Inflation at 7month high How you can inflationproof your portfolio

Post on: 19 Июнь, 2015 No Comment

India’s wholesale price inflation rose to 6.46 percent against expectations of 6 percent as prices of manufacturing goods continued to climb despite a relief rally in the battered rupee.

The headline inflation has risen to to 6.46% in September as compared to 6.1% in August & 5.85% in July.

The biggest driver of inflation is still food inflation, which accelerated to a three-year high of 18.40 percent in September from 18.8 percent in August because of supply disruptions due to heavy monsoon and poor storage facilities.Read more here.

Reuters

So, how can someone who isn’t money savvy, inflation- proof their portfolio. To know more read on.

Equities: Historical data shows that one financial instrument which has been able to fight inflation is equities. Equities could be entered via direct stock picking or via the Mutual Funds way.

Another certified financial planner in the city, echoes this view but said Equities are a good investment avenue, when it comes to inflation, but not all have the stomach to take the risk associated with equities. There are no particular stocks or sectors which will offer you total inflation proofing of your portfolio.

You will have to ensure that you pick the stocks in your portfolio only after proper research, and analysing the fundamentals of the company.

For lay investors like you, we suggest to stay away from stock picking and enter equities via MFs.

Fixed income products won’t beat inflation, have some part of portfolio in equities, that too for long terms, more than five years plus. Equities have given excellent returns over a very long term.

Though equities offer returns which can beat inflations, they work better for lay investors in the long term for at least 10 years to get the most benefits for your investments in equities.

Fixed income products give returns which are low and close to rate of inflation, and they are taxable too, so good chance that could give negative returns.

Gold: India’s obsession for gold is well known. And gold works as a superb hedge against inflation as the price of gold have seen a steady increase over the years in the long term.

There is a good chance that you already have some gold as part of your portfolio, you will need to ensure you have 5-10 percent as gold in your portfolio.

We have seen that most people have an emotional bond with our jewellery and selling the same to book a profit is an extremely difficult task. If you are someone who wants to have it, it should not cross more than 5 percent of your portfolio.

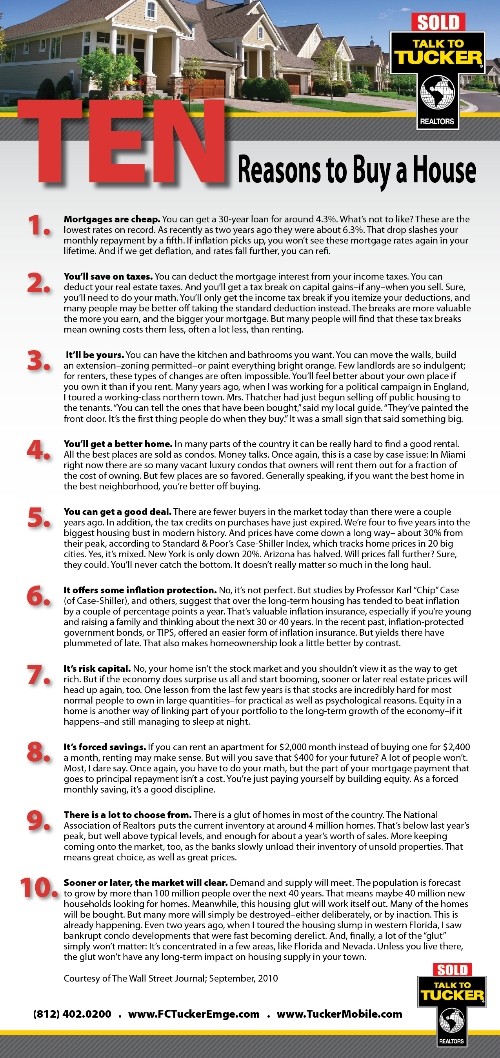

Real Estate: Another investment avenue to beat inflation is real estate. But real estate is a big ticket item, long-term item. You could by real estate in the form of residential, commercial or land. If you can’t make big ticket purchases, you could buy a small plot for a 2-3 lakhs, as a part of your portfolio. Real estate over the long term have offered decent returns but even if you do have the funds, you should not over do it.

Many are over invested in real estate, apart from the house that you stay in, you should not have more than 30 percent of your portfolio in real estate. The advantage of real estate is that it could give you rental income as well, but you will have to deal with loads of paper work, pay property tax, maintenance bills, renovation expenses and the like.

Inflation proofing should not be the only reason to rearrange your portfolio. But buy the above mentioned products as per your comfort and also the ability. This story merely aims to guide you with basic knowledge on how to go about your inflation proofing your portfolio.