time, which requires correctly picking market tops and bottoms. Though this can be done some of the time, it cannot be successfully accomplished all of the time. And this is the main reason why active funds will always lag passive funds over time.

So while the SEC does its part to make investment funds safer for investors, investors need to do their part to increase their own investment safety. Passive funds tracking a sector or index do perform better over the longer term. But if you just cant resist an actively managed funds prospects, at the very least do your homework and conduct your own investigation into the funds holdings, strategies, and its managers experience.

Joseph Cafariello