How to Use Standard Deviation Indicator In Forex Trading

Post on: 16 Март, 2015 No Comment

Standard deviation is really a statistical way of measuring volatility. Because currency marketplace is extremely volatile compared to others, the Foreign exchange traders ought to analyze the actual volatility within the currency motion. The only way of measuring volatility comes by the conventional deviation. Standard Deviation may also be used with additional oscillators.

There is just one parameter within calculation associated with standard deviation that is the amount of periods. Automatically it arrives as 20-periods. Trader can help to make shift associated with 20 in order to 10 with regard to intraday in order to 50 with regard to positional phone. There can also be option to make use of SMA, EMA, smoothed as well as linear weight-age. It is suggested to utilize EMA with regard to intraday position since it more focuses upon present price motion.

Standard Change Calculation:

Its derived through calculating n-period easy moving average from the currency cost summing the actual squares from the difference in between currency shutting price and it is moving typical over each one of the preceding n-time intervals, dividing this particular sum through n, after which calculate the actual square cause of this outcome.

= √∑(Near price- n-period SMA/EMA associated with close cost)2/n

n = quantity of time intervals

SMA = Easy moving average.

EMA = Rapid Moving average.

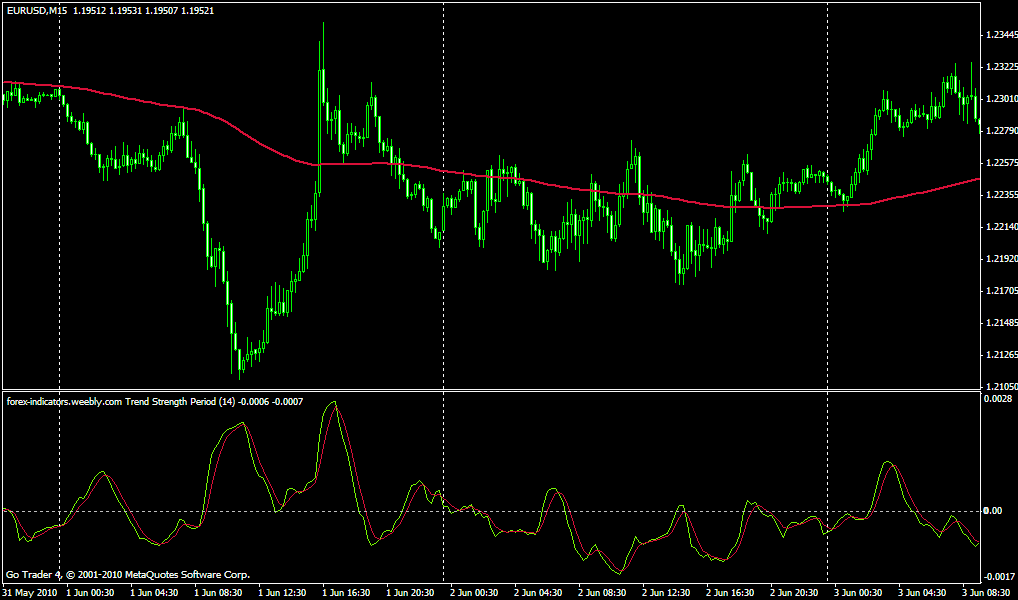

One needs to take Navigator in order to oscillator and choose standard Change. In over Diagram period automatically is displaying 10 Times and Methodology is straightforward.

Standard Change Interpretation:

High Standard deviation ideals occur once the closing cost and typical closing cost differ substantially. Similarly reduced standard change values happen when costs are steady.

Major covers are supported with higher volatility because investor has a problem with both excitement and concern. Thus market signal is actually indicated whenever standard deviation reaches its maximum, indicating the marketplace is quickly rising because of emotions and can fall later on. Thus the Trader should prevent long placement in foreign currency and anticipate trade within opposite path.

Major bottoms are required to end up being calmer because investors possess few expectancy of revenue. Thus the buy transmission is indicated since the standard deviation reaches its reduced indicating lull within the volatility.

Thus Trader should consider fresh lengthy position within the currency. A Trader should judge if the sudden ups as well as down tend to be mere the actual emotion brought movements or theyre really already been the a few technical elements influencing the actual currency cost movement.